Rosetta Stone 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. COMMITMENTS AND CONTINGENCIES (Continued)

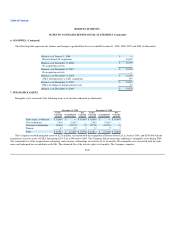

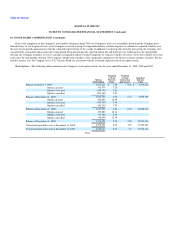

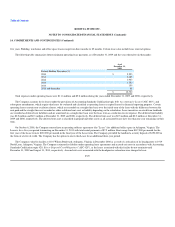

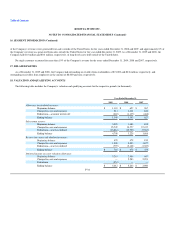

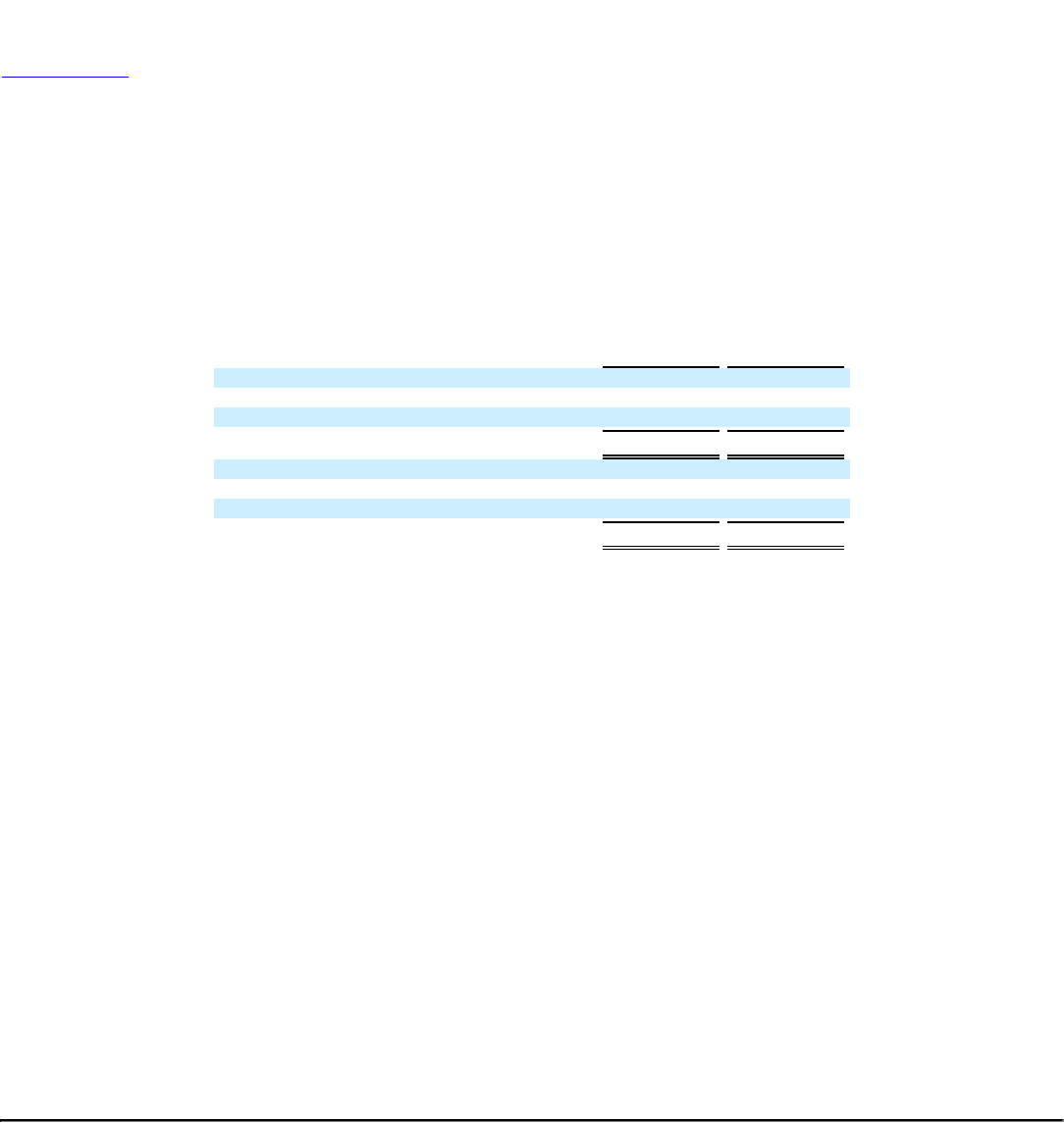

abandonment expense in December 2008. The following table summarizes the accrued exit costs for the 1101 Wilson Boulevard facility (in thousands):

As of

December 31,

2009

As of

December 31,

2008

Accrued exit costs, beginning of period $ 1,676 $ —

Costs incurred and charged to expense (8) 1,676

Principal reductions (649) —

Accrued exit costs, end of period $ 1,019 $ 1,676

Accrued exit cost liability

Short-term $ 504 $ 713

Long-term 515 963

Total $ 1,019 $ 1,676

Royalty Agreement

On December 28, 2006 the Company entered into an agreement to license software from a vendor for incorporation in software products that the

Company is developing. The agreement required a one-time, non-refundable payment of $0.3 million, which was expensed in full as research and

development costs during 2006 because the products in which the licensed software were to be incorporated into had not yet reached technological feasibility.

In addition, the agreement specifies that, in the event the software is incorporated into specified Company software products, royalties will be due at a rate of

20% of sales for those products up to an additional amount totaling $0.4 million. There were no additional royalty payments made under this agreement in

2009 or 2008.

Employment Agreements

The Company has agreements with certain of its executives and key employees which provide guaranteed severance payments upon termination of their

employment without cause. The severance payments range from six to fifteen months of base salary.

Litigation

In July 2009, the Company filed a lawsuit in the United States District Court for the Eastern District of Virginia against Google Inc., seeking, among

other things, to prevent Google from infringing upon its trademarks. In this lawsuit, the Company asserts, among other things, that Google allows third

parties, including individuals involved in software piracy operations, to purchase the right to use its trademarks or other terms confusingly similar in Google's

Adwords advertising program. This lawsuit seeks, among other things, injunctive relief to prevent Google from selling the Company's trademarks or other

terms confusingly similar for use in Google's Adwords advertising program. To date, Google has not made any counterclaims for damages against us,

however, the Company expects to incur material legal fees and other costs and expenses in pursuit of its claims against Google.

The Company is involved in various litigation matters arising out of the normal course of business. In the opinion of management, the amount of

liability, if any, resulting from the final resolution of these matters will not have a material adverse impact on the Company's results of operations, financial

position and cash flows.

F-30