Rosetta Stone 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In May 2008, the FASB issued Accounting Standards Codification topic ASC 105, Generally Accepted Accounting Principles, ("ASC 105"), which

identifies the sources of accounting principles and provides the framework for selecting the principles used in the preparation of financial statements of

nongovernmental entities that are presented in conformity with generally accepted accounting principles in the United States. ASC 105 is effective for

financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The adoption of ASC 105 did not have significant impact

on our financial position, results of operation, or cash flows.

On October 10, 2008, the FASB issued Accounting Standards Codification topic 820, Fair Value Measurements and Disclosures("ASC 820"), which

was effective upon issuance, including periods for which financial statements have not been issued. ASC 820 provided an illustrative example to demonstrate

how the fair value of a financial asset is determined when the market for that financial asset is inactive. The adoption of ASC 820 did not have a material

impact on our consolidated financial position and the results of operations.

In April 2009, the FASB issued Accounting Standards Codification topic 820-10-65-4, Fair Value Measurements and Disclosures ("ASC 820"), which

provides guidance on how to determine the fair value of assets and liabilities when the volume and level of activity for the asset or liability has significantly

decreased. ASC 820 also provides guidance on identifying circumstances that indicate a transaction is not orderly. In addition, ASC 820 requires disclosure in

interim and annual periods of the inputs and valuation methods used in determining fair value and a discussion of any changes in those valuation methods.

ASC 820 is effective for annual and interim periods ending on or after June 15, 2009. The adoption of ASC 820 did not have a material impact on our

consolidated financial position and the results of operations.

On May 28, 2009, the FASB issued Accounting Standards Codification topic 855, Subsequent Events ("ASC 855"). Although ASC 855 does not

significantly change current practice surrounding the disclosure of subsequent events, it provides guidance on management's assessment of subsequent events

and the requirement to disclose the date through which subsequent events have been evaluated. ASC 855 became effective for the quarter ended June 30,

2009. The adoption of ASC 855 did not have any impact on our consolidated financial position or results of operations.

On June 12, 2009, the FASB issued Statement No. 167, Amendments to FASB Interpretation No. 46(R) ("SFAS No. 167"). SFAS No. 167 modifies the

existing quantitative guidance used in determining the primary beneficiary of a variable interest entity ("VIE") by requiring entities to qualitatively assess

whether an enterprise is a primary beneficiary, based on whether the entity has (i) power over the significant activities of the VIE, and (ii) an obligation to

absorb losses or the right to receive benefits that could be potentially significant to the VIE. SFAS No. 167 becomes effective for all new and existing VIEs on

January 1, 2010. The adoption of SFAS No. 167 will not have any impact on our consolidated financial position or results of operations.

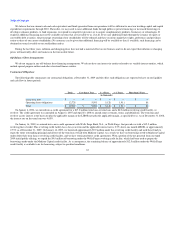

On June 29, 2009, the FASB issued Accounting Standards Codification topic ASC 105, Generally Accepted Accounting Principles("ASC 105"), which

establishes the FASB Accounting Standards Codification (the "Codification") as the primary source of authoritative GAAP recognized by the FASB to be

applied by nongovernmental entities. Rules and interpretive releases of the SEC are also sources of authoritative GAAP for SEC registrants. ASC 105 and the

Codification become effective on September 30, 2009. When effective, the Codification will supersede all existing non-SEC accounting and reporting

standards and the FASB will not issue new standards in the form of Statements, FASB Staff Positions, or Emerging Issues Task Force Abstracts. Instead, the

FASB will issue Accounting Standards Updates, which will serve only to: (a) update the Codification; (b) provide background information about the

guidance; and (c) provide the basis for conclusions on the change(s) in the Codification. The adoption of ASC 105 and the Codification on September 30,

2009 did not have a material effect on our consolidated financial statements.

65