Rosetta Stone 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

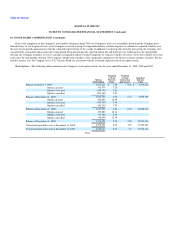

10. STOCK-BASED COMPENSATION

2006 Stock Incentive Plan

On January 4, 2006, the Company established the Rosetta Stone Inc. 2006 Stock Incentive Plan (the "2006 Plan") under which the Company's Board of

Directors, at its discretion, could grant stock options to employees and certain directors of the Company and affiliated entities. The plan initially authorized

the grant of stock options for up to 1,942,200 shares of common stock. On May 28, 2008, the Board of Directors authorized the grant of additional stock

options for up to 195,000 shares of common stock under the plan, resulting in total stock options available for grant under the 2006 Plan of 2,137,200 as of

December 31, 2008. The stock options granted under the Stock Plan generally expire at the earlier of a specified period after termination of service or the date

specified by the Board or its designated committee at the date of grant, but not more than ten years from such grant date. Stock issued as a result of exercises

of stock options will be issued from the Company's authorized available stock.

2009 Omnibus Incentive Plan

On February 27, 2009, the Company's Board of Directors approved a new Stock Incentive and Award Plan (the "2009 Plan") that provides for the ability

of the Company to grant up to 2,437,744 new stock incentive awards or options including Incentive and Nonqualified Stock Options, Stock Appreciation

Rights, Restricted Stock, Restricted Stock Units, Performance Units, Performance Shares, Performance based Restricted Stock, Share Awards, Phantom Stock

and Cash Incentive Awards. The stock incentive awards and options granted under the 2009 Plan generally expire at the earlier of a specified period after

termination of service or the date specified by the Board or its designated committee at the date of grant, but not more than ten years from such grant date.

Concurrent with the approval of the 2009 Plan, the 2006 Plan was terminated for purposes of future grants. At December 31, 2009 there were 1,960,958

shares available for future grant under the 2009 Plan.

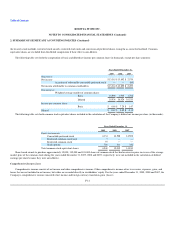

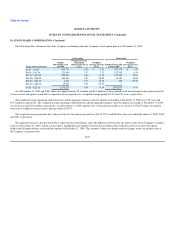

In accordance with Accounting Standards Codification topic 718, Compensation—Stock Compensation ("ASC 718"), the fair value of stock-based

awards to employees is calculated as of the date of grant. Compensation expense is then recognized on a straight-line basis over the requisite service period of

the award. The Company uses the Black-Scholes pricing model to value its stock options, which requires the use of estimates, including future stock price

volatility, expected term and forfeitures. Stock-based compensation expense recognized is based on the estimated portion of the awards that are expected to

vest. Estimated forfeiture rates were applied in the expense calculation.The fair value of each option grant is estimated on the date of grant using the Black

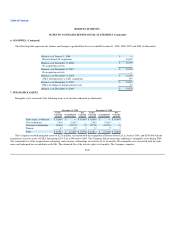

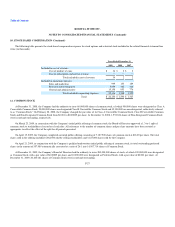

Scholes option pricing model as follows:

Year Ended December 31,

2009 2008 2007

Expected stock price volatility 61% 57% - 62% 62% - 70%

Expected term of options 6 years 6 years 6 years

Expected dividend yield — — —

Risk-free interest rate 1.71% - 2.46% 2.08% - 3.36% 3.50% - 4.96%

F-23