Rosetta Stone 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

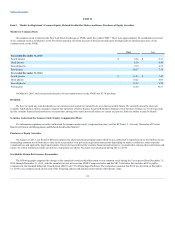

up the Enterprise & Education operating segment. Consumer Language and Consumer Fit Brains are components of the Consumer operating segment. Prior

to 2013, the reporting units were the same as our operating segments.

We test goodwill for impairment annually on June 30 of each year at the reporting unit level using a fair value approach or more frequently, if

impairment indicators arise. We have the option to first assess qualitative factors to determine whether it is more likely than not that the fair value of a

reporting unit is less than its carrying value, a "Step 0" analysis. If, based on a review of qualitative factors, it is more likely than not that the fair value of a

reporting unit is less than its carrying value, we perform "Step 1" of the traditional two-step goodwill impairment test by comparing the fair value of a

reporting unit with its carrying amount. If the carrying value exceeds the fair value, we measure the amount of impairment loss in "Step 2", if any, by

comparing the implied fair value of the reporting unit goodwill to its carrying amount.

The factors that we consider important in a qualitative analysis, and which could trigger an interim impairment review, include, but are not limited to: a

significant decline in the market value of our common stock for a sustained period; a material adverse change in economic, financial market, industry or

sector trends; a material failure to achieve operating results relative to historical levels or projected future levels; and significant changes in operations or

business strategy. We evaluate our reporting units with remaining goodwill balances on a quarterly basis to determine if a triggering event has occurred. We

will continue to review for impairment indicators.

In estimating the fair value of our reporting units in Step 1, we use a variety of techniques including the income approach (i.e., the discounted cash flow

method) and the market approach (i.e., the guideline public company method). Our projections are estimates that can significantly affect the outcome of the

analysis, both in terms of our ability to accurately project future results and in the allocation of fair value between reporting units.

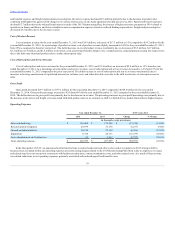

In connection with the annual goodwill impairment analysis performed as of June 30, 2015, we exercised our option to bypass Step 0 and began our

annual test with Step 1. We determined that the fair value of our Enterprise & Education literacy and Enterprise & Education language reporting units

substantially exceeded their carrying values. The fair value of our Consumer Fit Brains reporting unit exceeded its carrying value, although to a lesser extent,

primarily due to the recent purchase and business combination in 2014. As a result of the 2015 annual test, no goodwill impairment charges were recorded.

During the fourth quarter of 2015, we determined that sufficient indication existed to require performance of an interim goodwill impairment analysis

for the Consumer Fit Brains reporting unit. This indicator was due to a decline in the operations of the Consumer Fit Brains reporting unit, with decreases in

revenue and bookings within this reporting unit driving lower than expected operating results for the quarter and impacting the forecast going forward. In

this interim goodwill impairment test, the Consumer Fit Brains reporting unit failed Step 1. The combination of lower reporting unit fair value calculated in

Step 1 and the identification of unrecognized fair value adjustments to the carrying values of other assets and liabilities (primarily developed technology and

deferred revenue) in Step 2 of the interim goodwill impairment test, resulted in an implied fair value of goodwill below its carrying value. As a result, we

recorded an impairment loss of $5.6 million associated with the interim impairment assessment of the Consumer Fit Brains reporting unit as of December 31,

2015.

During the fourth quarter of 2015, we determined that sufficient indication existed to require performance of an interim goodwill impairment analysis

for the Enterprise & Education language reporting unit. This indicator was due to declines in the operations of the Enterprise & Education reporting unit,

with decreases in revenue and bookings within this reporting unit driving lower than expected operating results for the quarter and impacting the forecast

going forward. As a result of the operating results in the fourth quarter of 2015, we have further refined our strategy of focusing on the Enterprise & Education

segment and in March 2016 we announced a plan to exit the direct distribution of Enterprise & Education language offerings in a number of non-US markets

and right-size the overall business. In particular, we initiated a process to exit direct presence and close offices in China, Brazil and France. This plan is

expected to result in significantly lower projected revenues, bookings, and short-term profitability of the Enterprise & Education Language reporting unit. As

a result, we determined that sufficient indication existed to require the performance of an interim goodwill impairment analysis for the Enterprise &

Education Language reporting unit. While this analysis did indicate that the fair value of the Enterprise & Education Language reporting unit declined, the

fair value is still greater than the carrying value of this reporting unit. Since the Enterprise & Education Language reporting unit passed the Step 1 test, no

further analysis or testing under Step 2 was necessary and no impairment charges were recorded in connection with this interim impairment assessment of this

reporting unit.

We also routinely review goodwill at the reporting unit level for potential impairment as part of our internal control framework. In the fourth quarter of

2015, we evaluated any reporting unit with remaining goodwill that was not tested for impairment to determine if a triggering event has occurred. As

of December 31, 2015, the Company concluded that there were no indicators of impairment that would cause us to believe that it is more likely than not that

the fair value of any such reporting units is less than the carrying value. Accordingly, a detailed impairment test has not been performed and no goodwill

impairment charges were recorded in connection with the interim impairment reviews of any such reporting units.

33