Rosetta Stone 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. INCOME TAXES

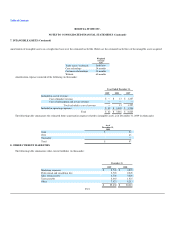

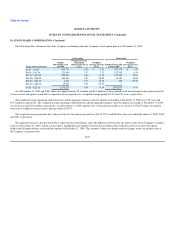

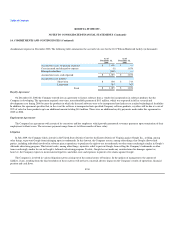

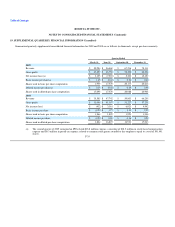

The following table summarizes the significant components of the Company's deferred tax assets and liabilities as of December 31, 2009 and 2008 (in

thousands):

As of

December 31,

2009 2008

Deferred tax assets:

Inventory $ 290 $ 183

Amortization and depreciation 3,521 5,068

Net operating loss carryforwards 4,359 5,112

Deferred revenue 663 528

Accrued liabilities 6,456 3,118

Stock-based compensation 2,266 965

Bad debt reserve 425 338

17,980 15,312

Valuation allowance (5,012) (5,263)

12,968 10,049

Deferred tax liabilities:

Prepaid expenses 1,328 876

Foreign currency translation loss 50 58

Other 5 5

1,383 939

Net deferred tax assets $ 11,585 $ 9,110

Net deferred tax assets as of December 31 are classified as follows:

Current $ 6,020 $ 2,282

Non-current 5,565 6,828

Total $ 11,585 $ 9,110

At December 31, 2009, the Company had $7.8 million of net operating loss ("NOL") carryforwards for United Kingdom income tax purposes that do not

expire, with a tax value of $2.2 million. The Company also had $5.2 million of NOL carryforwards for Japanese income tax purposes which expire in 2014

and 2015, with a tax value of $2.2 million. Accounting Standards Codification topic 740, Income Taxes ("ASC 740") requires that a valuation allowance be

established when it is more likely than not that all or a portion of a deferred tax asset will not be realized. As a result of the losses incurred for the years ended

December 31, 2008 and 2007, both the United Kingdom and Japanese operations remain in cumulative loss positions providing sufficient negative evidence

under the provisions of ASC 740 for the Company to determine that a valuation allowance of $5.0 million against the deferred tax assets associated with its

foreign operations is appropriate. The decrease of $0.3 million in the valuation allowance is attributable to utilization of net deferred tax assets, primarily

operating losses, in the United Kingdom and Japan in the year ended December 31, 2009 and changes year over year in the value of deferred tax assets when

translated from local currency to U.S. dollars. The valuation allowance will offset assets associated with future foreign tax deductions as well as carryforward

items.

F-31