Rosetta Stone 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

basis, we established the option grant date, the interpolated common stock fair value and stock option fair value as of the

date on which all key option terms were communicated to the employees, which is the date reflected above.

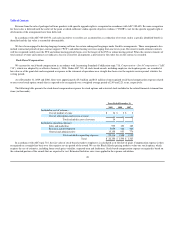

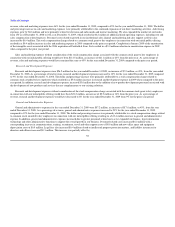

Stock-based Compensation Expense in Connection with Executive Stock Grants and IPO Option and Restricted Stock Grants

We made stock grants, restricted stock grants and stock option grants to our employees on April 15, 2009. In connection with these grants, we recorded

an aggregate expense of approximately $18.5 million in the second quarter of 2009, and an additional $6.3 million that will be recorded over the four-year

vesting period of the stock options and restricted stock grants.

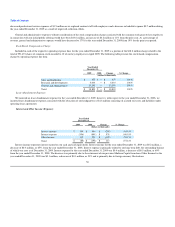

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable consist of amounts due to us from our normal business activities. We provide an allowance for doubtful accounts to reflect the

expected non-collection of accounts receivable based on past collection history and specific risks identified.

Intangible Assets

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark and other

intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives in accordance

with Accounting Standards Codification topic 350, Goodwill and Other Intangible Assets ("ASC 350"). On an annual basis, we review our indefinite lived

intangible assets for impairment based on the fair value of indefinite lived intangible assets as compared to the carrying value in accordance with ASC 350. In

the event the carrying value exceeds the fair value of the assets, the assets are written down to their fair value. There has been no impairment of intangible

assets during any of the periods presented.

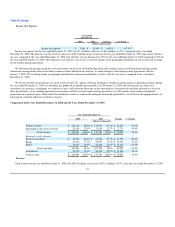

Goodwill

In accordance with ASC 350, goodwill is not amortized and is tested for impairment annually on June 30th and whenever events and circumstances

occur indicating goodwill might be impaired. The first step is a screen for potential impairment by comparing the fair value of our one reporting unit with its

carrying amount. The second step measures the amount of impairment loss, if any. As of June 30, 2009 and 2008, we reviewed the goodwill for impairment

and determined that no impairment of goodwill was identified during any of the periods presented, nor is the reporting unit at risk of failing step one of the

goodwill impairment test.

Valuation of Long-Lived Assets

In accordance with Accounting Standards Codification topic 360, Accounting for the Impairment or Disposal of Long-lived Assets ("ASC 360"), we

evaluate the recoverability of our long-lived assets. ASC 360 requires recognition of impairment of long-lived assets in the event that the net book value of

such assets exceeds the future undiscounted net cash flows attributable to such assets. Impairment, if any, is recognized in the period of identification to the

extent the carrying amount of an asset exceeds the fair value of such asset. Based on our analysis, we believe that no impairment of our long-lived assets was

indicated as of December 31, 2009 and 2008.

50