Rosetta Stone 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. INCOME TAXES (Continued)

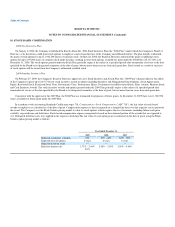

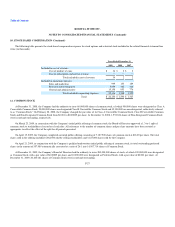

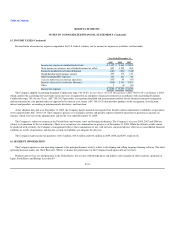

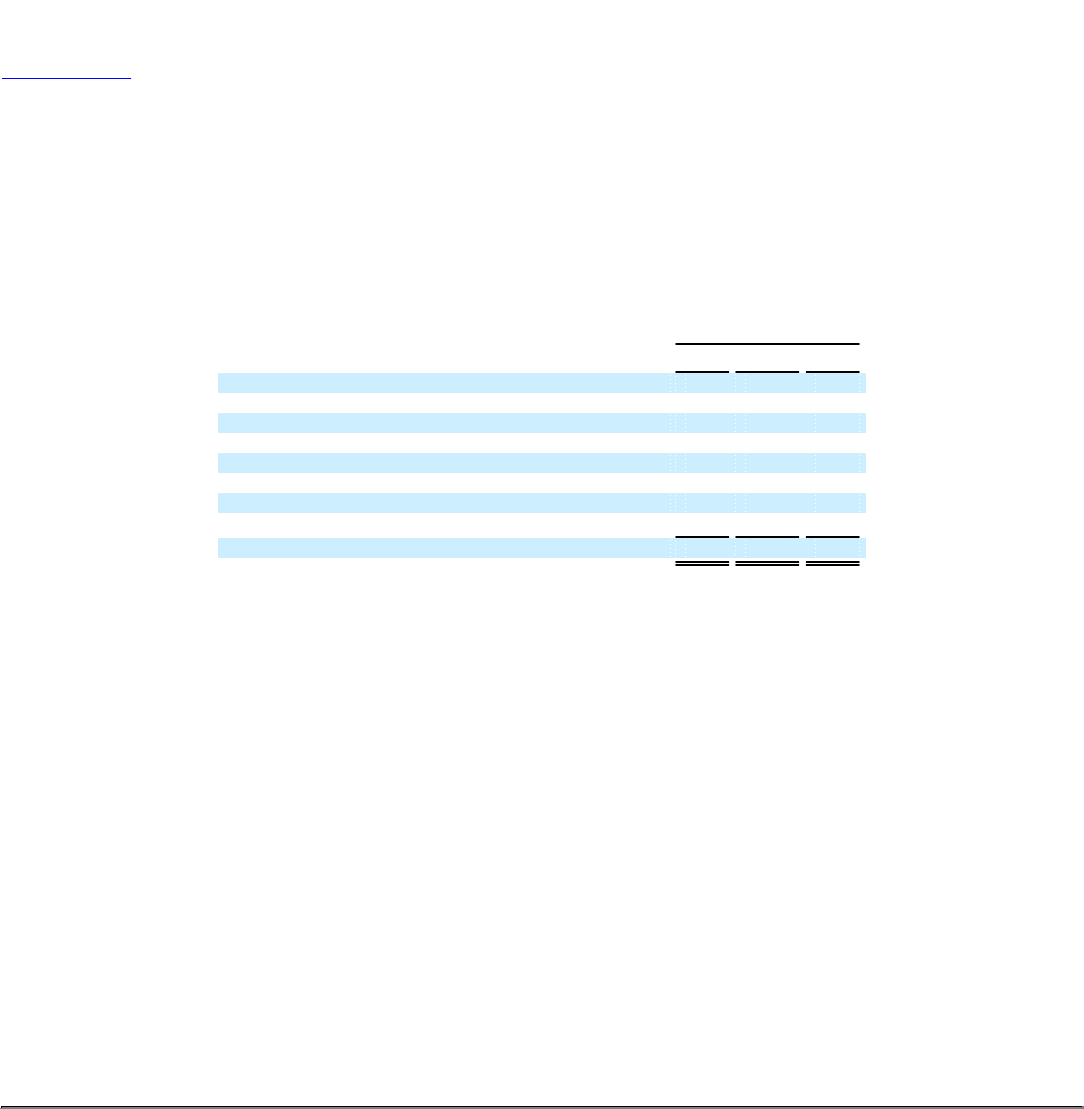

Reconciliation of income tax expense computed at the U.S. federal statutory rate to income tax expense is as follows (in thousands):

Year Ended December 31,

2009 2008 2007

Income tax expense at statutory federal rate $ 7,157 $ 9,565 $ 2,805

State income tax expense, net of federal income tax effect 809 1,529 568

Domestic production activities deduction (481) (811) (348)

Nondeductible intercompany interest 205 174 122

Other nondeductible expenses 143 101 92

Tax rate differential on foreign operations (192) 90 (53)

Increase (decrease) in valuation allowance (566) 2,791 2,293

Other 9 (4) (44)

Income tax expense $ 7,084 $ 13,435 $ 5,435

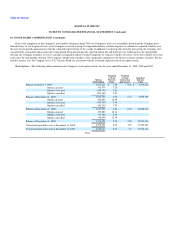

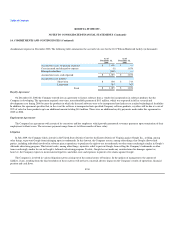

The Company adopted Accounting Standards Codification topic 740-10-25, Income Taxes: Overall: Recognition,("ASC 740-10-25") on January 1, 2007,

which clarifies the accounting for uncertainty in income taxes recognized in an enterprise's financial statements in accordance with Accounting Standards

Codification topic 740, Income Taxes. ASC 740-10-25 prescribes a recognition threshold and measurement attribute for the financial statement recognition

and measurement of a tax position taken or expected to be taken in a tax return. ASC 740-10-25 also provides guidance on de-recognition, classification,

interest and penalties, accounting in interim periods, disclosure, and transition.

