Rosetta Stone 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

which was released in July 2009. Revenue is recognized for software products and related services in accordance with Accounting Standards Codification

subtopic 985-605, Software: Revenue Recognition ("ASC 985-605").

Revenue is recognized when all of the following criteria are met: there is persuasive evidence of an arrangement; the product has been delivered or

services have been rendered; the fee is fixed and determinable; and collectability is probable. Revenues from packaged software and audio practice products

and online software subscriptions are recorded net of discounts.

Revenue is recognized from the sale of packaged software and audio practice products when the product has been delivered, assuming the remaining

revenue recognition criteria have been met. Software products include sales to end user customers and resellers. In most cases, revenue from sales to resellers

is not contingent upon resale of the software to the end user and is recorded in the same manner as all other product sales. Revenue from sales of packaged

software products are recognized as the products are shipped and title passes. A limited amount of packaged software products are sold to resellers on a

consignment basis. Revenue is recognized for these consignment transactions once the end-user sale has occurred, assuming the remaining revenue

recognition criteria have been met. In accordance with Accounting Standards Codification subtopic 985-605-50, Software: Revenue Recognition: Customer

Payments and Incentives ("ASC 985-605-50"), price protection for changes in the manufacturer suggested retail value granted to resellers for the inventory

that they have on hand at the date the price protection is offered is recorded as a reduction to revenue. We offer customers the ability to make payments for

packaged software purchases in installments over a period of time, which typically ranges between three and five months. Given that these installment

payment plans are for periods less than twelve months and a successful collection history has been established, revenue is recognized at the time of sale,

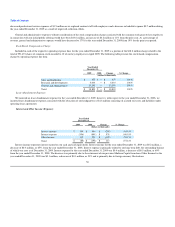

assuming the remaining revenue recognition criteria have been met. For the years ended December 31, 2009, 2008 and 2007, installment sales represented

8%, 4% and 3% respectively. Packaged software is provided to customers who purchase directly from us with a six-month right of return. We also allow our

retailers to return unsold products, subject to some limitations. In accordance with Accounting Standards Codification subtopic 985-605-15, Software:

Revenue Recognition: Products ("ASC 985-605-15"), product revenue is reduced for estimated returns, which are based on historical return rates.

Revenue for software license agreements sold via online software subscriptions as hosting agreements are recognized in accordance with Accounting

Standards Codification subtopic 985-605-05, Software: Revenue Recognition: Background ("ASC 985-605-05"). Revenue for online software subscriptions is

recognized ratably over the term of the subscription period, assuming all revenue recognition criteria have been met, which typically ranges between three and

twelve months. Some online licensing arrangements include a specified number of licenses that can be activated over a period of time, which typically ranges

between twelve and twenty-four months. Revenue for these arrangements is recognized on a per license basis ratably over the term of the individual license

subscription period, assuming all revenue recognition criteria have been met, which typically ranges between three and twelve months. Revenue for set-up

fees related to online licensing arrangements is recognized ratably over the term of the online licensing arrangement, assuming all revenue recognition criteria

have been met. Accounts receivable and deferred revenue are recorded at the time a customer enters into a binding subscription agreement and the

subscription services are made available to the customer. In connection with packaged software product sales and online software subscriptions, technical

support is provided to customers, including customers of resellers, at no additional charge. As the fee for technical support is included in the initial licensing

fee, the technical support and services are generally provided within one year, the estimated cost of providing such support is deemed insignificant and no

unspecified upgrades/enhancements are offered, technical support revenues are recognized together with the software product and license revenue. Costs

associated with the technical support are accrued at the time of sale.

47