Pfizer 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

98

2012 Financial Report

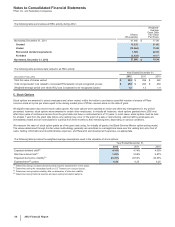

administrative expenses, and Research and development expenses, as appropriate, and adjusted each reporting period, as necessary, to

reflect changes in the price of Pfizer's common stock, changes in management's assessment of the probability that the specified performance

criteria will be achieved and/or changes in management's assessment of the probable vesting term.

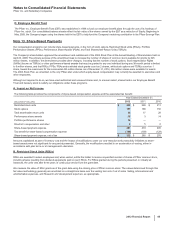

F. Portfolio Performance Shares (PPSs)

PPSs are awarded to select employees and, when vested, entitle the holder to receive, at the end of the performance period, a number of

shares within a possible range of shares of Pfizer common stock, including shares resulting from dividend equivalents paid on such shares. For

PPSs granted during the period presented, the awards vest after three years of continuous service from the grant date and the number of

shares paid, if any, depends on the achievement of predetermined goals related to Pfizer's long-term product portfolio during a five year

performance period from the year of the grant date. The target number of shares is determined by reference to competitive survey data.

We measure the value of PPS grants as of the grant date using the intrinsic value method, for which we use the closing price of Pfizer common

stock. The values are amortized on a straight-line basis over the probable vesting term into Research and development expenses and adjusted

each reporting period, as necessary, to reflect changes in the price of Pfizer's common stock, changes in management's assessment of the

probability that the specified performance criteria will be achieved and/or changes in management's assessment of the probable vesting term.

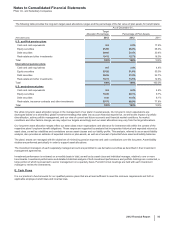

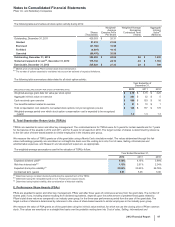

The following table summarizes all PPS activity during 2012, with the shares representing the maximum award that could be achieved:

Shares

(Thousands)

Weighted-

Average

Intrinsic

Value

Per Share

Nonvested, December 31, 2011 —$—

Granted 3,964 21.03

Vested (2) 22.42

Forfeited (220)23.18

Nonvested, December 31, 2012 3,742 $25.08

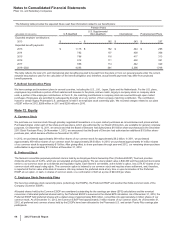

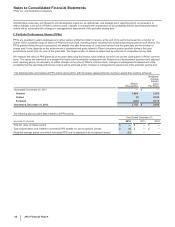

The following table provides data related to all PPS activity:

(MILLIONS OF DOLLARS)

Year Ended December 31,

2012 2011 2010

Total fair value of shares vested $—$—$—

Total compensation cost related to nonvested PPS awards not yet recognized, pre-tax $33$—$—

Weighted-average period over which nonvested PPS cost is expected to be recognized (years) 2.2 ——