Rosetta Stone 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Revenue from the sale of packaged software products with specific upgrade rights is recognized in accordance with ASC 985-605. Revenue recognition

for these sales is deferred until the earlier of the point at which sufficient vendor-specific objective evidence ("VSOE") exist for the specific upgrade right or

all elements of the arrangement have been delivered.

In accordance with ASC 985-605-50, cash sales incentives to resellers are accounted for as a reduction of revenue, unless a specific identified benefit is

identified and the fair value is reasonably determinable.

We have been engaged to develop language learning software for certain endangered languages under fixed fee arrangements. These arrangements also

include contractual periods of post-contract support ("PCS") and online hosting services ranging from one to ten years. Revenue for multi-element contracts

will be recognized ratably once the PCS and online hosting periods begin, over the longer of the PCS or online hosting period. When the current estimates of

total contract revenue and contract cost indicate a loss for a fixed fee arrangement, a provision for the entire loss on the contract is recorded.

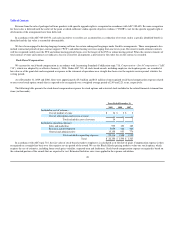

Stock-Based Compensation

We account for stock-based compensation in accordance with Accounting Standards Codification topic 718, Compensation—Stock Compensation ("ASC

718"), which was adopted by us effective January 1, 2006. Under ASC 718, all stock-based awards, including employee stock option grants, are recorded at

fair value as of the grant date and recognized as expense in the statement of operations on a straight-line basis over the requisite service period, which is the

vesting period.

As of December 31, 2009 and 2008, there were approximately $5.3 million and $4.4 million of unrecognized stock-based compensation expense related

to non-vested stock option awards that is expected to be recognized over a weighted average period of 2.49 and 2.21 years, respectively.

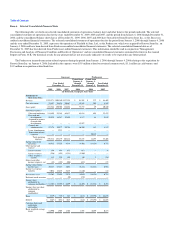

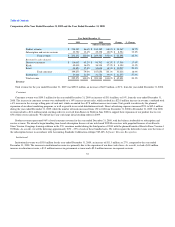

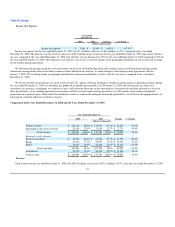

The following table presents the stock-based compensation expense for stock options and restricted stock included in the related financial statement line

items (in thousands):

Years Ended December 31,

2009 2008 2007

Included in cost of revenue:

Cost of product revenue $ 34 $ 2 $ 2

Cost of subscription and service revenue — — —

Total included in cost of revenue 34 2 2

Included in operating expenses:

Sales and marketing 999 153 189

Research and development 5,959 482 360

General and administrative 15,158 953 776

Total included in operating expenses 22,116 1,588 1,325

Total $ 22,150 $ 1,590 $ 1,327

In accordance with ASC topic 718, the fair value of stock-based awards to employees is calculated as of the date of grant. Compensation expense is then

recognized on a straight-line basis over the requisite service period of the award. We use the Black-Scholes pricing model to value our stock options, which

requires the use of estimates, including future stock price volatility, expected term and forfeitures. Stock-based compensation expense recognized is based on

the estimated portion of the awards that are expected to vest. Estimated forfeiture rates were applied in the expense calculation.

48