Rosetta Stone 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

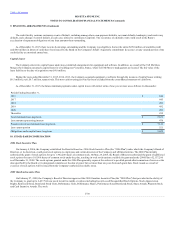

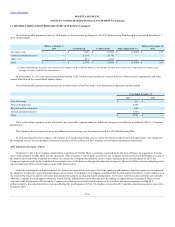

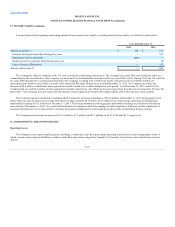

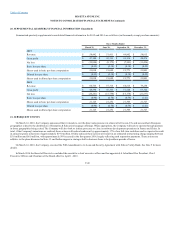

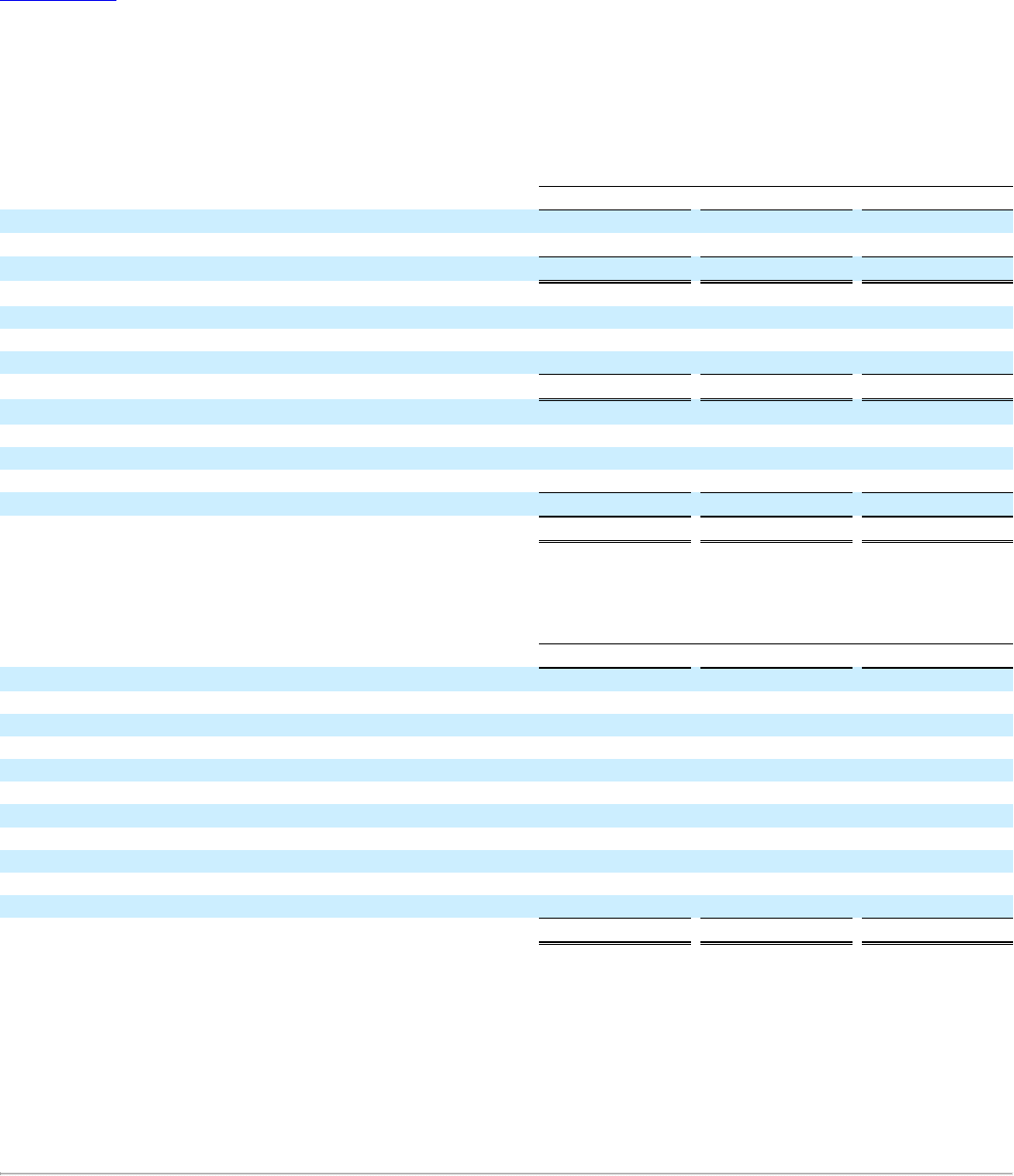

The components of loss before income taxes and the provision for taxes on income consist of the following (in thousands):

