Rosetta Stone 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. INCOME TAXES (Continued)

Despite enacting certain tax planning strategies during the year ended December 31, 2009, neither subsidiary has produced sustainable pretax profits as of

December 31, 2009. Company management will monitor actual results and updated projections on a quarterly basis. When and if the subsidiaries realize or

realistically anticipate sustainable profitability, the Company will assess the appropriateness of releasing the valuation allowance in whole or in part. Although

management believes that these assets could ultimately be fully utilized, future performance cannot be assured.

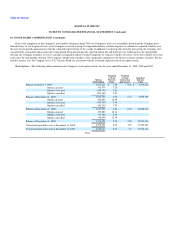

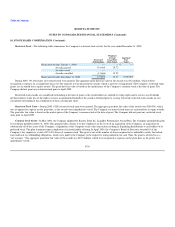

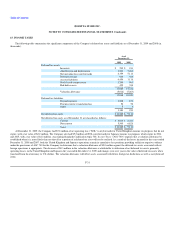

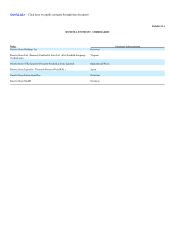

The components of income (loss) before income taxes are as follows (in thousands):

Year Ended December 31,

2009 2008 2007

United States $ 19,030 $ 36,109 $ 14,825

Foreign 1,417 (8,782) (6,811)

Income before income taxes $ 20,447 $ 27,327 $ 8,014

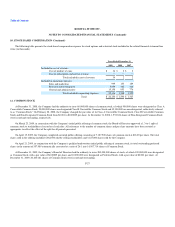

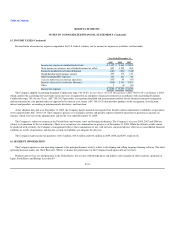

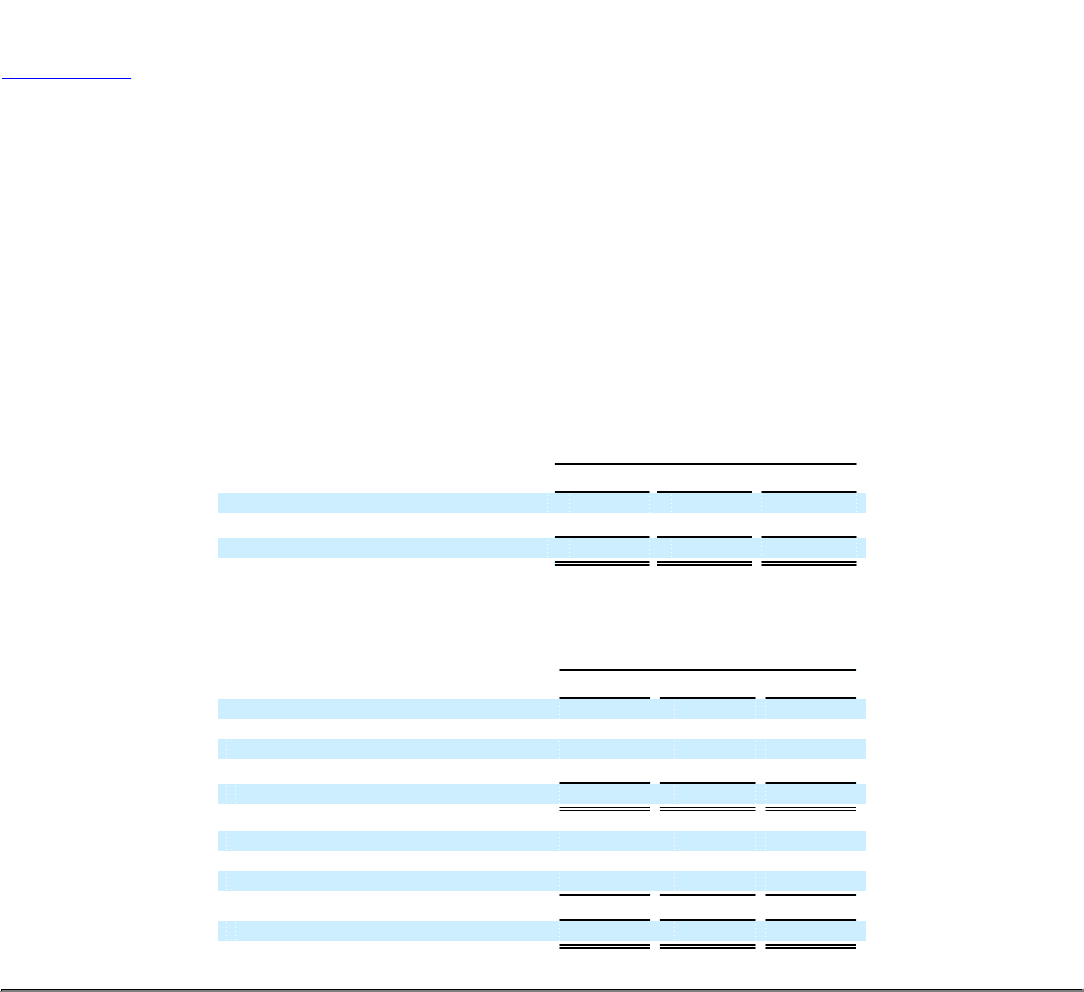

The provision for taxes on income consists of the following (in thousands):

Year Ended December 31,

2009 2008 2007

Current:

Federal $ 7,555 $ 12,842 $ 5,311

State 1,864 2,788 1,429

Foreign 140 34 —

Total current $ 9,559 $ 15,664 $ 6,740

Deferred:

Federal $ (1,917) $ (1,946) $ (944)

State (430) (283) (361)

Foreign (128) — —

Total deferred (2,475) (2,229) (1,305)

Provision for income taxes $ 7,084 $ 13,435 $ 5,435

F-32