Rosetta Stone 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

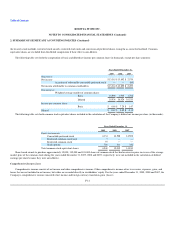

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Foreign Currency Translation and Transactions

The functional currency of the Company's foreign subsidiaries is their local currency. Accordingly, assets and liabilities of the foreign subsidiaries are

translated into U.S. dollars at exchange rates in effect on the balance sheet date. Income and expense items are translated at average rates for the period.

Translation adjustments are recorded as a component of other comprehensive income in stockholders' equity.

Cash flows of consolidated foreign subsidiaries, whose functional currency is the local currency, are translated to U.S. dollars using average exchange

rates for the period. The Company reports the effect of exchange rate changes on cash balances held in foreign currencies as a separate item in the

reconciliation of the changes in cash and cash equivalents during the period.

Gains and losses resulting from foreign currency transactions are included in other income and expense. Foreign currency transaction gains (losses) were

$(44,000), $0.2 million and $0.1 million for the years ended December 31, 2009, 2008 and 2007, respectively.

Recently Issued Accounting Standards

In February 2008, the FASB issued Accounting Standards Codification topic 820, Fair Value Measurements and Disclosures ("ASC 820"). The

provisions of ASC 820, which provide guidance for, among other things, the definition of fair value and the methods used to measure fair value, were adopted

January 1, 2008 for financial instruments. The provisions adopted in 2008 did not have an impact on the Company's financial statements. The effective date of

ASC 820 for all nonrecurring fair value measurements of nonfinancial assets and liabilities (except for those that are recognized or disclosed at fair value in

the financial statements on a recurring basis) was fiscal years beginning after November 15, 2008. On January 1, 2009 the Company adopted the provisions in

ASC 820 for nonrecurring fair value measurements of nonfinancial assets and liabilities. The Company applied the provisions adopted in the first quarter of

2009 to the fair value measurements recorded as part of the acquisition of SGLC International Co. Ltd. See note 4.

In December 2007, the FASB issued Accounting Standards Codification topic 805, Business Combinations ("ASC 805"), which establishes principles

and requirements for how an acquirer in a business combination recognizes and measures in its financial statements the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest; recognizes and measures the goodwill acquired in the business combination or a gain from a bargain

purchase; and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business

combination. ASC 805 is to be applied prospectively to business combinations for which the acquisition date is on or after an entity's fiscal year that begins

after December 15, 2008. The Company applied the provisions adopted in the first quarter of 2009 to the accounting for the acquisition of SGLC

International Co. Ltd. See note 4.

In December 2007, the FASB issued Accounting Standards Codification topic 810, Consolidation ("ASC 810"), which establishes new accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. Specifically, this statement requires the

recognition of a noncontrolling interest (minority interest) as equity in the consolidated financial statements and separate from the parent's equity. The amount

of net income attributable to the noncontrolling interest will be included in consolidated net income on the face of the income

F-15