Rosetta Stone 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

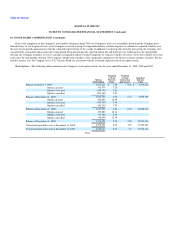

10. STOCK-BASED COMPENSATION (Continued)

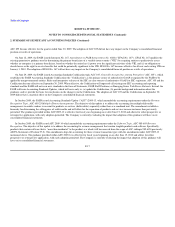

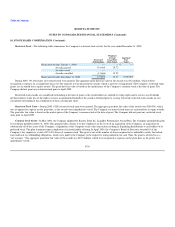

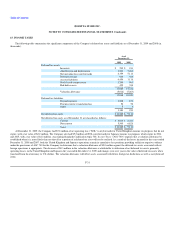

The following table presents the stock-based compensation expense for stock options and restricted stock included in the related financial statement line

items (in thousands):

Years Ended December 31,

2009 2008 2007

Included in cost of revenue:

Cost of product revenue $ 34 $ 2 $ 2

Cost of subscription and service revenue — — —

Total included in cost of revenue 34 2 2

Included in operating expenses:

Sales and marketing 999 153 189

Research and development 5,959 482 360

General and administrative 15,158 953 776

Total included in operating expenses 22,116 1,588 1,325

Total $ 22,150 $ 1,590 $ 1,327

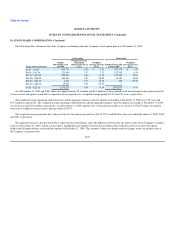

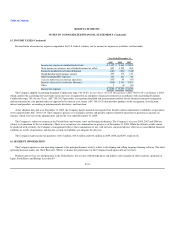

11. COMMON STOCK

At December 31, 2008, the Company had the authority to issue 60,000,000 shares of common stock, of which 900,000 shares were designated as Class A

Convertible Common Stock, 20,000,000 shares are designated Class B Convertible Common Stock and 39,100,000 are non-designated, collectively referred

to as "Common Stock." On February 28, 2008, the Company changed the par value of its Class A Convertible Common Stock, Class B Convertible Common

Stock and Non-Designated Common Stock from $0.001 to $0.00005 per share. At December 31, 2008, 1,935,654 shares of Non-Designated Common Stock

were issued and outstanding, respectively.

On March 23, 2009, in connection with the Company's initial public offering of common stock, the Board of Directors approved a 1.3-to-1 split of

common stock to stockholders of record as of such date. All references to the number of common shares and per share amounts have been restated as

appropriate to reflect the effect of the split for all periods presented.

On April 15, 2009, the Company completed an initial public offering consisting of 7,187,500 shares of common stock at $18.00 per share. The total

shares sold in the offering included 4,062,500 sold by selling stockholders and 3,125,000 shares sold by the Company.

On April 21, 2009, in conjunction with the Company's qualified underwritten initial public offering of common stock, its total outstanding preferred

shares in the amount of 557,989 automatically converted at a ratio of 26:1 into 14,507,714 shares of Common Stock.

At December 31, 2009, the Company's Board of Directors had the authority to issue 200,000,000 shares of stock, of which 190,000,000 were designated

as Common Stock, with a par value of $0.00005 per share, and 10,000,000 were designated as Preferred Stock, with a par value of $0.001 per share. At

December 31, 2009, 20,440,181 shares of Common Stock were issued and outstanding.

F-27