Rosetta Stone 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

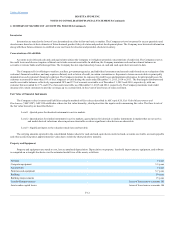

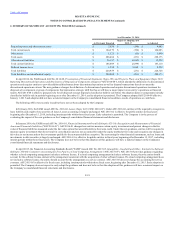

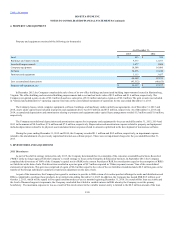

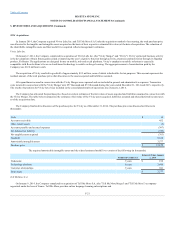

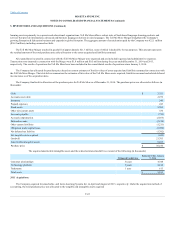

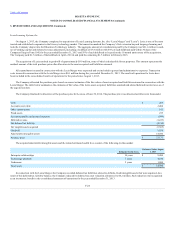

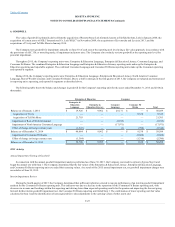

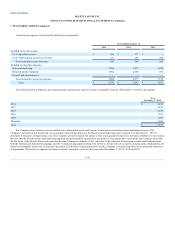

Prepaid expenses and other current assets

$ 5,038

$ (196)

$ 4,842

Total current assets

$ 164,279

$ (196)

$ 164,083

Other assets

$ 1,525

$ (35)

$ 1,490

Total assets

$ 288,404

$ (231)

$ 288,173

Other current liabilities

$ 56,157

$ (2,899)

$ 53,258

Total current liabilities

$ 186,009

$ (2,899)

$ 183,110

Deferred income taxes

$ 1,554

$ 2,668

$ 4,222

Total liabilities

$ 224,959

$ (231)

$ 224,728

Total liabilities and stockholders' equity

$ 288,404

$ (231)

$ 288,173

In April 2014, the FASB issued ASU No. 2014-08,

("ASU 2014-08"), which amends the definition of a discontinued

operation and requires entities to provide additional disclosures about discontinued operations as well as disposal transactions that do not meet the

discontinued operations criteria. The new guidance changes the definition of a discontinued operation and requires discontinued operations treatment for

disposals of a component or group of components that represents a strategic shift that has or will have a major impact on an entity’s operations or financial

results. ASU 2014-08 is effective prospectively for all disposals (except disposals classified as held for sale before the adoption date) or components initially

classified as held for sale in periods beginning on or after December 15, 2014; earlier adoption is permitted. The Company adopted ASU 2014-08 effective

January 1, 2015 and adoption did not have a material impact on the Company's consolidated financial condition, results of operations or cash flows.

The following ASUs were recently issued but have not yet been adopted by the Company:

In February 2016, the FASB issued ASU No. 2016-02, ("ASU 2016-02"). Under ASU 2016-02, entities will be required to recognize a

lease liability and a right-of-use asset for all leases. Lessor accounting is largely unchanged. ASU 2016-02 is effective for public entities in fiscal years

beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption is permitted. The Company is in the process of

evaluating the impact of the new guidance on the Company's consolidated financial statements and disclosures.

In January 2016, the FASB issued ASU No. 2016-01,

("ASU 2016-01"). ASU 2016-01 changes how entities measure certain equity investments and present changes in the fair

value of financial liabilities measured under the fair value option that are attributable to their own credit. Under the new guidance, entities will be required to

measure equity investments that do not result in consolidation and are not accounted for under the equity method at fair value and recognize any changes in

fair value in net income unless the investments qualify for the new practicability exception. The accounting for other financial instruments, such as loans and

investments in debt securities is largely unchanged. ASU 2016-01 is effective for public entities in fiscal years beginning after December 15, 2017, including

interim periods within those fiscal years. The Company does not believe that the adoption of this guidance will have a material impact on the Company's

consolidated financial statements and disclosures.

In April 2015, the Financial Accounting Standards Board ("FASB") issued ASU No. 2015-05,

("ASU 2015-05"). ASU 2015-05 provides guidance regarding

whether a cloud computing arrangement includes a software license. If a cloud computing arrangement includes a software license, then the entity should

account for the software license element of the arrangement consistent with the acquisition of other software licenses. If a cloud computing arrangement does

not include a software license, the entity should account for the arrangement as a service contract. ASU 2015-05 does not change the accounting for service

contracts. ASU 2015-05 is effective for fiscal years, including interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is

permitted. The Company does not expect to early adopt the guidance and does not believe that the adoption of this guidance will have a material impact on

the Company's consolidated financial statements and disclosures.

F-18