Rosetta Stone 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

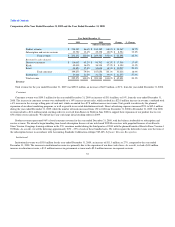

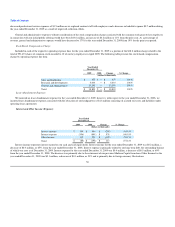

Income tax expense for the year ended December 31, 2008 was $13.4 million, an increase of $8.0 million, or 147%, compared to the year ended

December 31, 2007. The increase was the result of an increase of $19.3 million in pre-tax income for the year ended December 31, 2008, compared to the

year ended December 31, 2007. Our effective tax rate decreased to 49.2% for the year ended December 31, 2008 compared to 67.8% for the year ended

December 31, 2007 as a result of a decline in the percentage of foreign losses relative to total consolidated income before tax. We do not currently recognize

income tax benefits on losses in our foreign subsidiaries.

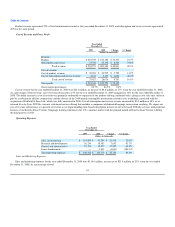

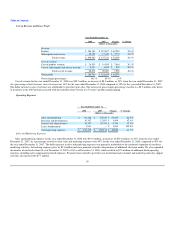

Liquidity and Capital Resources

Our primary operating cash requirements include the payment of salaries, incentive compensation, employee benefits and other personnel-related costs,

as well as direct advertising expenses, costs of office facilities and costs of information technology systems.

Since our inception, we have financed our operations solely through cash flow from operations with the exception of the acquisition of Fairfield &

Sons, Ltd., which was funded in part through the sale of preferred and common stock and a $17.0 million term loan from Madison Capital Funding LLC. At

December 31, 2009, our principal sources of liquidity were cash and cash equivalents totaling $95.2 million and available borrowings under our credit facility.

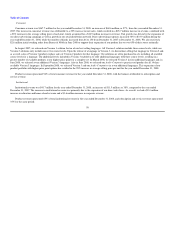

On January 16, 2009, we entered into a new secured credit agreement with Wells Fargo Bank, N.A., or Wells Fargo, that provides us with a

$12.5 million revolving line of credit. This revolving credit facility has a two-year term and the applicable interest rate is 2.5% above one month LIBOR, or

approximately 2.73% as of December 31, 2009. On January 16, 2009, we borrowed approximately $9.9 million under this revolving credit facility and used

these funds to repay the entire outstanding principal and interest of the term loan we had with Madison Capital. As a result, we have no borrowings owed to

Madison Capital under either their term loan or revolving credit facility, and we have terminated these credit agreements. In April 2009, we completed our

initial public offering and received net proceeds of $49.0 million after deducting the underwriters discount and initial public offering expenses. We used

$9.9 million to repay Wells Fargo the outstanding principal and interest of the revolving credit facility. The full $12.5 million under the Wells Fargo revolving

credit facility remains available to us for borrowing, subject to specified conditions.

We expect that our future growth will continue to require additional working capital. Our future capital requirements will depend on many factors,

including development of new products, market acceptance of our products, the levels of advertising and promotion required to launch additional products and

improve our competitive position in the marketplace, the expansion of our sales, support and marketing organizations, the establishment of additional offices

in the United States and worldwide and building the infrastructure necessary to support our growth, the response of competitors to our products and our

relationships with suppliers and clients. We have experienced increases in our expenditures consistent with the growth in our operations and personnel, and

we anticipate that our expenditures will continue to increase in the future. We believe that anticipated cash flows from operations and available sources of

funds, including available borrowings under our revolving credit facility, will provide sufficient liquidity to fund our business and meet our obligations in the

foreseeable future.

In April 2009, we completed an initial public offering. After deducting the payment of underwriters' discounts and commissions and offering expenses,

our net proceeds from the sale of shares in the offering were $49.0 million. The net proceeds from the offering were used to repay a $9.9 million balance on

our revolving credit facility with Wells Fargo and $7.9 million to satisfy the federal, state and local withholding tax obligations associated with the net

issuance of common stock to certain of our key employees.

61