Rosetta Stone 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

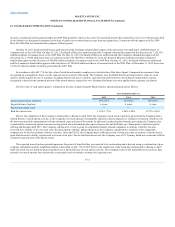

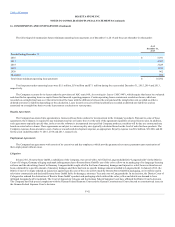

respectively. Additionally, no tax benefits were provided on 2012 losses incurred in foreign jurisdictions where the Company has determined a valuation

allowance is required. As of December 31, 2015, a full valuation allowance was provided for domestic and certain foreign deferred tax assets in those

jurisdictions where the Company has determined the deferred tax assets will more likely than not be realized.

If future events change the outcome of the Company's projected return to profitability, a valuation allowance may not be required to reduce the

deferred tax assets. The Company will continue to assess the need for a valuation allowance.

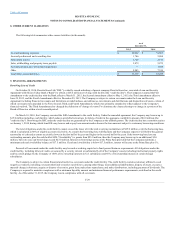

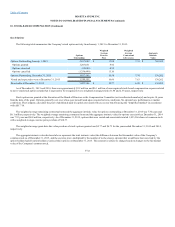

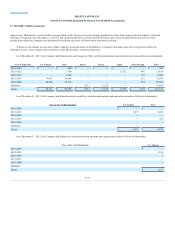

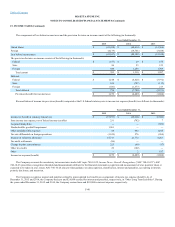

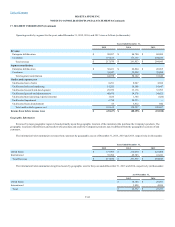

As of December 31, 2015, the Company had federal, state and foreign tax NOL carryforward amounts and expiration periods as follows (in thousands):

2016-2020

$ —

$ 498

$ —

$ —

$ —

$ —

$ 498

2021-2025

—

1,180

—

—

11,872

607

13,659

2026-2030

—

6,288

—

—

—

152

6,440

2031-2035

39,437

34,008

—

—

—

251

73,696

2036-2040

48,904

38,532

—

—

—

932

88,368

Indefinite

—

—

5,511

13,158

—

—

18,669

Totals

$ 88,341

$ 80,506

$ 5,511

$ 13,158

$ 11,872

$ 1,942

$ 201,330

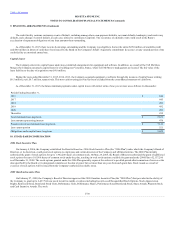

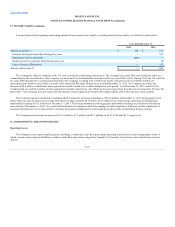

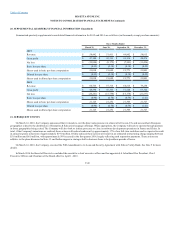

As of December 31, 2015, the Company had federal and state capital loss carryforward amounts and expiration periods as follows (in thousands):

2016-2020

$ —

$ —

2021-2025

6,837

6,055

2026-2030

—

—

2031-2035

—

360

2036-2040

—

—

Indefinite

—

—

Totals

$ 6,837

$ 6,415

As of December 31, 2015, the Company had federal tax credit carryforward amounts and expiration periods as follows (in thousands):

2016-2020

$ —

2021-2025

1,516

2026-2030

1

2031-2035

—

2036-2040

—

Indefinite

—

Totals

$ 1,517

F-39