United States

$ (41,458)

$ (60,434)

$ (14,360)

Foreign

(4,179)

(19,761)

(3,658)

Loss before income taxes

$ (45,637)

$ (80,195)

$ (18,018)

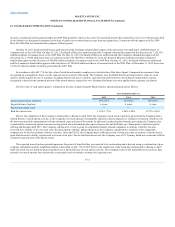

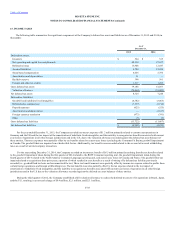

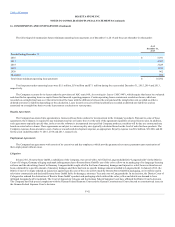

The provision for taxes on income consists of the following (in thousands):

Federal

$ (157)

$ 29

$ 155

State

96

23

123

Foreign

444

1,258

1,709

Total current

$ 383

$ 1,310

$ 1,987

Deferred:

Federal

$ 1,148

$ (5,425)

$ (3,972)

State

169

(797)

(112)

Foreign

(541)

(1,577)

213

Total deferred

776

(7,799)

(3,871)

Provision (benefit) for income taxes

$ 1,159

$ (6,489)

$ (1,884)

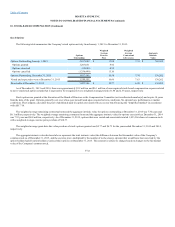

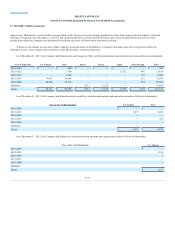

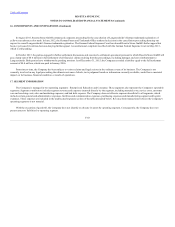

Reconciliation of income tax provision (benefit) computed at the U.S. federal statutory rate to income tax expense (benefit) is as follows (in thousands):

Income tax benefit at statutory federal rate

$ (15,973)

$ (28,068)

$ (6,306)

State income tax expense, net of federal income tax effect

231

(782)

7

Acquired intangibles

—

—

(859)

Nondeductible goodwill impairment

1,961

—

—

Other nondeductible expenses

88

482

1,105

Tax rate differential on foreign operations

(1,019)

276

(264)

Increase in valuation allowance

15,713

21,772

4,263

Tax audit settlements

(96)

—

—

Change in prior year estimates

225

(69)

(17)

Other tax credits

29

(102)

—

Other

—

2

187

Income tax expense (benefit)

$ 1,159

$ (6,489)

$ (1,884)

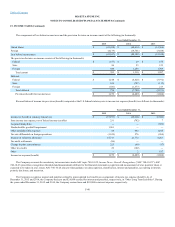

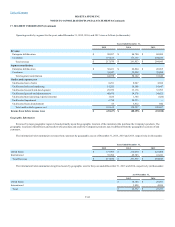

The Company accounts for uncertainty in income taxes under ASC topic 740-10-25, ("ASC 740-10-25"). ASC

740-10-25 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. ASC 740-10-25 also provides guidance on derecognition, classification, interest and penalties, accounting in interim

periods, disclosure, and transition.

The Company recognizes interest and penalties related to unrecognized tax benefits as a component of income tax expense (benefit). As of

December 31, 2015 and 2014, the Company had zero and $26,000 accrued for interest and penalties, respectively, in "Other Long Term Liabilities". During

the years ended December 31, 2015 and 2014, the Company accrued zero and $10,000 in interest expense, respectively.

F-40