At the adoption date and as of December 31, 2009, the Company had no material unrecognized tax benefits and no adjustments to liabilities or operations

were required under ASC 740-10-25. The Company's practice is to recognize interest and penalty expense related to uncertain tax positions in income tax

expense, which were zero at the adoption date and for the year ended December 31, 2009.

The Company is subject to taxation in the United States and various states and foreign jurisdictions. The Company's tax years 2008, 2007 and 2006 are

subject to examination by the tax authorities. There were no income tax examinations in process as of December 31, 2009. While the ultimate results cannot

be predicted with certainty, the Company's management believes that examinations, if any, will not have a material adverse effect on its consolidated financial

condition or results of operations, and that the accrued tax liabilities are adequate for all years.

The Company made income tax payments of $6.4 million, $14.6 million and $4.8 million in 2009, 2008 and 2007, respectively.

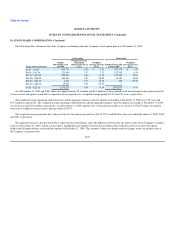

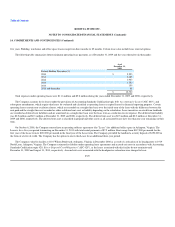

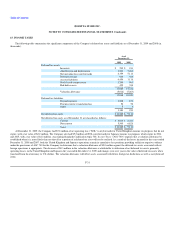

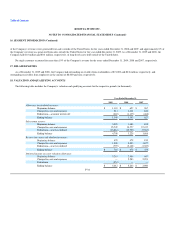

16. SEGMENT INFORMATION

The Company operates as one operating segment as the principal business activity relates to developing and selling language learning software. The chief

operating decision maker, the Chief Executive Officer, evaluates the performance of the Company based upon software revenues.

Products and services are sold primarily in the United States, but are also sold through direct and indirect sales channels in other countries, primarily in

Japan, South Korea and Europe. Less than 5%

F-33