Rosetta Stone 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

decreased professional service expenses of $1.5 million as we replaced contract staff with employees and a decrease in bad debt expense $0.7 million during

the year ended December 31, 2009 as a result of improved collection efforts.

General and administrative expenses without consideration of the stock compensation charge associated with the common stock grant to key employees

in connection with our initial public offering would have been $43.8 million, an increase of $4.2 million or 11% from the prior year. As a percentage of

revenue, general and administrative expenses would have decreased to 17% for the year ended December 31, 2009 from 19% for the prior year period.

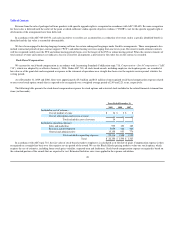

Stock-Based Compensation Charge

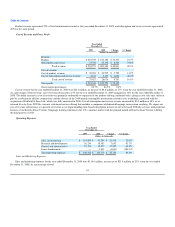

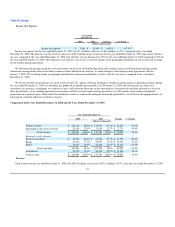

Included in each of the respective operating expense lines for the year ended December 31, 2009 is a portion of the $18.8 million charge related to the

total of 591,491 shares of common stock awarded to 10 of our key employees in April 2009. The following table presents the stock-based compensation

charge by operating expense line item:

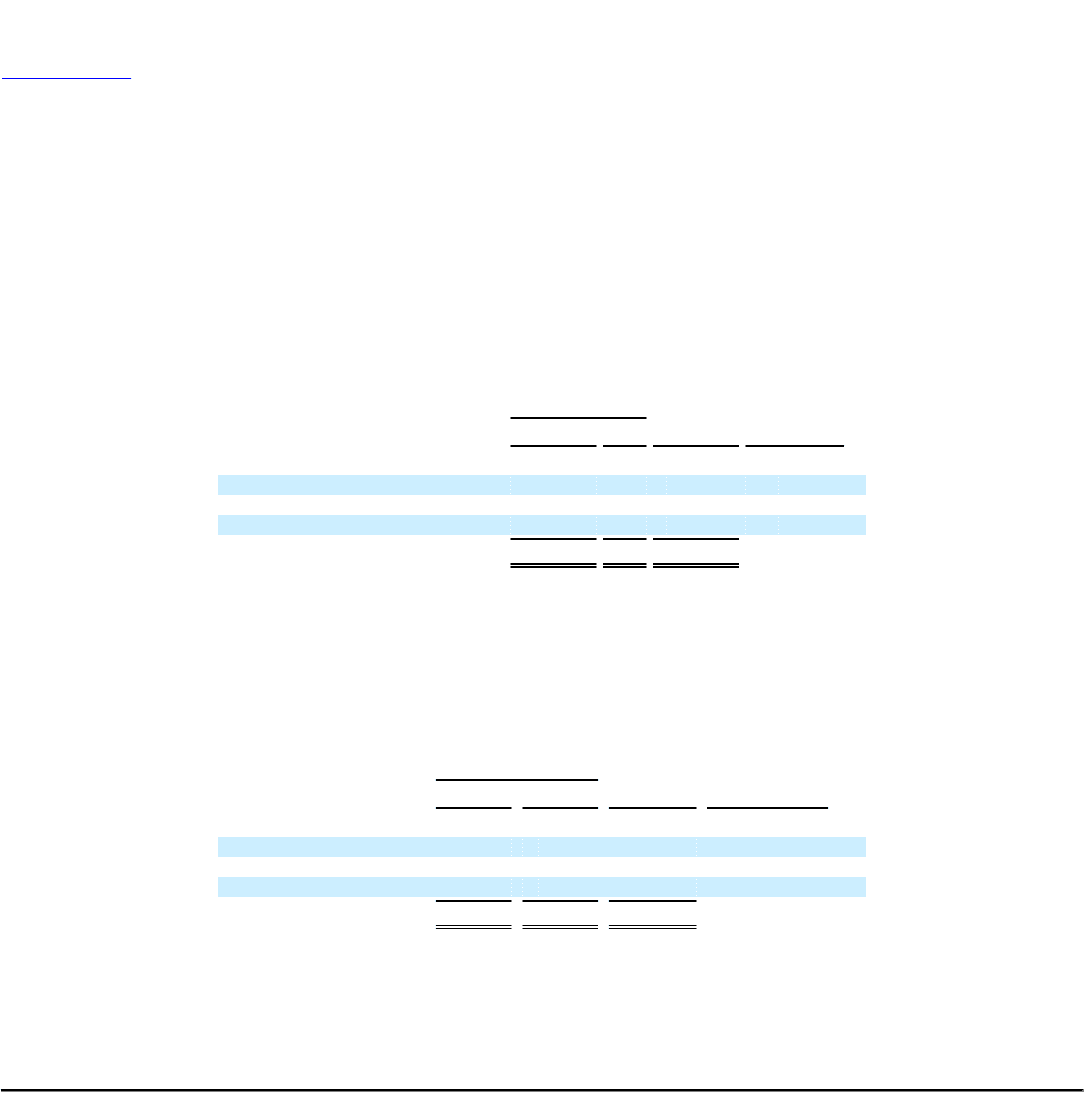

Year Ended

December 31,

2009 2008 Change % Change

(dollars in thousands)

Sales and marketing $ 377 $ — $ 377 100%

Research and development 5,033 — $ 5,033 100%

General and administrative 13,393 — 13,393 100%

Total $ 18,803 $ — $ 18,803 100%

Lease Abandonment Expenses

We incurred no lease abandonment expense for the year ended December 31, 2009; however, with respect to the year ended December 31, 2008, we

incurred lease abandonment expense associated with the relocation of our headquarters of $1.8 million consisting of accrued exit costs and liabilities under

operating lease agreements.

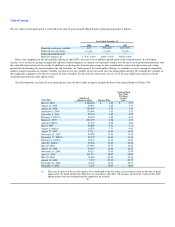

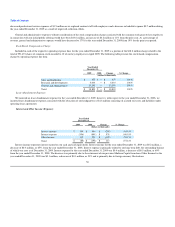

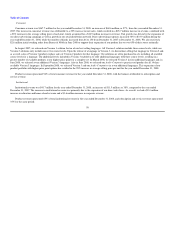

Interest and Other Income (Expense)

Year Ended

December 31,

2009 2008 Change % Change

(dollars in thousands)

Interest income $ 159 $ 454 $ (295) (65.0)%

Interest expense (356) (891) $ 535 (60.0)%

Other income 112 239 $ (127) (53.1)%

Total $ (85) $ (198) $ 113 (57.1)%

Interest income represents interest earned on our cash and cash equivalents. Interest income for the year ended December 31, 2009 was $0.2 million, a

decrease of $0.3 million, or 65%, from the year ended December 31, 2008. Interest expense is primarily related to our long-term debt, the outstanding balance

of which was zero as of December 31, 2009. Interest expense for the year ended December 31, 2009 was $0.4 million, a decrease of $0.5 million, or 60%

from the year ended December 31, 2008. The decrease was primarily due to the retirement of our previous Madison Capital term loan. Other Income for the

year ended December 31, 2009 was $0.1 million, a decrease of $0.1 million, or 53% and is primarily due to foreign currency fluctuations.

56