Rosetta Stone 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

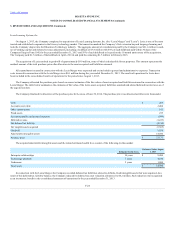

Net loss per share is computed under the provisions of ASC topic 260, . Basic loss per share is computed using net loss and the

weighted average number of shares of common stock outstanding. Diluted loss per share reflect the weighted average number of shares of common stock

outstanding plus any potentially dilutive shares outstanding during the period. Potentially dilutive shares consist of shares issuable upon the exercise of

stock options, restricted stock awards, restricted stock units and conversion of shares of preferred stock. Common stock equivalent shares are excluded from

the diluted computation if their effect is anti-dilutive. When there is a net loss, there is a presumption that there are no dilutive shares as these would be anti-

dilutive.

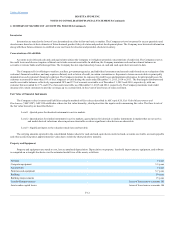

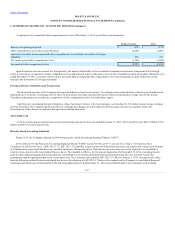

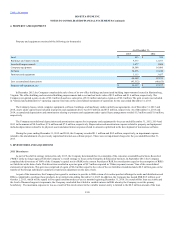

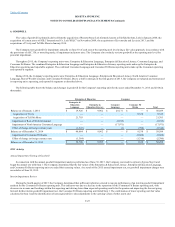

The following table sets forth the computation of basic and diluted net loss per common share:

Net loss

$ (46,796)

$ (73,706)

$ (16,134)

Common shares and equivalents outstanding:

Basic weighted average shares

21,571

21,253

21,528

Diluted weighted average shares

21,571

21,253

21,528

Loss per share:

Basic

$ (2.17)

$ (3.47)

$ (0.75)

Diluted

$ (2.17)

$ (3.47)

$ (0.75)

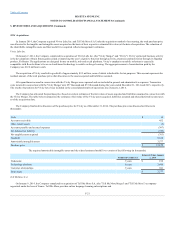

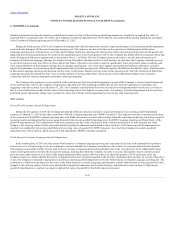

For the years ended December 31, 2015, 2014 and 2013, no common stock equivalent shares were included in the calculation of the Company’s

diluted net loss per share. The following is a summary of common stock equivalents for the securities outstanding during the respective periods that have

been excluded from the earnings per share calculations as their impact was anti-dilutive.

Stock options

35

67

279

Restricted stock units

39

103

90

Restricted stocks

82

89

248

Total common stock equivalent shares

156

259

617

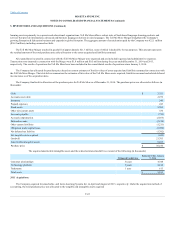

Comprehensive (loss) income consists of net loss and other comprehensive (loss) income. Other comprehensive (loss) income refers to revenues,

expenses, gains, and losses that are not included in net loss, but rather are recorded directly in stockholders' equity. For the years ended December 31, 2015,

2014 and 2013, the Company's comprehensive (loss) income consisted of net loss and foreign currency translation gains (losses). The other comprehensive

(loss) income presented in the consolidated financial statements and the notes are presented net of tax. There have been no tax expense or benefit associated

with the components other comprehensive loss due to the presence of a full valuation allowance for each of the years ended December 31, 2015, 2014 and

2013.

F-16