Rosetta Stone 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Net cash used in financing activities was $0.3 million for the year ended December 31, 2014 compared to cash used in financing activities of $10.5

million for the year ended December 31, 2013. Net cash used in financing activities during the year ended December 31, 2014 was primarily due to payments

made under capital lease obligations of $0.6 million and payment of debt issuance costs of $0.4 million, offset by net cash provided of $0.7 million from the

exercise of stock options.

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing arrangements. We do not have any material interest in entities referred to as variable interest

entities, which include special purpose entities and other structured finance entities.

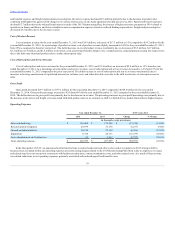

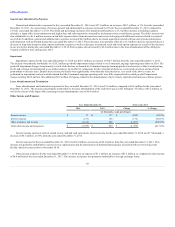

Contractual Obligations

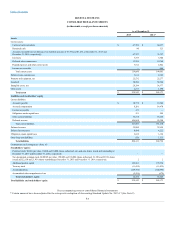

As discussed in Notes 9 and 16 of Item 8, , we lease buildings, parking spaces, equipment, and office

space under operating lease agreements. We also lease certain equipment, software and a building near Versailles, France under capital lease agreements. The

following table summarizes our future minimum rent payments under non-cancellable operating and capital lease agreements as of December 31, 2015 and

the effect such obligations are expected to have on our liquidity and cash flow in future periods.

Capitalized leases and other financing arrangements

$ 3,621

$ 644

$ 1,138

$ 984

$ 855

Operating leases

16,592

5,591

8,196

2,215

590

Total

$ 20,213

$ 6,235

$ 9,334

$ 3,199

$ 1,445

Foreign Currency Exchange Risk

The functional currency of our foreign subsidiaries is their local currency. Accordingly, our results of operations and cash flows are subject to

fluctuations due to changes in foreign currency exchange rates. The volatility of the prices and applicable rates are dependent on many factors that we cannot

forecast with reliable accuracy. In the event our foreign sales and expenses increase, our operating results may be more greatly affected by fluctuations in the

exchange rates of the currencies in which we do business. At this time we do not, but we may in the future, invest in derivatives or other financial instruments

in an attempt to hedge our foreign currency exchange risk.

Interest Rate Sensitivity

Interest income and expense are sensitive to changes in the general level of U.S. interest rates. However, based on the nature and current level of our

marketable securities, which are primarily short-term investment grade and government securities and our notes payable, we believe that there is no material

risk of exposure.

Credit Risk

Accounts receivable and cash and cash equivalents present the highest potential concentrations of credit risk. We reserve for credit losses and do not

require collateral on our trade accounts receivable. In addition, we maintain cash and investment balances in accounts at various banks and brokerage firms.

We have not experienced any losses on cash and cash equivalent accounts to date. We sell products to retailers, resellers, government agencies, and

individual consumers and extend credit based on an evaluation of the customer's financial condition, without requiring collateral. Exposure to losses on

accounts receivable is principally dependent on each customer's financial condition. We monitor exposure for credit losses and maintain allowances for

anticipated losses. We maintain trade credit insurance for certain customers to provide coverage, up to a certain limit, in the event of insolvency of some

customers.

Our consolidated financial statements, together with the related notes and the report of independent registered public accounting firm, are set forth on

the pages indicated in Item 15.

49