Rosetta Stone 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. STOCK-BASED COMPENSATION (Continued)

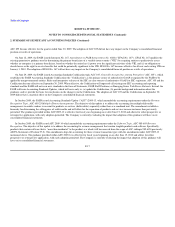

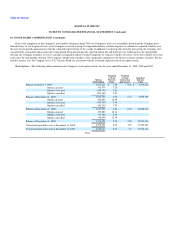

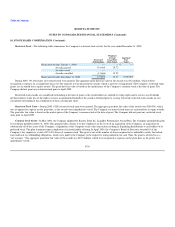

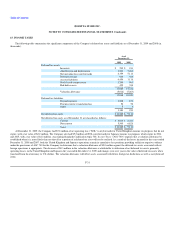

Restricted Stock—The following table summarizes the Company's restricted stock activity for the year ended December 31, 2009:

Nonvested

Outstanding

Weighted

Average

Grant Date

Fair Value

Aggregate

Fair

Value

Nonvested Awards, January 1, 2009 — — $ —

Awards granted 191,468 18.72

Awards vested —

Awards cancelled (11,666) 19.55

Nonvested Awards, December 31, 2009 179,802 18.67 3,356,903

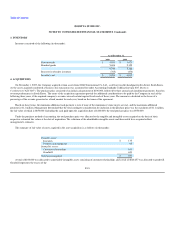

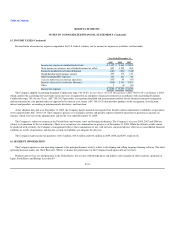

During 2009, 191,468 shares of restricted stock were granted. The aggregate grant date fair value of the awards was $3.6 million, which will be

recognized as expense on a straight-line basis over the requisite service period of the awards, which is also the vesting period. The Company's restricted stock

grants are accounted for as equity awards. The grant date fair value is based on the market price of the Company's common stock at the date of grant. The

Company did not grant any restricted stock prior to April 2009.

Restricted stock awards are considered outstanding at the time of grant as the stock holders are entitled to voting rights and to receive any dividends

declared subject to the loss of the right to receive accumulated dividends if the award is forfeited prior to vesting. Unvested restricted stock awards are not

considered outstanding in the computation of basic earnings per share.

Restricted Stock Units—During 2009, 9,858 restricted stock units were granted. The aggregate grant date fair value of the awards was $180,000, which

was recognized as expense on the grant date, as the awards were immediately vested. The Company's restricted stock units are accounted for as equity awards.

The grant date fair value is based on the market price of the Company's common stock at the date of grant. The Company did not grant any restricted stock

units prior to April 2009.

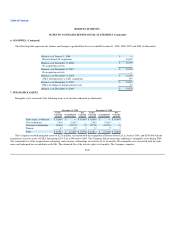

Common Stock Grant—In May 2006, the Company adopted the Rosetta Stone Inc. Liquidity Performance Award Plan. The Company amended this plan

by resolution dated December 31, 2008. This plan provides a bonus to its key employees in the event of an acquisition of the Company, an acquisition of

substantially all of the assets of the Company, a liquidation of the Company or any other transaction resulting in liquidating distributions to any holders of its

preferred stock. This plan terminates upon completion of an initial public offering. In April 2009, the Company's Board of Directors awarded 10 of the

Company's key employees a total of 591,491 shares of common stock. This grant is net of the number of shares required to be withheld to satisfy the federal,

state and local tax withholding obligations, which were paid by the Company to the respective taxing authorities in cash. Thus, the grant is referred to as a

"net issuance." The aggregate grant date fair value of the awards was $18.5 million, which was recognized as expense on the grant date, as the grants were

immediately vested.

F-26