Rosetta Stone 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

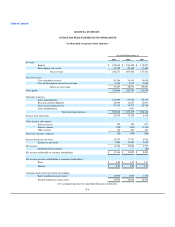

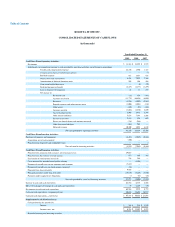

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

contract are bifurcated and are recognized at fair value with changes in fair value recognized as either a gain or loss in earnings. The Company determines the

fair value of derivative instruments and hybrid instruments based on available market data using appropriate valuation models, giving consideration to all of

the rights and obligations of each instrument.

Stock Split

On March 23, 2009, in connection with the Company's initial public offering of common stock, the Board of Directors approved a 1.3-to-1 split of

common stock to stockholders of record as of such date. All references to the number of common shares and per share amounts have been restated as

appropriate to reflect the effect of the split for all periods presented.

Guarantees

Indemnifications are provided of varying scope and size to certain institutional customers against claims of intellectual property infringement made by

third parties arising from the use of its products. The Company has not incurred any costs or accrued any liabilities as a result of such obligations.

Cost of Revenue

Cost of revenue consists of the direct and indirect costs to produce and distribute Rosetta Stone software. Inventory related costs include materials

purchasing, inbound freight, inventory receiving, production assembly of boxed products, product royalty fees, storage of inventory, inventory obsolescence

and inventory shrinkage. Distribution related costs include out-bound freight, fulfillment partner fees, internal shipping labor and packaging materials. Other

costs included in cost of revenue include credit card processing fees, amortization of certain intangible assets, depreciation of fixed assets used, and the cost of

technical support for customers.

Research and Development

Research and development expenses include employee compensation costs, professional services fees and overhead costs associated with product

development. Software products are developed for sale to external customers. The Company considers technological feasibility to be established when all

planning, designing, coding, and testing has been completed according to design specifications. The Company has determined that technological feasibility for

its software products is reached shortly before the products are released to manufacturing. Costs incurred after technological feasibility is established have not

been material, and accordingly, the Company has expensed all research and development costs when incurred.

Software Developed for Internal Use

Product development also includes certain software products for internal use. Development costs for internal use software are expensed as incurred until

the project reaches the application development stage, in accordance with Accounting Standards Codification topic 350, Accounting for the Costs of

Computer Software Developed or Obtained for Internal Use ("ASC 350"). Internal-use software is defined to have the following characteristics: (a) the

software is internally developed, or modified solely to meet the entity's internal needs, and (b) during the software's development or modification, no

substantive

F-12