Rosetta Stone 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

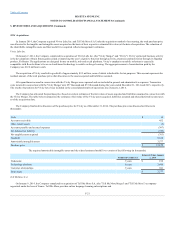

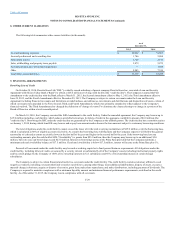

In April 2015, the FASB issued ASU No. 2015-03,

("ASU 2015-03"). ASU 2015-03 requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct

deduction from the carrying amount of that debt liability, consistent with debt discounts. The recognition and measurement guidance for debt issuance costs

are not affected by the amendments in ASU 2015-03. ASU 2015-03 will be effective for interim and annual financial statements issued for fiscal years

beginning after December 15, 2015. Early adoption is permitted for financial statements that have not been previously issued. The Company does not believe

that the adoption of this guidance will have a material impact on the Company's consolidated financial statements and disclosures.

In August 2014, the FASB issued ASU No. 2014-15, ("ASU 2014-15"). ASU

2014-15 addresses management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to

provide related footnote disclosures. Management’s evaluation should be based on relevant conditions and events that are known and reasonably knowable

at the date that the financial statements are issued. ASU 2014-15 will be effective for the first interim period within annual reporting periods beginning after

December 15, 2016. Early adoption is permitted. The Company does not expect to early adopt this guidance and does not believe that the adoption of this

guidance will have a material impact on the Company's financial statements and disclosures.

In May 2014, the FASB issued ASU No. 2014-09, ("ASU 2014-09"), which replaces the current

revenue accounting guidance. ASU 2014-09 is effective for annual periods beginning after December 15, 2016. In August 2015, the FASB issued ASU No.

2015-14, ("ASU 2015-14") which defers the effective date of the updated

guidance on revenue recognition by one year to make ASU 2014-09 effective for annual periods beginning after December 31, 2017. The core principle of

ASU 2014-09 is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply a five

step model to 1) identify the contract(s) with a customer, 2) identify the performance obligations in the contract, 3) determine the transaction price, 4) allocate

the transaction price to the performance obligations in the contract and 5) recognize revenue when (or as) the entity satisfies a performance obligation.

Entities may choose from two adoption methods, with certain practical expedients. The Company expects that it will adopt this new guidance beginning in

the first quarter of 2018 and is currently evaluating the appropriate transition method and any impact of the new guidance on the Company's consolidated

financial statements and disclosures.

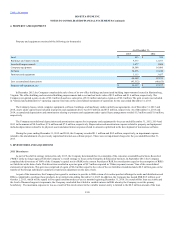

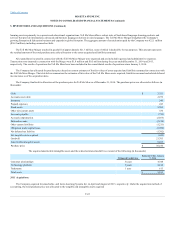

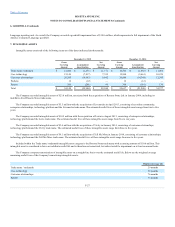

Inventory consisted of the following (in thousands):

Raw materials

$ 3,375

$ 3,163

Finished goods

3,958

3,337

Total inventory

$ 7,333

$ 6,500

F-19