Rosetta Stone 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The value of goodwill is primarily derived from the acquisition of Rosetta Stone Ltd. (formerly known as Fairfield & Sons, Ltd.) in January 2006, the

acquisition of certain assets of SGLC International Co. Ltd ("SGLC") in November 2009, the acquisitions of Livemocha and Lexia in 2013, and the

acquisitions of Vivity and Tell Me More in January 2014.

The Company tests goodwill for impairment annually on June 30 of each year at the reporting unit level using a fair value approach, in accordance with

the provisions of ASC 350, or more frequently, if impairment indicators arise. The Company also routinely reviews goodwill at the reporting unit level for

potential impairment.

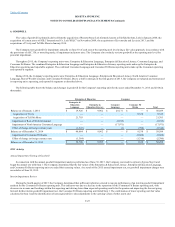

Throughout 2015, the Company's reporting units were: Enterprise & Education Language, Enterprise & Education Literacy, Consumer Language, and

Consumer Fit Brains. The combined Enterprise & Education Language and Enterprise & Education Literacy reporting units make up the Enterprise &

Education operating and reportable segment. The combined Consumer Language and Consumer Fit Brains reporting units make up the Consumer operating

and reportable segment.

During 2014, the Company's reporting units were: Enterprise & Education Language, Enterprise & Education Literacy, North America Consumer

Language, Rest of World Consumer, and Consumer Fit Brains. Due to a shift in strategy in the first quarter of 2015, the Company reevaluated and restructured

its reporting units, operating, and reportable segments as described above.

