Rosetta Stone 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

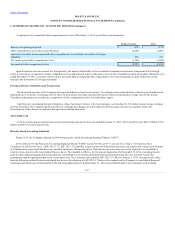

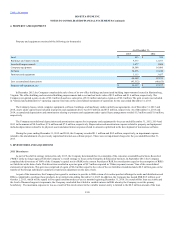

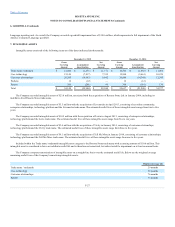

Components of accumulated other comprehensive loss as of December 31, 2015 are as follows (in thousands):

Balance at beginning of period

$ (678)

$ (678)

Other comprehensive loss before reclassifications

(2,003)

(2,003)

Amounts reclassified from accumulated other comprehensive loss related to divestiture of foreign

subsidiary

455

455

Net current period other comprehensive loss

(1,548)

(1,548)

Accumulated other comprehensive loss

$ (2,226)

$ (2,226)

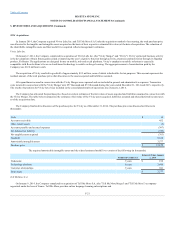

Upon divestiture of an investment in a foreign entity, the amount attributable to the accumulated translation adjustment component of that foreign

entity is removed as a component of other comprehensive loss and reported as part of the gain or loss on sale or liquidation of the investment. During the year

ended December 31, 2015, a transfer of $0.5 million was made from accumulated other comprehensive loss and recognized as a gain within net income

related to the divestiture of a foreign subsidiary.

The functional currency of the Company's foreign subsidiaries is their local currency. Accordingly, assets and liabilities of the foreign subsidiaries are

translated into U.S. dollars at exchange rates in effect on the balance sheet date. Income and expense items are translated at average rates for the period.

Translation adjustments are recorded as a component of other comprehensive loss in stockholders' equity.

Cash flows of consolidated foreign subsidiaries, whose functional currency is the local currency, are translated to U.S. dollars using average exchange

rates for the period. The Company reports the effect of exchange rate changes on cash balances held in foreign currencies as a separate item in the

reconciliation of the changes in cash and cash equivalents during the period.

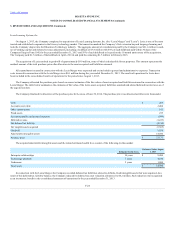

Costs for advertising are expensed as incurred. Advertising expense for the years ended December 31, 2015, 2014, and 2013 were $46.9 million, $79.6

million and $63.6 million, respectively.

