Rosetta Stone 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

deferred tax assets will not be realized. The impact of tax rate changes on deferred tax assets and liabilities is recognized in the year that the change is

enacted.

Significant judgment is required to determine whether a valuation allowance is necessary and the amount of such valuation allowance, if appropriate.

The valuation allowance is reviewed at each reporting period and is maintained until sufficient positive evidence exists to support a reversal.

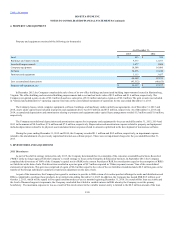

When assessing the realization of the Company's deferred tax assets, the Company considers all available evidence, including:

• the nature, frequency, and severity of cumulative financial reporting losses in recent years;

• the carryforward periods for the net operating loss, capital loss, and foreign tax credit carryforwards;

• predictability of future operating profitability of the character necessary to realize the asset;

• prudent and feasible tax planning strategies that would be implemented, if necessary, to protect against the loss of the deferred tax assets;

and

• the effect of reversing taxable temporary differences.

The evaluation of the recoverability of the deferred tax assets requires that the Company weigh all positive and negative evidence to reach a

conclusion that it is more likely than not that all or some portion of the deferred tax assets will not be realized. The weight given to the evidence is

commensurate with the extent to which it can be objectively verified. The more negative evidence that exists, the more positive evidence is necessary and the

more difficult it is to support a conclusion that a valuation allowance is not needed.

The establishment of a valuation allowance has no effect on the ability to use the deferred tax assets in the future to reduce cash tax payments. The

Company will continue to assess the likelihood that the deferred tax assets will be realizable at each reporting period and the valuation allowance will be

adjusted accordingly, which could materially affect the Company's financial position and results of operations.

The Company accounts for its stock-based compensation in accordance ASC topic 718, ("ASC 718"). Under

ASC 718, all stock-based awards, including employee stock option grants, are recorded at fair value as of the grant date and recognized as expense in the

statement of operations on a straight-line basis over the requisite service period, which is the vesting period.

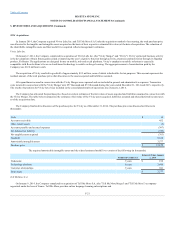

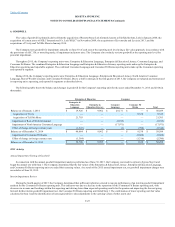

In the first quarter of 2015, as part of the 2015 Restructuring Plan, the Company announced and initiated actions to reduce headcount and other costs in

order to support its strategic shift in business focus and address periods of loss. In connection with this plan, the Company incurred restructuring related costs,

including employee severance and related benefit costs, contract termination costs, and other related costs. These costs are included within the Sales and

marketing, Research and development, and General and administrative operating expense categories on the Company's consolidated statements of

operations.

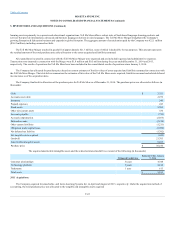

Employee severance and related benefit costs primarily include cash payments, outplacement services, continuing health insurance coverage, and other

benefits. Where no substantive involuntary termination plan previously exists, these severance costs are generally considered “one-time” benefits and

recognized at fair value in the period in which a detailed plan has been approved by management and communicated to the terminated employees. Severance

costs pursuant to ongoing benefit arrangements, including termination benefits provided for in existing employment contracts, are recognized when probable

and reasonably estimable.

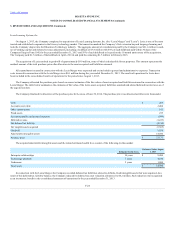

Contract termination costs include penalties to cancel certain service and license contracts. Contract termination costs are recognized at fair value in the

period in which the contract is terminated in accordance with the contract terms.

Other related costs generally include external consulting and legal costs associated with the strategic shift in business focus of the Company’s

Consumer business. Such costs are recognized at fair value in the period in which the costs are incurred.

F-15