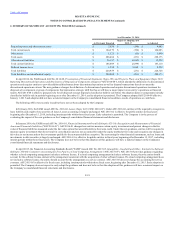

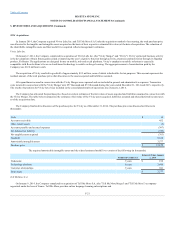

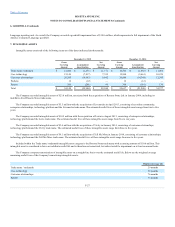

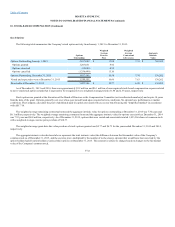

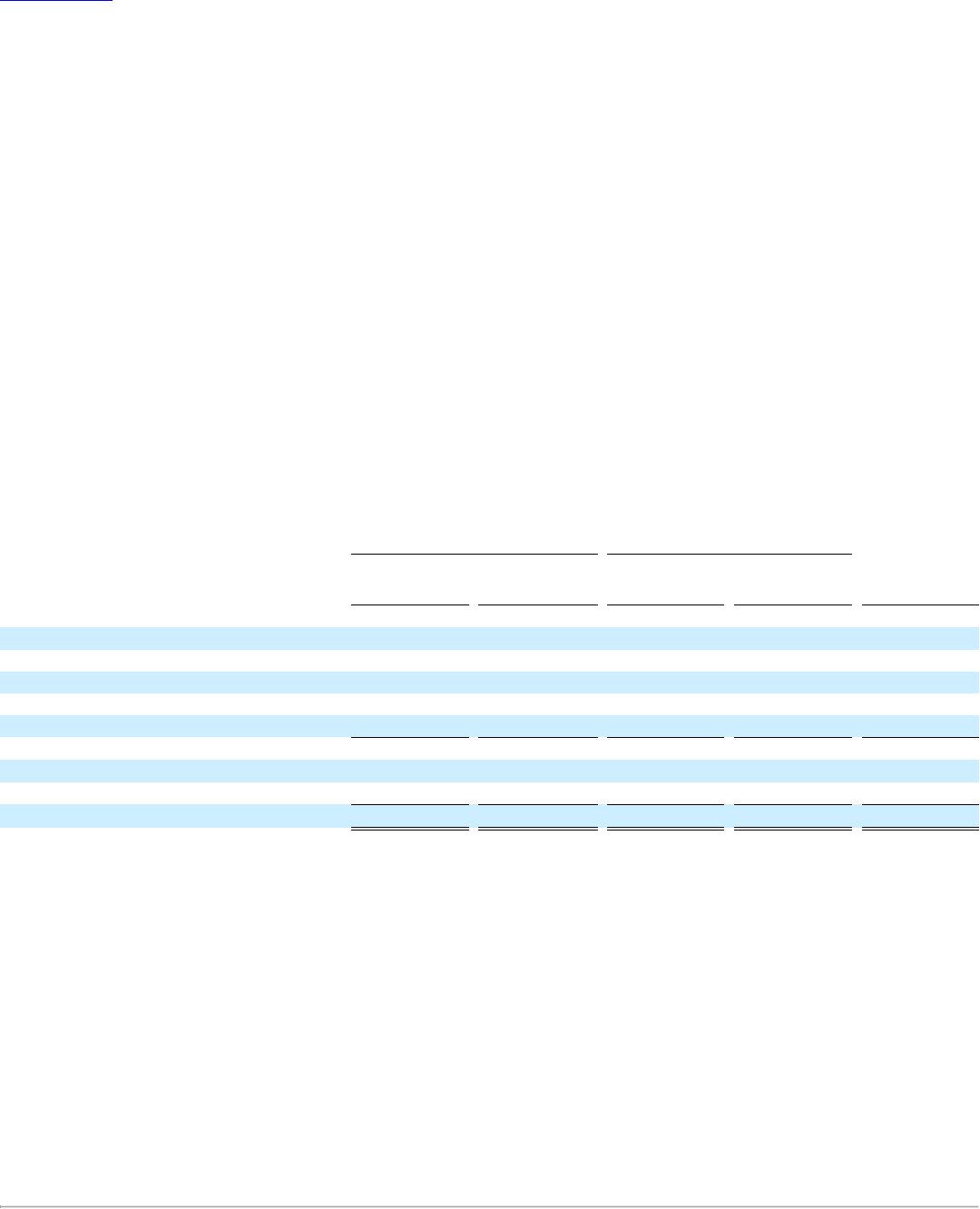

The following table shows the balance and changes in goodwill for the Company's reporting units for the years ended December 31, 2015 and 2014 (in

thousands):

Balance as of January 1, 2014

$ 19,926

$ 9,962

$ 20,171

$ —

$ 50,059

Acquisition of Vivity

—

—

—

9,336

9,336

Acquisition of Tell Me More

21,703

—

—

—

21,703

Impairment of Rest of World Consumer

—

—

(2,199)

—

(2,199)

Impairment of North America Consumer Language

—

—

(17,971)

—

(17,971)

Effect of change in foreign currency rate

(1,545)

—

(1)

(798)

(2,344)

Balance as of December 31, 2014

$ 40,084

$ 9,962

$ —

$ 8,538

$ 58,584

Impairment of Consumer Fit Brains

—

—

—

(5,604)

(5,604)

Effect of change in foreign currency rate

(1,384)

—

—

(1,316)

(2,700)

Balance as of December 31, 2015

$ 38,700

$ 9,962

$ —

$ 1,618

$ 50,280

2015 Activity

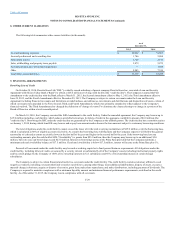

In connection with the annual goodwill impairment analysis performed as of June 30, 2015, the Company exercised its option to bypass Step 0 and

began the annual test with Step 1. The Company determined that the fair values of the Enterprise & Education Literacy, Enterprise & Education Language,

and Consumer Fit Brains reporting units exceeded their carrying values. As a result of the 2015 annual impairment test, no goodwill impairment charges were

recorded as of June 30, 2015.

During the fourth quarter of 2015, the Company determined that sufficient indication existed to require performance of an interim goodwill impairment

analysis for the Consumer Fit Brains reporting unit. This indicator was due to a decline in the operations of the Consumer Fit Brains reporting unit, with

decreases in revenue and bookings within this reporting unit driving lower than expected operating results for the quarter and impacting the forecast going

forward. In this interim goodwill impairment test, the Consumer Fit Brains reporting unit failed Step 1. The combination of lower reporting unit fair value

calculated in Step 1 and the identification of unrecognized fair value adjustments to the carrying values of other assets and

F-25