Rosetta Stone 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. COMMITMENTS AND CONTINGENCIES (Continued)

five years. Building, warehouse and office space leases range from three months to 85 months. Certain leases also include lease renewal options.

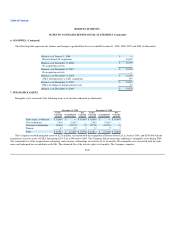

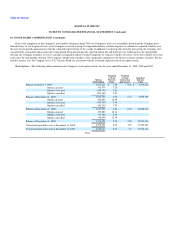

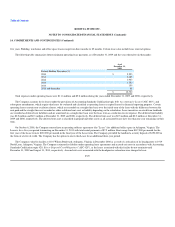

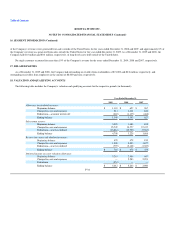

The following table summarizes future minimum operating lease payments as of December 31, 2009 and the years thereafter (in thousands):

As of

December 31,

2009

Periods Ending December 31,

2010 $ 5,593

2011 3,185

2012 1,943

2013 1,752

2014 159

2015 and thereafter 88

$ 12,720

Total expenses under operating leases were $11.6 million and $9.8 million during the years ended December 31, 2009 and 2008, respectively.

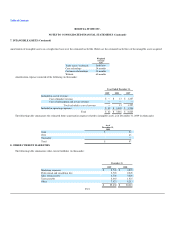

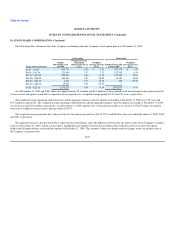

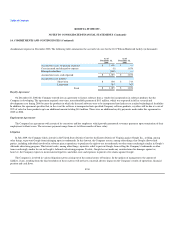

The Company accounts for its leases under the provisions of Accounting Standards Codification topic 840, Accounting for Leases("ASC 840"), and

subsequent amendments, which require that leases be evaluated and classified as operating leases or capital leases for financial reporting purposes. Certain

operating leases contain rent escalation clauses, which are recorded on a straight-line basis over the initial term of the lease with the difference between the

rent paid and the straight-line rent recorded as either a deferred rent asset or liability depending on the calculation. Lease incentives received from landlords

are recorded as deferred rent liabilities and are amortized on a straight-line basis over the lease term as a reduction to rent expense. The deferred rent liability

was $0.5 million and $0.3 million at December 31, 2009 and 2008, respectively. The deferred rent asset was $0.5 million and $0.3 million at December 31,

2009 and 2008, respectively. The deferred rent asset is classified in prepaid and other assets as all associated leases have less than one year remaining on their

term.

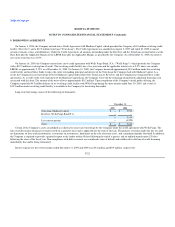

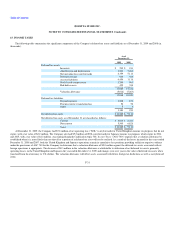

On October 6, 2008, the Company entered into an operating sublease agreement (the "Lease") for additional office space in Arlington, Virginia. The

Lease is for a five year period terminating on December 31, 2013 with total rental payments of $7.5 million. Rents range from $117,000 per month for the

first year of the Lease term to $132,000 per month in the final year of the Lease term. The Company provided the landlord a security deposit of $352,000 in

the form of a letter of credit. The Company has the option to renew this Lease for an additional three-year period.

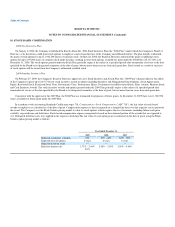

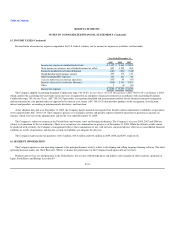

The Company exited its facility at 1101 Wilson Boulevard, Arlington, Virginia in December 2008 as a result of a relocation of its headquarters to 1919

North Lynn, Arlington, Virginia. The Company estimated its liability under operating lease agreements and accrued exit costs in accordance with Accounting

Standards Codification topic 420, Exit or Disposal Cost Obligations ("ASC 420"), as the leases associated with this facility do not terminate until

December 31, 2009 and August 31, 2013, respectively. Accrued exit costs associated with the headquarters relocation were charged to lease

F-29