Rosetta Stone 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

specific identifiable benefit is identified and the fair value is reasonably determinable. Price protection for changes in the manufacturer suggested retail value

granted to resellers for the inventory that they have on hand at the date the price protection is offered is recorded as a reduction to revenue at the time of sale.

We offer our U.S. and Canada consumers the ability to make payments for packaged software purchases in installments over a period of time, which

typically ranges between three and five months. Given that these installment payment plans are for periods less than 12 months, a successful collection

history has been established and these fees are fixed and determinable, revenue is recognized at the time of sale, assuming the remaining revenue recognition

criteria have been met.

In connection with packaged software product sales and web-based software subscriptions, technical support is provided to customers, including

customers of resellers, via telephone support at no additional cost for up to six months from the time of purchase. As the fee for technical support is included

in the initial licensing fees, the technical support and services are generally provided within one year, the estimated cost of providing such support is deemed

insignificant and no unspecified upgrades/enhancements are offered, technical support revenues are recognized together with the software product and web-

based software subscription revenue. Costs associated with the technical support service are accrued at the time of sale.

Sales commissions from non-cancellable web-based software subscription contracts are deferred and amortized in proportion to the revenue recognized

from the related contract.

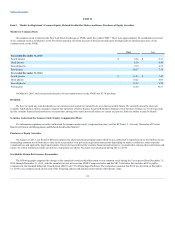

Stock-Based Compensation

All stock-based awards, including employee stock option grants, are recorded at fair value as of the grant date and recognized as expense in the

statement of operations on a straight-line basis over the requisite service period, which is the vesting period.

We use the Black-Scholes pricing model to value our stock options, which requires the use of estimates, including future stock price volatility,

expected term, and forfeitures. Stock-based compensation expense recognized is based on the estimated portion of the awards that are expected to vest.

Estimated forfeiture rates were applied in the expense calculation. The fair value of each option grant is estimated on the date of grant using the Black

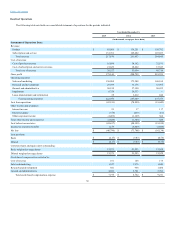

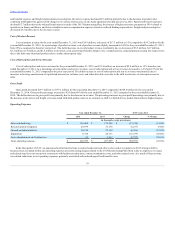

Scholes option pricing model as follows:

Expected stock price volatility

49%-63%

63%-65%

64%-67%

Expected term of options

6 years

6 years

6 years

Expected dividend yield

—

—

—

Risk-free interest rate

1.19%-1.75%

1.46%-1.80%

0.75%-1.65%

Prior to the completion of our initial public offering in April 2009, our stock was not publicly quoted and we had a limited history of stock option

activity, so we reviewed a group of comparable industry-related companies to estimate our expected volatility over the most recent period commensurate

with the estimated expected term of the awards. In addition to analyzing data from the peer group, we also considered the contractual option term and vesting

period when determining the expected option life and forfeiture rate. Subsequent to the initial public offering and through April 2015, we continued to

review a group of comparable industry-related companies to estimate volatility, but also considered the volatility of our own stock since the initial public

offering. After April 2015, we had a sufficient period of stock price data to estimate volatility based upon the historical volatility experienced with our own

stock price. For the risk-free interest rate, we use a U.S. Treasury Bond rate consistent with the estimated expected term of the option award.

Given the nature of our granted stock options, we derive the estimated term of all stock options using a combination of peer company information and

the simplified method. Prior to the completion of our initial public offering in April 2009, our stock was not publicly quoted and we had a limited history of

stock option activity. We believe the limited historical exercise data related to our stock options does not provide a reasonable basis on which to estimate the

expected term.

Goodwill

The value of goodwill is primarily derived from the acquisition of Rosetta Stone Ltd. (formerly known as Fairfield & Sons, Ltd.) in January 2006, the

acquisition of certain assets of SGLC International Co. Ltd ("SGLC") in November 2009, the acquisitions of Livemocha and Lexia in 2013 and the

acquisitions of Vivity and Tell Me More in 2014.

As of December 31, 2015, our reporting units are: Enterprise & Education Language, Enterprise & Education Literacy, Consumer Language, and

Consumer Fit Brains. Each of these businesses is considered a reporting unit for goodwill impairment testing purposes. The combined Enterprise & Education

Language and Enterprise & Education Literacy reporting units make

32