Rosetta Stone 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. BORROWING AGREEMENT

On January 4, 2006, the Company entered into a Credit Agreement with Madison Capital, which provided the Company a $4.0 million revolving credit

facility ("Revolver") and a $17.0 million term loan ("Term Loan"). The Credit Agreement was amended on August 2, 2007 and April 23, 2008 to amend

certain covenants, terms, and definitions. Under the Credit Agreement, all amounts outstanding under the Revolver and the Term Loan accrued interest at the

Base Rate plus the Applicable Margin or the LIBOR Rate plus the Applicable Margin, as specified by the Company. As of December 31, 2008, the interest

rate on the term loan was 4.65%.

On January 16, 2009, the Company entered into a new credit agreement with Wells Fargo Bank, N.A. ("Wells Fargo"), which provides the Company

with a $12.5 million revolving line of credit. This revolving credit facility has a two-year term and the applicable interest rate is 2.5% above one month

LIBOR, or approximately 2.73% as of December 31, 2009. On January 16, 2009, the Company borrowed approximately $9.9 million under this revolving

credit facility and used these funds to repay the entire outstanding principal and interest of the Term Loan the Company had with Madison Capital. As a

result, the Company has no borrowings owed to Madison Capital under either their Term Loan or Revolver, and the Company has terminated these credit

agreements. As a result of the early repayment of the Madison Capital Loan, the Company wrote-off the remaining unamortized capitalized financing costs

associated with this loan. The amount of the write-off was approximately $0.2 million. Upon completion of the Company's initial public offering, the

Company repaid the $9.9 million balance of its revolving credit facility with Wells Fargo during the three months ended June 30, 2009, and a total of

$12.5 million under revolving credit facility is available to the Company for borrowing thereunder.

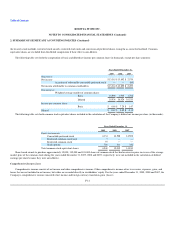

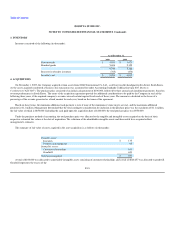

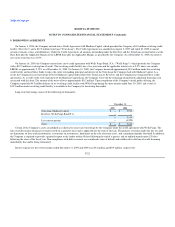

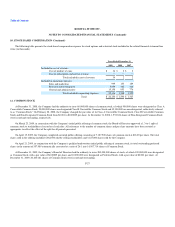

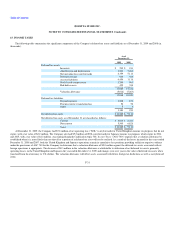

Long-term borrowings consist of the following (in thousands):

December 31,

2009 2008

Term loan, Madison Capital $ — $ 9,910

Revolver, Wells Fargo Bank N.A. — —

— 9,910

Less current portion — (4,250)

Total $ — $ 5,660

Certain of the Company's assets are pledged as collateral to secure any borrowings by the Company under the credit agreement with Wells Fargo. The

line of credit contains financial covenants tested on a quarterly basis and is applicable for the term of the loan. The primary covenants under the line of credit

are limitations on liens and encumbrances, restrictions on investments, limitations on the sale of certain assets, and a minimum liquidity threshold. In addition,

the Company is required to provide a quarterly report to the lender within 45 days following the end of a quarter, and an audited annual report 120 days

following the close of the fiscal year. Non-compliance with debt covenants are considered events of default and could result in the line of credit becoming

immediately due and/or being terminated.

Interest expense for the twelve months ended December 31, 2009 and 2008 was $0.4 million and $0.9 million, respectively.

F-22