Rosetta Stone 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We believe that our current cash and cash equivalents and funds generated from our operations will be sufficient to meet our working capital and capital

expenditure requirements through 2010. Thereafter, we may need to raise additional funds through public or private financings or increased borrowings to

develop or enhance products, to fund expansion, to respond to competitive pressures or to acquire complementary products, businesses or technologies. If

required, additional financing may not be available on terms that are favorable to us, if at all. If we raise additional funds through the issuance of equity or

convertible debt securities, the percentage ownership of our stockholders will be reduced and these securities might have rights, preferences and privileges

senior to those of our current stockholders. No assurance can be given that additional financing will be available or that, if available, such financing can be

obtained on terms favorable to our stockholders and us.

During the last three years, inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing

prices will materially affect our business in the foreseeable future.

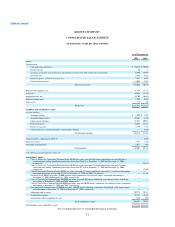

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing arrangements. We do not have any interest in entities referred to as variable interest entities, which

include special purpose entities and other structured finance entities.

Contractual Obligations

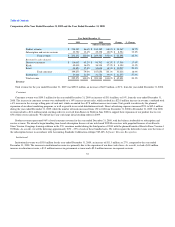

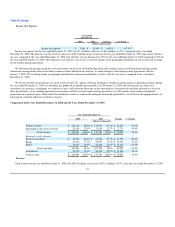

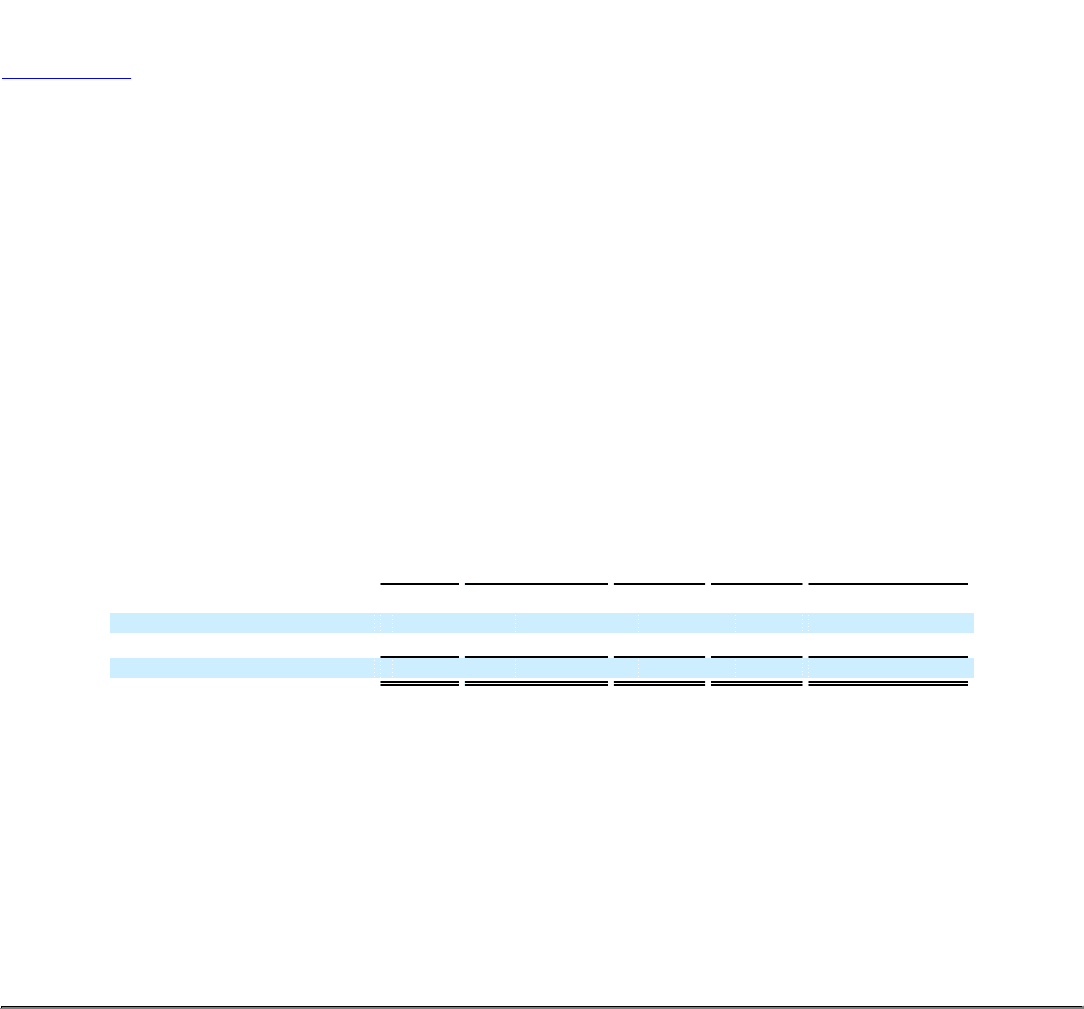

The following table summarizes our contractual obligations at December 31, 2009 and the effect such obligations are expected to have on our liquidity

and cash flow in future periods.

Total Less than 1 Year 1 - 3 Years 3 - 5 Years More than 5 Years

(in thousands)

Long-term debt $ — $ — $ — $ — $ —

Operating lease obligations 12,720 5,593 5,128 1,911 88

Total $ 12,720 $ 5,593 $ 5,128 $ 1,911 $ 88

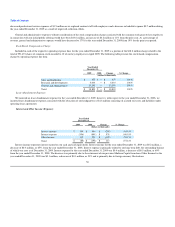

On January 4, 2006, we entered into a credit agreement for a $17.0 million term loan, or term loan, and a $4.0 million revolving credit facility, or

revolver. The credit agreement was amended on August 2, 2007 and April 23, 2008 to amend some covenants, terms, and definitions. The term loan and

revolver accrue interest at the base rate plus the applicable margin or the LIBOR rate plus the applicable margin, as specified by us. As of December 31, 2008,

the interest rate on the term loan was 4.65%.

On January 16, 2009, we entered into a new credit agreement with Wells Fargo Bank, N.A., or Wells Fargo, that provides us with a $12.5 million

revolving line of credit. This revolving credit facility has a two-year term and the applicable interest rate is 2.5% above one month LIBOR, or approximately

2.73% as of December 31, 2009. On January 16, 2009, we borrowed approximately $9.9 million under this revolving credit facility and used these funds to

repay the entire outstanding principal and interest of the term loan we had with Madison Capital. As a result, we have no borrowings owed to Madison Capital

under either their term loan or revolving credit facility, and we have terminated these credit agreements. With a portion of the net proceeds from our April

2009 initial public offering, we repaid the $9.9 million of borrowing under the Wells Fargo revolving credit facility, which had been used to prepay the

borrowings made under the Madison Capital credit facility. As a consequence, the remaining balance of approximately $12.5 million under the Wells Fargo

credit facility is available to us for borrowing, subject to specified conditions.

63