Rosetta Stone 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

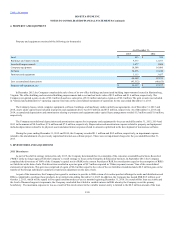

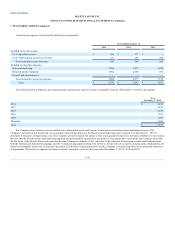

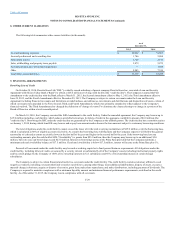

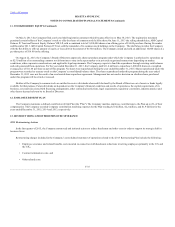

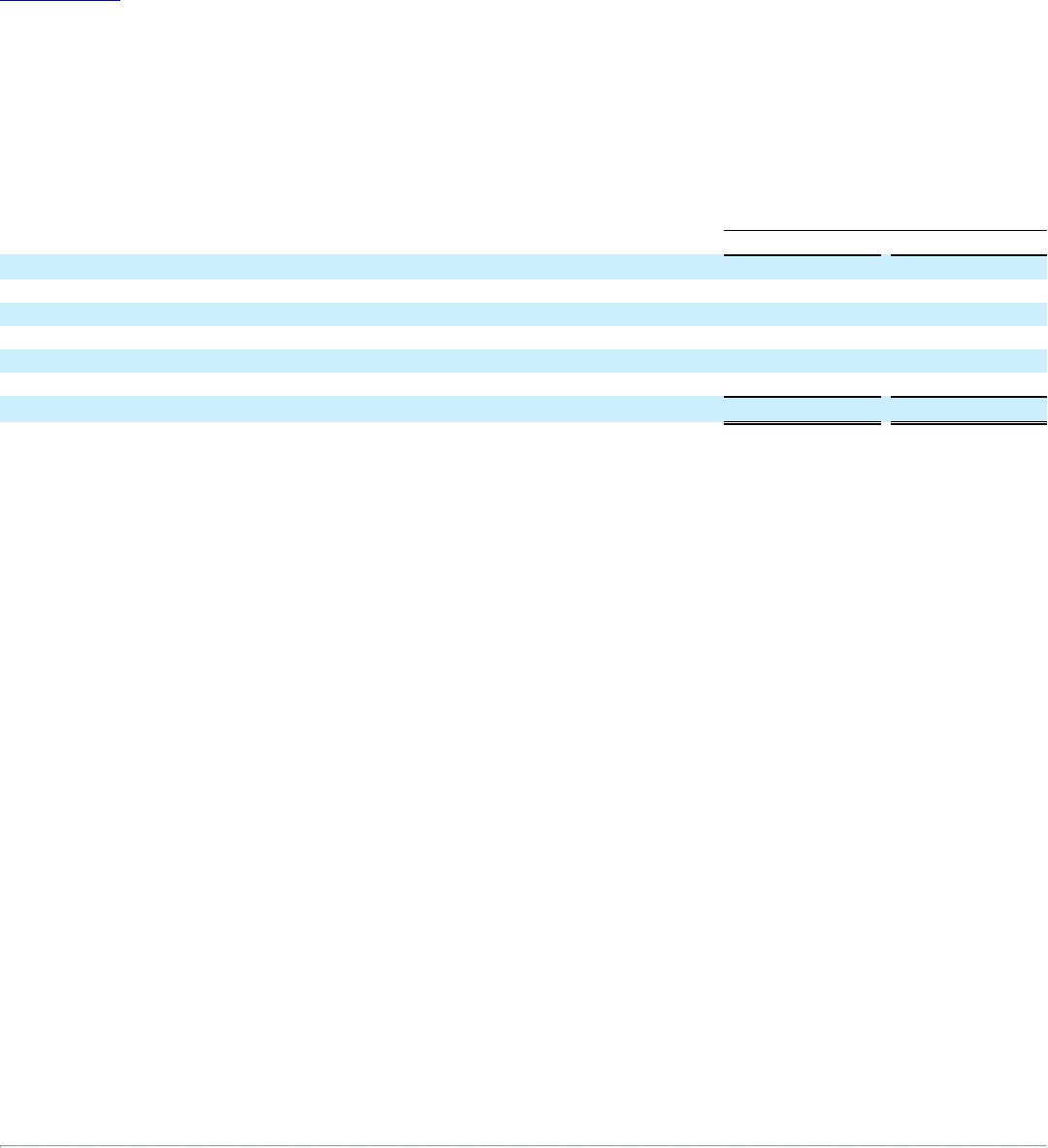

The following table summarizes other current liabilities (in thousands):

