Rosetta Stone 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

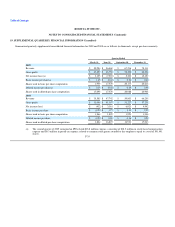

16. SEGMENT INFORMATION (Continued)

of the Company's revenues were generated from sales outside of the United States for the years ended December 31, 2008 and 2007, and approximately 8% of

the Company's revenue was generated from sales outside the United States for the year ended December 31, 2009. As of December 31, 2009 and 2008, the

Company had $1.0 million and $0.4 million, respectively, of long-lived assets held outside of the United States.

No single customer accounted for more than 10% of the Company's revenue for the years ended December 31, 2009, 2008 and 2007, respectively.

17. RELATED PARTIES

As of December 31, 2009 and 2008, the Company had outstanding receivables from stockholders of $74,000 and $0.2 million, respectively, and

outstanding receivables from employees in the amount of $8,000 and zero, respectively.

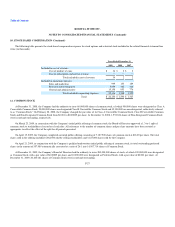

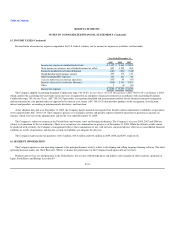

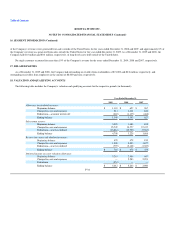

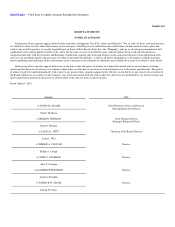

18. VALUATION AND QUALIFYING ACCOUNTS

The following table includes the Company's valuation and qualifying accounts for the respective periods (in thousands):

Year Ended December 31,

2009 2008 2007

Allowance for doubtful accounts:

Beginning balance $ 1,103 $ 627 $ 267

Charged to costs and expenses 911 1,611 828

Deductions—accounts written off (665) (1,135) (468)

Ending balance 1,349 1,103 627

Sales return reserve:

Beginning balance 3,229 1,688 858

Charged to costs and expenses 18,340 14,337 10,413

Deductions—reserves utilized (16,861) (12,796) (9,583)

Ending balance 4,708 3,229 1,688

Reserve for excess and obsolete inventory:

Beginning balance 470 478 190

Charged to costs and expenses 1,090 2,093 1,677

Deductions—reserves utilized (795) (2,101) (1,389)

Ending balance $ 765 $ 470 $ 478

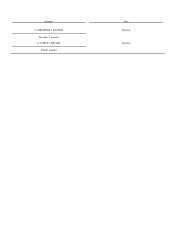

Deferred income tax asset valuation allowance:

Beginning balance 5,263 2,980 687

Charged to costs and expenses — 2,283 2,293

Deductions (251) — —

Ending balance $ 5,012 $ 5,263 $ 2,980

F-34