Rosetta Stone 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

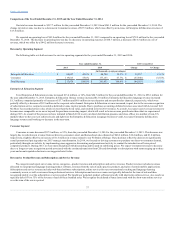

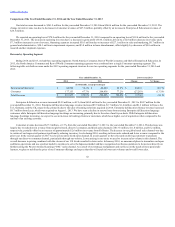

During 2014, we determined sufficient indicators existed to require the performance of interim goodwill impairment analysis for our then existent North

America Consumer and Rest of World Consumer reporting units due to unexpected declines in the Consumer language-learning business. As a result, we

recorded a total goodwill impairment loss of $20.2 million during the year ending December 31, 2014, which represents a full impairment of the goodwill

associated with the language-learning Consumer business. There were no goodwill impairments in 2013.

Intangible Assets

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark, and

other intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives. Intangible

assets with finite lives are reviewed routinely for potential impairment as part of our internal control framework. Annually, as of December 31, and more

frequently if a triggering event occurs, we review the Rosetta Stone trade name, our only indefinite-lived intangible asset, to determine if indicators of

impairment exist. We have the option to first assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset

is impaired as a basis for determining whether it is necessary to perform the quantitative test. If necessary, the quantitative test is performed by comparing the

fair value of indefinite-lived intangible assets to the carrying value. In the event the carrying value exceeds the fair value of the assets, the assets are written

down to their fair value.

During the fourth quarter of 2015, we elected to bypass the qualitative assessment and performed the quantitative assessment. In the quantitative

assessment, we noted that the fair value of the Rosetta Stone trade name has declined due to the reduction in forecasted revenue and bookings from both the

Enterprise & Education Language and the Consumer Language reporting units, however, the fair value exceeded the carrying value. There has been no

impairment of intangible assets during the years ending December 31, 2015, 2014 and 2013.

Valuation of Long-Lived Assets

As part of our internal control framework we evaluate the recoverability of our long-lived assets. An impairment of long-lived assets is recognized in

the event that the net book value of such assets exceeds the future undiscounted net cash flows attributable to such assets. Impairment, if any, is recognized in

the period of identification to the extent the carrying amount of an asset exceeds the fair value of such asset. During 2015 and 2014, we recorded $1.1 million

and $0.2 million in impairment expense related to the abandonment of software projects that were previously capitalized. There were no impairment charges

for the years ended December 31, 2013.

Restructuring Costs

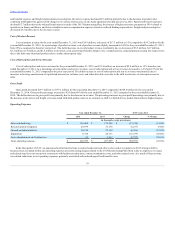

In the first quarter of 2015, as part of the 2015 Restructuring Plan, we announced and initiated actions to reduce headcount and other costs in order to

support our strategic shift in business focus and address periods of loss. In connection with this plan, we incurred restructuring related costs, including

employee severance and related benefit costs, contract termination costs, and other related costs. These costs are included in our operating expense line items

on the Statement of Operations.

On March 14, 2016, we announced that we intend to exit the direct sales presence in almost all of our non-U.S. and non-northern European geographies

related to the distribution of our Enterprise & Education language offerings, the "2016 Restructuring Plan". Where appropriate, we will seek to operate

through partners in those geographies being exited. We will also look to initiate processes to close our software development operations in France and

China. In total, if our intentions are realized, these actions will reduce headcount by approximately 17% of our full-time workforce and is expected to result

in annual expense reductions of approximately $19 million. If fully realized, these actions will result in an estimated restructuring charge ranging between

$5.0 million and $6.0 million, with approximately 50% accrued in the first quarter 2016, largely reflecting separation payments. These actions are additive to

the 2015 Restructuring Plan and further support our strategic shift in business focus to help address periods of losses.

Employee severance and related benefit costs primarily include cash payments, outplacement services, continuing health insurance coverage, and other

benefits. Where no substantive involuntary termination plan previously exists, these severance costs are generally considered “one-time” benefits and

recognized at fair value in the period in which a detailed plan has been approved by management and communicated to the terminated employees. Severance

costs pursuant to ongoing benefit arrangements, including termination benefits provided for in existing employment contracts, are recognized when probable

and reasonably estimable.

Contract termination costs include penalties to cancel certain service and license contracts. Contract termination costs are recognized at fair value in the

period in which the contract is terminated in accordance with the contract terms.

34