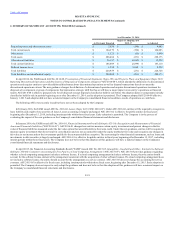

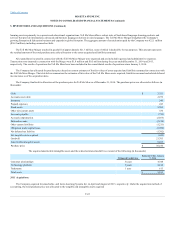

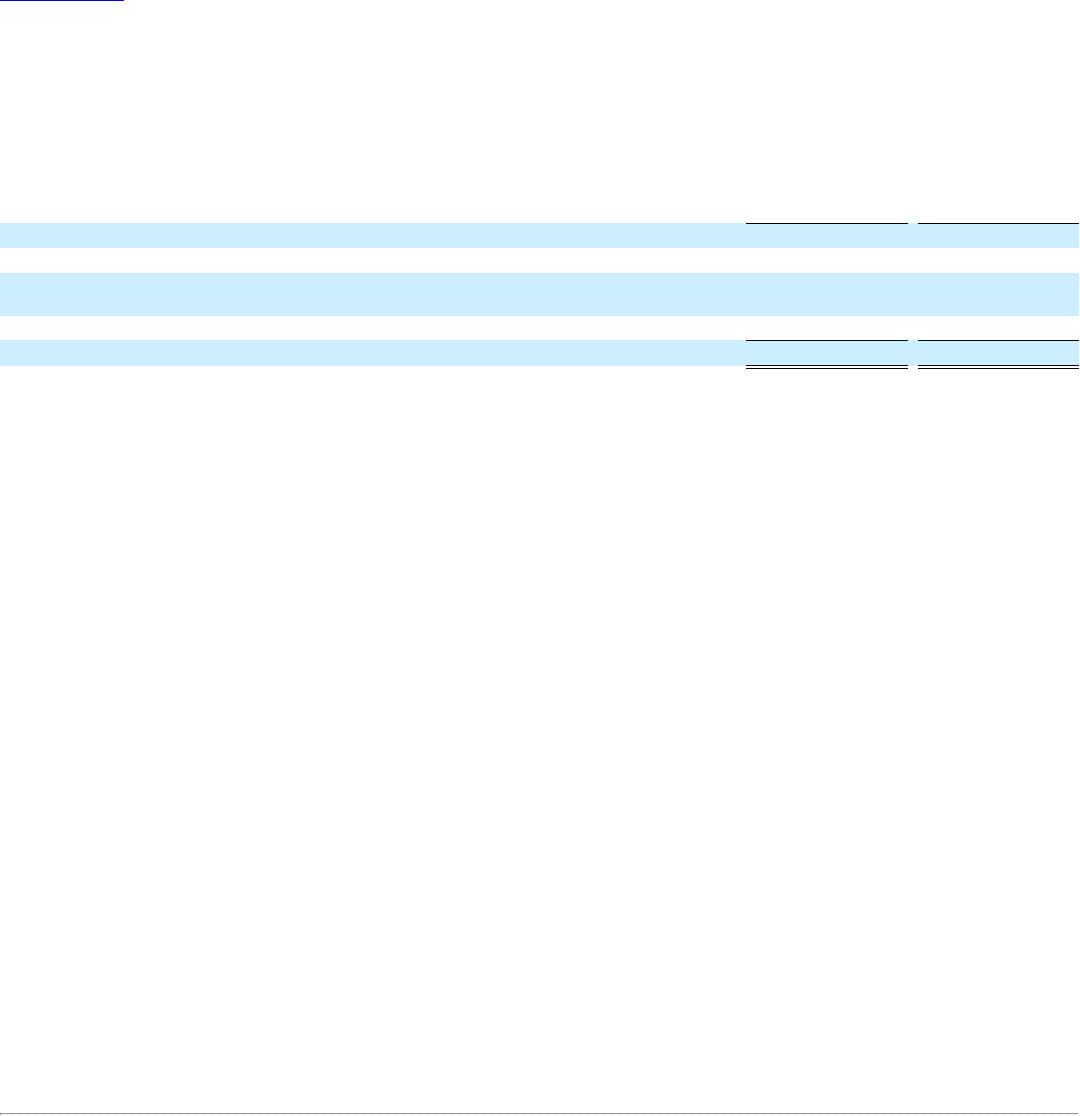

During 2015, the Company adopted the following recently issued Accounting Standard Updates ("ASU"):

In November 2015, the Financial Accounting Standards Board ("FASB") issued ASU No. 2015-17,

("ASU 2015-17"). ASU 2015-17 simplifies the presentation of deferred income taxes and requires non-current classification

of all deferred tax assets and liabilities in a classified statement of financial position. Deferred income taxes were previously required to be classified as

current or non-current on the consolidated balance sheets. The standard is effective for fiscal years beginning after December 15, 2016, including interim

periods within that reporting period. Early adoption is permitted for any interim and annual financial statements that have not yet been issued. The

amendments may be applied prospectively or retrospectively. The Company early adopted ASU 2015-17 effective January 1, 2015, retrospectively. Other

than the following reclassifications and related disclosures, the adoption of ASU 2015-17 had no other impacts on the Company's consolidated financial

statements and disclosures which resulted in the following adjustments to the December 31, 2014 consolidated balance sheet (amounts in thousands):

F-17