Rosetta Stone 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

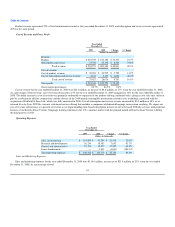

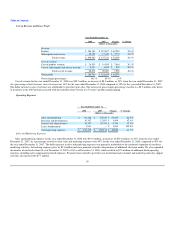

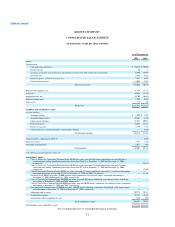

The operating lease obligations reflected in the table above include our corporate office leases and site licenses for our kiosks.

Recent Accounting Pronouncements

In February 2008, the FASB issued Accounting Standards Codification topic 820, Fair Value Measurements and Disclosures ("ASC 820"). The

provisions of ASC 820, which provide guidance for, among other things, the definition of fair value and the methods used to measure fair value, were adopted

January 1, 2008 for financial instruments. The provisions adopted in 2008 did not have an impact on the Company's financial statements. The effective date of

ASC 820 for all nonrecurring fair value measurements of nonfinancial assets and liabilities (except for those that are recognized or disclosed at fair value in

the financial statements on a recurring basis) was fiscal years beginning after November 15, 2008. On January 1, 2009 we adopted the provisions in ASC 820

for nonrecurring fair value measurements of nonfinancial assets and liabilities. We applied the provisions adopted in the first quarter of 2009 to the accounting

for the acquisition of SGLC International Co. Ltd. See note 4.

In December 2007, the FASB issued Accounting Standards Codification topic 805, Business Combinations ("ASC 805"), which establishes principles

and requirements for how an acquirer in a business combination recognizes and measures in its financial statements the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest; recognizes and measures the goodwill acquired in the business combination or a gain from a bargain

purchase; and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business

combination. ASC 805 is to be applied prospectively to business combinations for which the acquisition date is on or after an entity's fiscal year that begins

after December 15, 2008. We applied the provisions adopted in the first quarter of 2009 to the fair value measurements recorded as part of the acquisition of

SGLC International Co. Ltd. See note 4.

In December 2007, the FASB issued Accounting Standards Codification topic 810, Consolidation ("ASC 810"), which establishes new accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. Specifically, this statement requires the

recognition of a noncontrolling interest (minority interest) as equity in the consolidated financial statements and separate from the parent's equity. The amount

of net income attributable to the noncontrolling interest will be included in consolidated net income on the face of the income statement. ASC 810 clarifies

that changes in a parent's ownership interest in a subsidiary that do not result in deconsolidation are equity transactions if the parent retains its controlling

financial interest. In addition, this statement requires that a parent recognize a gain or loss in net income when a subsidiary is deconsolidated. Such gain or

loss will be measured using the fair value of the noncontrolling equity investment on the deconsolidation date. ASC 810 also includes expanded disclosure

requirements regarding the interests of the parent and its noncontrolling interest. ASC 810 is effective for fiscal years, and interim periods within those fiscal

years, beginning on or after December 15, 2008. Earlier adoption is prohibited. The adoption of ASC 810 did not have a material impact on our financial

position, results of operations or cash flows.

In March 2008, the FASB issued Accounting Standards Codification topic 815, Derivatives and Hedging ("ASC 815"), which requires enhanced

disclosures about an entity's derivative and hedging activities. This Statement is effective for financial statements issued for fiscal years and interim periods

beginning after November 15, 2008. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments,

(b) how derivative instruments and related hedged items are accounted for and (c) how derivative instruments and related hedged items affect an entity's

financial position, financial performance and cash flows. The adoption of ASC 815 did not have a significant impact on our financial position, results of

operations or cash flows.

64