Rosetta Stone 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

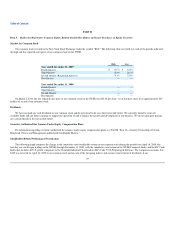

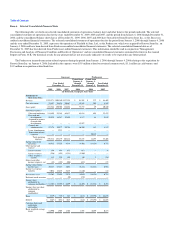

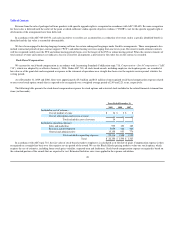

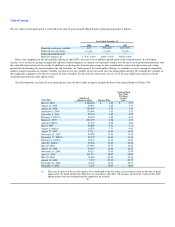

COMPARISON OF 8 MONTH CUMULATIVE TOTAL RETURN*

Among Rosetta Stone Inc., The NYSE Composite Index

And SIC code 7372 index

*$100 invested on 4/16/09 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

Use of Proceeds from Public Offering of Common Stock

On April 15, 2009, our registration statement (File No. 333-153632) was declared effective for our initial public offering, pursuant to which we

registered the offering and sale of 3,125,000 shares of common stock by Rosetta Stone Inc. and the associated sale of 3,125,000 shares of common stock by

funds associated with ABS Capital Partners and Norwest Equity Partners VIII, LP (collectively, the "Private Equity Funds") and the additional sale pursuant

to the underwriters' over-allotment option for an additional 937,500 shares of common stock by the Private Equity Funds, at a public offering price of $18.00

per share. The offering closed on April 21, 2009. The managing underwriters were Morgan Stanley & Co. Incorporated and William Blair & Company, LLC.

As a result of the offering, we received net proceeds of approximately $49.0 million, after deducting underwriting discounts and commissions of

$3.9 million and additional offering-related expenses of approximately $3.3 million. In April 2009, we used $7.9 million to satisfy the federal, state and local

withholding tax obligations associated with the "net issuance" of stock grants we made to 10 of our key employees, including executive officers, on April 15,

2009. In April 2009, we used $9.9 million of the net proceeds to repay the outstanding balances under our revolving line of credit with Wells Fargo. We

anticipate that we will use the remaining net proceeds from our initial public offering for working capital and other general corporate purposes, which may

include the acquisition of other businesses, products or technologies. We do not, however, have agreements or commitments for any specific acquisitions at

this time. Pending such uses, we plan to invest the net proceeds in short-term, interest-bearing, investment grade securities.

40