Accrued marketing expenses

$ 20,022

$ 31,985

Accrued professional and consulting fees

1,746

2,804

Sales return reserve

3,728

3,570

Sales, withholding, and property taxes payable

3,879

5,875

Accrued purchase price of business acquisition

—

1,688

Other

5,943

7,336

Total Other current liabilities

$ 35,318

$ 53,258

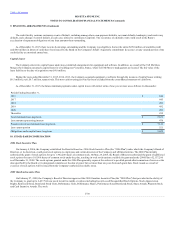

Revolving Line of Credit

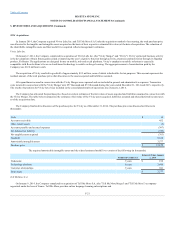

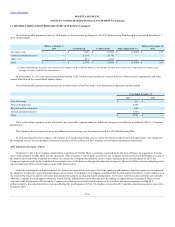

On October 28, 2014, Rosetta Stone Ltd (“RSL”), a wholly owned subsidiary of parent company Rosetta Stone Inc., executed a Loan and Security

Agreement with Silicon Valley Bank (“Bank”) to obtain a $25.0 million revolving credit facility (the “credit facility”). The Company executed the First

Amendment to the credit facility with the Bank effective March 31, 2015, the Second Amendment effective May 1, 2015, the Third Amendment effective

June 29, 2015, and the Fourth Amendment effective December 29, 2015. The Company is subject to certain covenants under the Loan and Security

Agreement including financial covenants and limitations on indebtedness, encumbrances, investments and distributions and dispositions of assets, certain of

which covenants were amended in the First, Second, Third, and Fourth Amendments, which were primarily amended to reflect updates to the Company's

financial outlook. The Third Amendment also changed the definition of "change of control" to eliminate the clause referring to a change in a portion of the

Board of Directors within a twelve-month period.

On March 14, 2016, the Company executed the Fifth Amendment to the credit facility. Under the amended agreement, the Company may borrow up to

$25.0 million including a sub-facility, which reduces available borrowings, for letters of credit in the aggregate availability amount of $4.0 million (the

"credit facility"). Borrowings by RSL under the credit facility are guaranteed by the Company as the ultimate parent. The credit facility has a term that expires

on January 1, 2018, during which time RSL may borrow and re-pay loan amounts and re-borrow the loan amounts subject to customary borrowing conditions.

The total obligations under the credit facility cannot exceed the lesser of (i) the total revolving commitment of $25.0 million or (ii) the borrowing base,

which is calculated as 80% of eligible accounts receivable. As a result, the borrowing base will fluctuate and the Company expects it will follow the general

seasonality of cash and accounts receivable (lower in the first half of the year and higher in the second half of the year). If the borrowing base less any

outstanding amounts, plus the cash held at SVB ("Availability") is greater than $25.0 million, then the Company may borrow up to an additional $5.0

million, but in no case can borrowings exceed $25.0 million. Interest on borrowings accrue at the Prime Rate provided that the Company maintains a

minimum cash and Availability balance of $17.5 million. If cash and Availability is below $17.5 million, interest will accrue at the Prime Rate plus 1%.

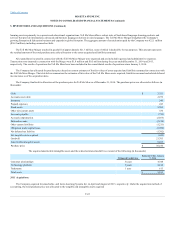

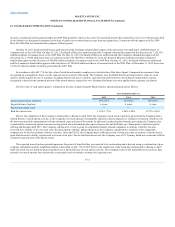

Proceeds of loans made under the credit facility may be used as working capital or to fund general business requirements. All obligations under the

credit facility, including letters of credit, are secured by a security interest on substantially all of the Company’s assets including intellectual property rights

and by a stock pledge by the Company of 100% of its ownership interests in U.S. subsidiaries and 66% of its ownership interests in certain foreign

subsidiaries.

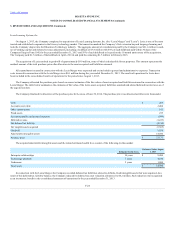

The Company is subject to certain financial and restrictive covenants under the credit facility. The credit facility contains customary affirmative and

negative covenants, including covenants that limit or restrict our ability to, among other things, incur additional indebtedness, dispose of assets, execute a

material change in business, acquire or dispose of an entity, grant liens, make share repurchases, and make distributions, including payment of dividends. The

Company is required to maintain compliance with a minimum liquidity amount and minimum financial performance requirements, as defined in the credit

facility. As of December 31, 2015, the Company was in compliance with all covenants.

F-29