Rosetta Stone 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

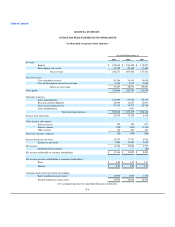

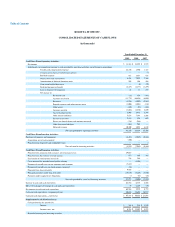

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

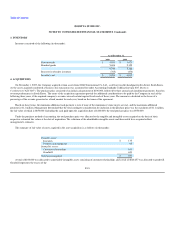

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

disposition of property and equipment, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is

recognized.

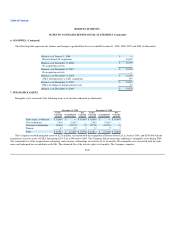

Intangible Assets

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark and other

intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives in accordance

with Accounting Standards Codification topic 350, Goodwill and Other Intangible Assets ("ASC 350"). On an annual basis, the Company reviews its

indefinite lived intangible assets for impairment based on the fair value of indefinite lived intangible assets as compared to the carrying value in accordance

with ASC 350. In the event the carrying value exceeds the fair value of the assets, the assets are written down to their fair value. There has been no

impairment of intangible assets during any of the periods presented.

Goodwill

In accordance with ASC 350, goodwill is not amortized and is tested for impairment annually on June 30th and whenever events and circumstances

occur indicating goodwill might be impaired. As of June 30, 2009 and 2008, the Company reviewed the goodwill for impairment and determined that no

impairment of goodwill was identified during any of the periods presented.

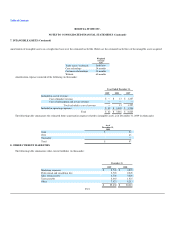

Valuation of Long-Lived Assets

In accordance with Accounting Standards Codification topic 360, Accounting for the Impairment or Disposal of Long-lived Assets ("ASC 360"), the

Company evaluates the recoverability of its long-lived assets. ASC 360 requires recognition of impairment of long-lived assets in the event that the net book

value of such assets exceeds the future undiscounted net cash flows attributable to such assets. Impairment, if any, is recognized in the period of identification

to the extent the carrying amount of an asset exceeds the fair value of such asset. Based on its analysis, the Company believes that no impairment of its long-

lived assets was indicated as of December 31, 2009 and 2008.

Financial Instruments with Characteristics of Both Liabilities and Equity

The Company issues financial instruments that have characteristics of both liabilities and equity. The Company accounts for these arrangements in

accordance with Accounting Standards Codification topic 480, Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and

Equity ("ASC 480"), as well as related interpretations of this standard.

Derivative Instruments

The Company enters into financing arrangements that consist of freestanding derivative instruments or are hybrid instruments that contain embedded

derivative features. The Company accounts for these arrangements in accordance with Accounting Standards Codification topic 815, Accounting for

Derivative Instruments and Hedging Activities ("ASC 815") as well as related interpretation of this standard. In accordance with this standard, derivative

instruments are recognized as either assets or liabilities in the balance sheet and are measured at fair values with gains or losses recognized in earnings.

Embedded derivatives that are not clearly and closely related to the host

F-11