Rosetta Stone 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

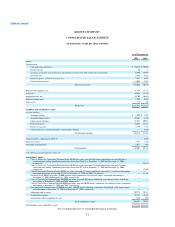

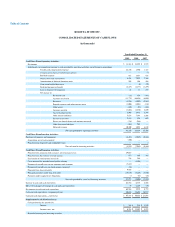

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

demand, product lifecycle status and product development plans. The Company uses historical information along with these future estimates to reserve for

obsolete and potential obsolete inventory.

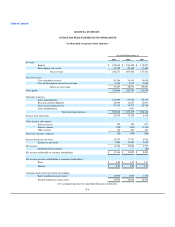

Concentrations of Credit Risk

Accounts receivable and cash and cash equivalents subject the Company to its highest potential concentrations of credit risk. The Company reserves for

credit losses and does not require collateral on its trade accounts receivable. In addition, the Company maintains cash and investment balances in accounts at

various banks and brokerage firms. The Company is insured by the Federal Deposit Insurance Corporation for up to $250,000 at each bank. The Company's

cash and cash equivalents may exceed the insured limits at times. The Company has not experienced any losses on cash and cash equivalent accounts to date

and the Company believes it is not exposed to any significant credit risk related to cash. The Company sells products to retailers, resellers, government

agencies, and individual consumers and extends credit based on an evaluation of the customer's financial condition, without requiring collateral. Exposure to

losses on receivables is principally dependent on each customer's financial condition. The Company monitors its exposure for credit losses and maintains

allowances for anticipated losses. No customer accounted for more than 10% of the Company's revenue during the years ended December 31, 2009, 2008 or

2007. The Company had 3 customers that accounted for 47% of accounts receivable at December 31, 2009, and two customers that accounted for 38% of

accounts receivable at December 31, 2008.

Fair Value of Financial Instruments

The carrying value of the Company's financial instruments, which include cash and cash equivalents, restricted cash, accounts receivable, accounts

payable, and other accrued expenses, approximate their fair values due to their short maturities. Based on borrowing rates currently available to the Company

for loans with similar terms, the carrying value of debt approximates fair value at December 31, 2009 and 2008.

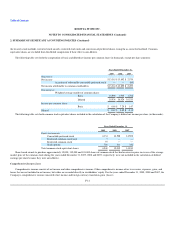

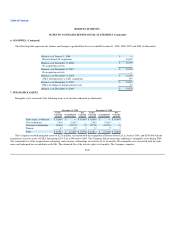

Property, Equipment and Software

Property, equipment, and software are stated at cost, less accumulated depreciation and amortization. Depreciation on property, leasehold improvements,

equipment, and software is computed on a straight-line basis over the estimated useful lives of the assets, as follows:

Software 3 years

Computer equipment 3 - 5 years

Automobiles 5 years

Furniture and equipment 5 - 7 years

Building 39 years

Building improvements 15 years

Leasehold improvements 4 - 7 years

Assets under capital leases lesser of lease term or economic life

Expenses for repairs and maintenance that do not extend the life of equipment are charged to expense as incurred. Expenses for major renewals and

betterments, which significantly extend the useful lives of existing property and equipment, are capitalized and depreciated. Upon retirement or

F-10