Rosetta Stone 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

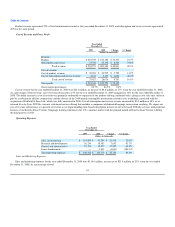

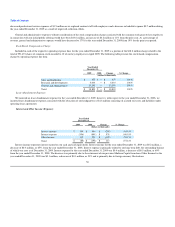

revenue, sales and marketing expenses were 46% for the year ended December 31, 2009, compared to 45% for the year ended December 31, 2008. The dollar

and percentage increase in sales and marketing expenses were primarily attributable to the continued expansion of our direct marketing activities. Advertising

expenses grew by $8.6 million and were primarily related to television and radio media and internet marketing. We also expanded the number of our kiosks

from 150 as of December 31, 2008 to 242 as of December 31, 2009, which resulted in $6.2 million of additional kiosk operating expenses, including rent and

sales compensation related expenses. Personnel costs related to growth in our institutional sales channel and marketing and sales support activities also

increased by $6.4 million. The stock compensation charge related to a common stock grant to key employees in connection with our initial public offering

resulted in a $0.4 million increase in sales and marketing expense in 2009 compared to the prior year period. Completion in January 2009 of the amortization

of the intangible assets associated with the 2006 acquisition of Fairfield & Sons, Ltd. resulted in a $3.0 million reduction in amortization expense in 2009

when compared to the prior year period.

Sales and marketing expenses without consideration of the stock compensation charge associated with the common stock grant to key employees in

connection with our initial public offering would have been $114.5 million, an increase of $21.1 million or 23% from the prior year. As a percentage of

revenue, sales and marketing expenses would have remained the same at 45% for the year ended December 31, 2009 compared to the prior year period.

Research and Development Expenses

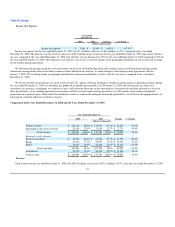

Research and development expenses were $26.2 million for the year ended December 31 2009, an increase of $7.9 million, or 43%, from the year ended

December 31, 2008. As a percentage of total revenue, research and development expenses increased to 10% for the year ended December 31, 2009 compared

to 9% for the year ended December 31, 2008. The dollar and percentage increase were primarily attributable to a stock compensation charge related to

common stock awarded to key employees which resulted in a $5.0 million increase in research and development expense in 2009 when compared to the prior

year period. In addition, research and development expenses increased $3.0 million due to the addition of new product development personnel associated with

the development of new products and services that are complementary to our existing solutions.

Research and development expenses without consideration of the stock compensation charge associated with the common stock grant to key employees

in connection with our initial public offering would have been $21.2 million, an increase of $2.9 million or 16% from the prior year. As a percentage of

revenue, research and development expenses would have decreased to 8% for the year ended December 31, 2009 from 9% for the prior year period.

General and Administrative Expenses

General and administrative expenses for the year ended December 31, 2009 were $57.2 million, an increase of $17.6 million, or 45%, from the year

ended December 31, 2008. As a percentage of revenue, general and administrative expenses increased to 23% for the year ended December 31, 2009

compared to 19% for the year ended December 31, 2008. The dollar and percentage increase was primarily attributable to a stock compensation charge related

to common stock awarded to key employees in connection with our initial public offering resulting in a $13.4 million increase in general and administrative

expense. In addition, general and administrative expenses increased due to greater personnel related costs as we expanded our finance, legal, information

technology and other administrative functions to support the overall growth in our business. Personnel-related costs increased $4.2 million with a

corresponding increase in communications, training, recruitment, travel and other support costs of $0.6 million and new office space and equipment

depreciation costs of $0.9 million. Legal fees also increased $0.4 million related to intellectual property protection matters, and liability insurances for

directors and officers increased $0.3 million. This increase was partially offset by

55