Rosetta Stone 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

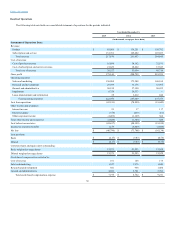

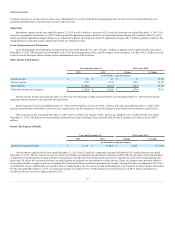

Income tax benefit

$ (6,489)

$ (1,884)

$ (4,605)

244.4%

Our income tax benefit for the year ended December 31, 2014 was $6.5 million, compared to income tax benefit of $1.9 million for the year ended

December 31, 2013. The change from the prior year primarily resulted from the tax benefits related to the goodwill impairments taken during 2014 related to

the Consumer Language reporting units and current year losses in Canada and France. The goodwill that was written off related to acquisitions from prior

years, a portion of which resulted in a tax benefit as a result of writing off a deferred tax liability previously recorded (i.e., goodwill had tax basis and was

amortized for tax). In the current year, these tax benefit amounts were partially offset by income tax expense related to current year profits from certain foreign

operations and foreign withholding taxes. The tax benefit was also partially offset by the tax expense related to the tax impact of the amortization of

indefinite lived intangibles, and the inability to recognize tax benefits associated with current year losses of operations in all other foreign jurisdictions and

in the U.S. due to the valuation allowance recorded against the deferred tax asset balances of these entities.

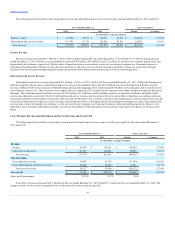

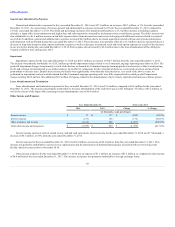

Our principal source of liquidity at December 31, 2015 consisted of $47.8 million in cash and cash equivalent and short-term investments, a decrease of

$16.9 million, from $64.7 million as of December 31, 2014. Our primary operating cash requirements include the payment of salaries, incentive

compensation, employee benefits and other personnel related costs, as well as direct advertising expenses, costs of office facilities, and costs of information

technology systems. Historically, we have primarily funded these requirements through cash flow from our operations. For the year ended December 31,

2015, we generated negative cash flows from operations as reflected in our consolidated statements of cash flows.

As part of our strategic shift, we have begun and continue to reorganize our business around our Enterprise & Education segment while we optimize our

Consumer segment for profitability and cash generation. Our Enterprise & Education business and our Consumer business are affected by different sales-to-

cash patterns. Within our Enterprise & Education segment, revenue in our education, government, and corporate sales channels are seasonally stronger in the

second half of the calendar year due to purchasing and budgeting cycles. Our Consumer revenue is affected by seasonal trends associated with the holiday

shopping season. Consumer sales typically turn to cash more quickly than Enterprise & Education sales, which tend to have longer collection cycles.

Historically, in the first half of the year we have been a net user of cash and in the second half of the year we have been a net generator of cash. We expect this

trend to continue. In 2016, we expect our cash balance to decline in part as we execute the restructuring actions in accordance with our revised strategy and

other initiatives, as well as anticipated near-term lower operating results.

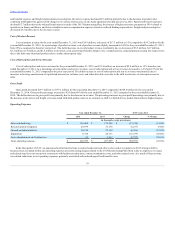

We believe our current cash and cash equivalents, short-term investments, and funds generated from our sales will be sufficient to meet our cash needs

for at least the next twelve months. We have generated significant operating losses as reflected in our accumulated deficit and we may continue to incur

operating losses in the future that may continue to require additional working capital to execute strategic initiatives to grow our business. Our future capital

requirements will depend on many factors, including development of new products, market acceptance of our products, the levels of advertising and

promotion required to launch additional products and improve our competitive position in the marketplace, the expansion of our sales, support and

marketing organizations, the optimization of office space in the U.S. and worldwide, building the infrastructure necessary to support our growth, the response

of competitors to our products and services, and our relationships with suppliers. We extend payments to certain vendors in order to minimize the amount of

working capital deployed in the business. In order to maximize our cash position, we will continue to manage our existing inventory, accounts receivable,

and accounts payable balances. In addition, borrowings under our revolving credit facility can be utilized to meet working capital requirements, anticipated

capital expenditures, and other obligations.

On October 28, 2014, we entered into a $25.0 million revolving credit Loan and Security Agreement with Silicon Valley Bank, which was amended

effective March 31, 2015, May 1, 2015, June 29, 2015, December 29, 2015 and further amended effective March 14, 2016. Under the amended agreement, we

may borrow up to $25.0 million including a sub-facility, which reduces available borrowings, for letters of credit in the aggregate availability amount of $4.0

million (the "credit facility"). Borrowings by RSL under the credit facility are guaranteed by us as the ultimate parent. The credit facility has a term that

expires on January 1, 2018, during which time RSL may borrow and re-pay loan amounts and re-borrow the loan amounts subject to customary borrowing

conditions.

46