Rosetta Stone 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

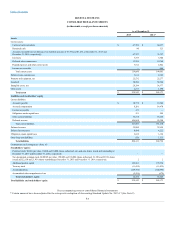

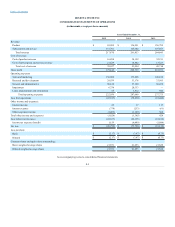

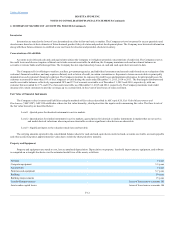

Net loss

$ (46,796)

$ (73,706)

$ (16,134)

Adjustments to reconcile net loss to cash (used in) provided by operating activities:

Stock-based compensation expense

7,195

6,762

9,241

Loss (gain) on foreign currency transactions

1,471

1,171

—

Bad debt expense

1,657

2,405

1,420

Depreciation and amortization

13,660

13,904

9,635

Deferred income tax expense (benefit)

849

(7,667)

(3,869)

(Gain) loss on disposal of equipment

(15)

184

278

Amortization of deferred financing costs

160

21

—

Loss on impairment

6,754

20,333

—

Loss from equity method investments

23

—

—

Gain on divestiture of subsidiary

(660)

—

—

Net change in:

Restricted cash

43

(13)

(37)

Accounts receivable

26,376

(16,478)

(9,477)

Inventory

(1,253)

341

(108)

Deferred sales commissions

(4,121)

(7,268)

(4,245)

Prepaid expenses and other current assets

1,080

1,844

(878)

Income tax receivable

568

(147)

827

Other assets

(684)

446

(68)

Accounts payable

(8,636)

8,394

3,702

Accrued compensation

(5,485)

(4,494)

(897)

Other current liabilities

(14,223)

11,318

4,250

Other long-term liabilities

(486)

459

481

Deferred revenue

16,878

48,864

13,947

Net cash (used in) provided by operating activities

(5,645)

6,673

8,068

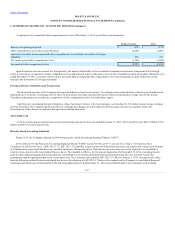

Purchases of property and equipment

(8,856)

(9,736)

(8,941)

Proceeds from sale of fixed assets

1,642

—

—

Decrease (increase) in restricted cash for Vivity acquisition

—

12,314

(12,314)

Acquisitions, net of cash acquired

(1,688)

(41,687)

(25,675)

Net cash outflow from divestiture of subsidiary

(186)

—

—

Other investing activities

(286)

—

—

Net cash used in investing activities

(9,374)

(39,109)

(46,930)

Proceeds from the exercise of stock options

114

669

2,457

Repurchase of shares from exercised stock options

—

—

(1,040)

Purchase of treasury stock

—

—

(11,435)

Proceeds from equity offering, net of issuance costs

—

—

(228)

Deferred financing costs

(130)

(381)

—

Payments under capital lease obligations

(711)

(593)

(241)

Net cash used in financing activities

(727)

(305)

(10,487)

Increase (decrease) in cash and cash equivalents

(15,746)

(32,741)

(49,349)

Effect of exchange rate changes in cash and cash equivalents

(1,129)

(1,427)

(16)

Net increase (decrease) in cash and cash equivalents

(16,875)

(34,168)

(49,365)

Cash and cash equivalents—beginning of year

64,657

98,825

148,190

Cash and cash equivalents—end of year

$ 47,782

$ 64,657

$ 98,825

Cash paid during the periods for:

Interest

$ 218

$ 211

$ 18

Income taxes, net of refund

$ 601

$ 1,722

$ 3,290

Noncash financing and investing activities: