Rosetta Stone 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

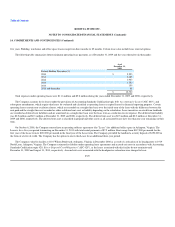

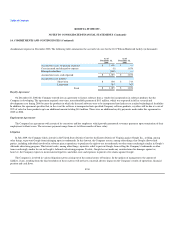

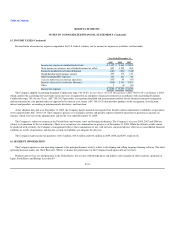

10. STOCK-BASED COMPENSATION (Continued)

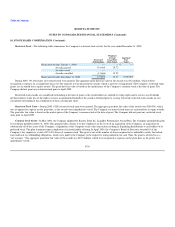

Prior to the completion of the Company's initial public offering in April 2009, the Company's stock was not publicly quoted and the Company had a

limited history of stock option activity, so the Company reviewed a group of comparable industry-related companies to estimate its expected volatility over

the most recent period commensurate with the estimated expected term of the awards. In addition to analyzing data from the peer group, the Company also

considered the contractual option term and vesting period when determining the expected option life and forfeiture rate. Subsequent to the initial public

offering, the Company continues to review a group of comparable industry-related companies to estimate volatility, but also reviews the volatility of its own

stock since the initial public offering. The Company considers the volatility of the comparable companies to be the best estimate of future volatility. For the

risk-free interest rate, the Company uses a U.S. Treasury Bond rate consistent with the estimated expected term of the option award.

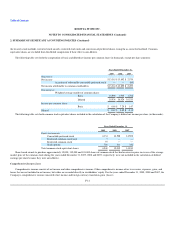

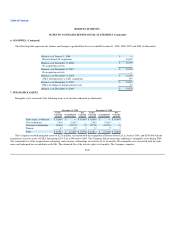

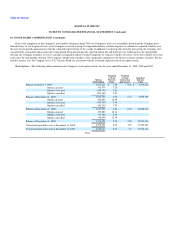

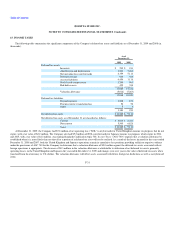

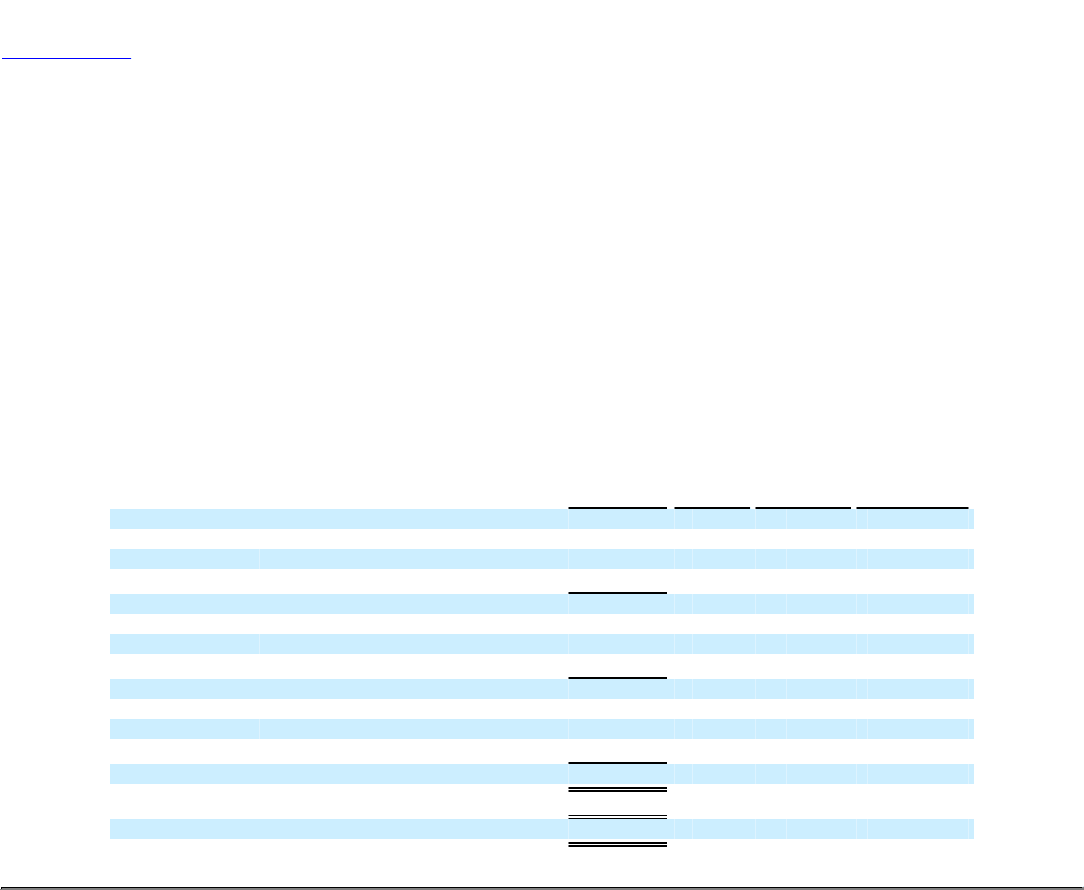

Stock Options—The following table summarizes the Company's stock option activity for the years ended December 31, 2009, 2008 and 2007:

Options

Outstanding

Weighted

Average

Exercise

Price

Weighted

Average

Contractual

Life (years)

Aggregate

Intrinsic

Value

Balance at January 1, 2007 1,531,231 $ 3.85 9.46 $ 3,415,823

Options granted 415,574 7.28

Options exercised (238,735) 3.85

Options cancelled (214,367) 4.53

Balance at December 31, 2007 1,493,703 4.70 8.70 9,695,391

Options granted 402,805 12.89

Options exercised (103,506) 3.96

Options cancelled (135,203) 7.97

Balance at December 31, 2008 1,657,799 6.48 8.05 18,268,386

Options granted 472,589 18.11

Options exercised (93,505) 5.10

Options cancelled (60,654) 12.48

Balance at December 31, 2009 1,976,229 9.14 7.58 17,511,103

Vested and expected to vest at December 31, 2008 1,572,720 6.23 7.99 17,722,546

Vested and expected to vest at December 31, 2009 1,878,917 8.73 7.5 17,396,124

F-24