Rosetta Stone 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

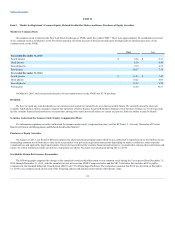

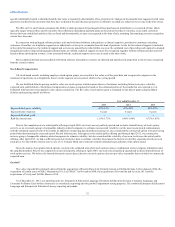

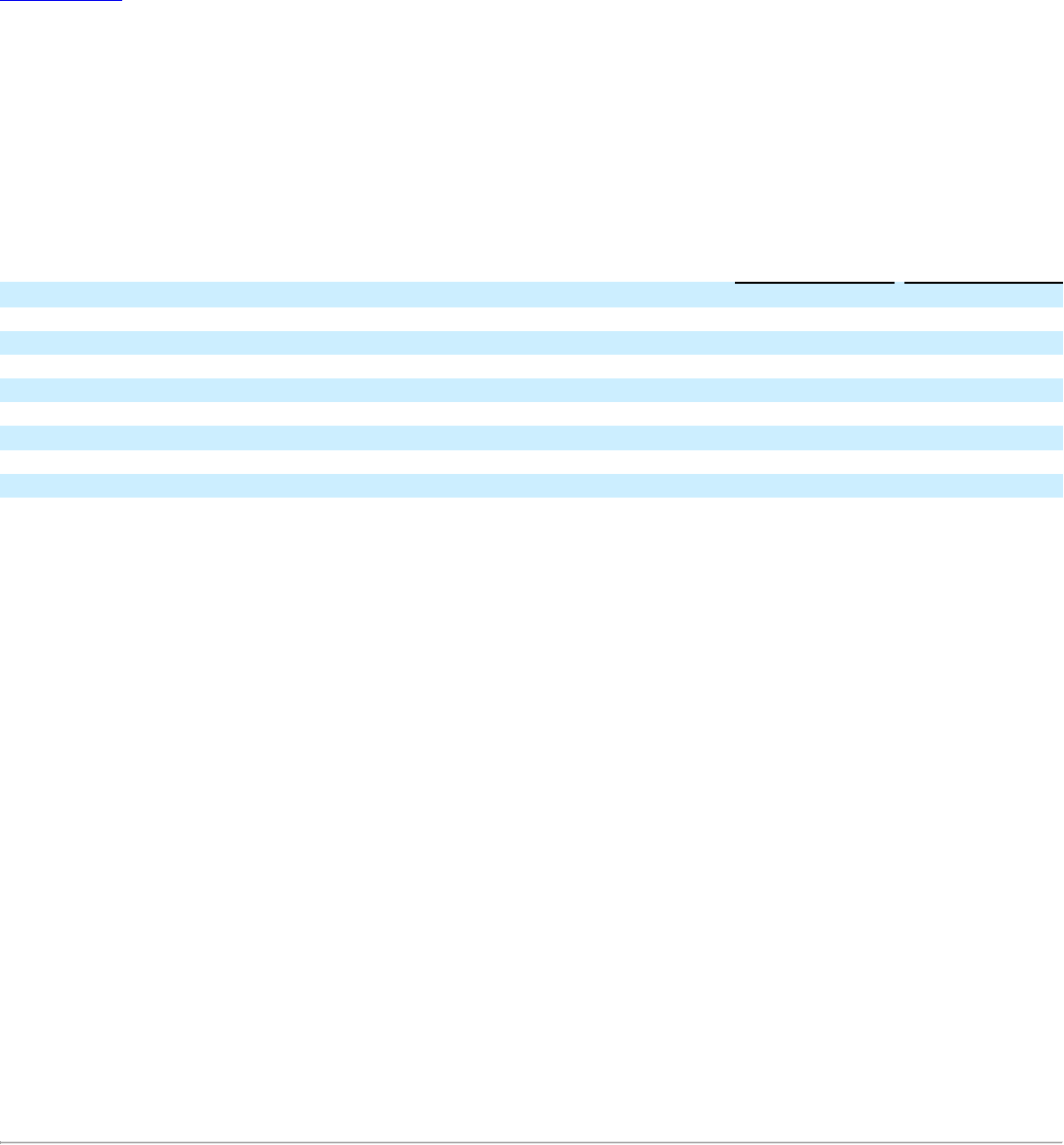

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol "RST." There were approximately 88 stockholders of record

of our common stock as of March 8, 2016. The following table sets forth, for each of the periods indicated, the high and low reported sales price of our

common stock on the NYSE.

Fourth Quarter

$ 8.22

$ 6.31

Third Quarter

8.50

6.40

Second Quarter

9.19

6.39

First Quarter

10.37

7.16

Fourth Quarter

$ 11.23

$ 7.42

Third Quarter

10.22

8.00

Second Quarter

12.32

9.20

First Quarter

12.50

10.53

On March 8, 2016, the last reported sales price of our common stock on the NYSE was $7.36 per share.

We have not paid any cash dividends on our common stock and do not intend to do so in the foreseeable future. We currently intend to retain all

available funds and any future earnings to support the operation of and to finance the growth and development of our business. Further, our revolving credit

facility contains financial and restrictive covenants that, among other restrictions and subject to certain exceptions, limit our ability to pay dividends.

For information regarding securities authorized for issuance under equity compensation plans, see Part III "Item 12—Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters."

On August 22, 2013, our Board of Directors approved a share repurchase program under which we are authorized to repurchase up to $25 million of our

outstanding common stock from time to time in the open market or in privately negotiated transactions depending on market conditions, other corporate

considerations, and applicable legal requirements. Our revolving credit facility contains financial and restrictive covenants that, among other restrictions and

subject to certain limitations, limits our ability to repurchase our shares. No shares were purchased during 2015 or 2014.

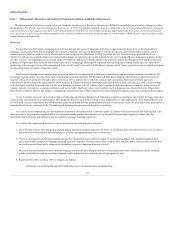

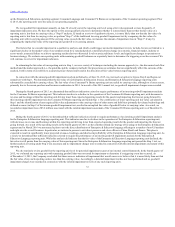

The following graph compares the change in the cumulative total stockholder return on our common stock during the 5-year period from December 31,

2010 through December 31, 2015, with the cumulative total return on the NYSE Composite Index and the SIC Code Index that includes all U.S. public

companies in the Standard Industrial Classification (SIC) Code 7372-Prepackaged Software. The comparison assumes that $100 was invested on December

31, 2010 in our common stock and in each of the foregoing indices and assumes reinvestment of dividends, if any.

24