Pfizer 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

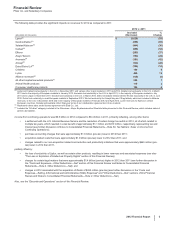

Financial Review

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

7

Competition Among Branded Products

Many of our products face competition in the form of branded products, which treat similar diseases or indications. These competitive

pressures can have an adverse impact on our results of operations.

The Global Economic Environment

In addition to the industry-specific factors discussed above, we, like other businesses, continue to face the effects of the challenging economic

environment, which have impacted our biopharmaceutical operations in the U.S. and Europe, including the countries that use the euro,

affecting the performance of products such as Lyrica, Enbrel, Prevnar 13/Prevenar 13 and Celebrex, and in a number of emerging markets.

We believe that patients, experiencing the effects of the challenging economic environment, including high unemployment levels, and

increases in co-pays, sometimes switch to generic products, delay treatments, skip doses or use less effective treatments to reduce their

costs. Challenging economic conditions in the U.S. also have increased the number of patients in the Medicaid program, under which sales of

pharmaceuticals are subject to substantial rebates and, in many states, to formulary restrictions limiting access to brand-name drugs, including

ours. In addition, we continue to experience pricing pressure in various markets around the world, including in developed European markets,

Japan and in a number of emerging markets, with government-mandated reductions in prices for certain biopharmaceutical products and

government-imposed access restrictions in certain countries.

Significant portions of our revenues and earnings are exposed to changes in foreign exchange rates. We seek to manage our foreign

exchange risk in part through operational means, including managing same-currency revenues in relation to same-currency costs and same-

currency assets in relation to same-currency liabilities. Depending on market conditions, foreign exchange risk also is managed through the

use of derivative financial instruments and foreign currency debt. As we operate in multiple foreign currencies, including the euro, the

Japanese yen, the U.K. pound, the Chinese renminbi, the Canadian dollar and approximately 100 other currencies, changes in those

currencies relative to the U.S. dollar will impact our revenues and expenses. If the U.S. dollar weakens against a specific foreign currency, our

revenues will increase, having a positive impact, and our overall expenses will increase, having a negative impact, on net income. Likewise, if

the U.S. dollar strengthens against a specific foreign currency, our revenues will decrease, having a negative impact, and our overall expenses

will decrease, having a positive impact on net income. Therefore, significant changes in foreign exchange rates can impact our results and our

financial guidance.

Despite the challenging financial markets, Pfizer maintains a strong financial position. Due to our significant operating cash flows, financial

assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to believe that we have the ability

to meet our liquidity needs for the foreseeable future. Our long-term debt is rated investment grade by both Standard & Poor’s (S&P) and

Moody’s Investors Service. As market conditions change, we continue to monitor our liquidity position. We have taken and will continue to take

a conservative approach to our financial investments. Both short-term and long-term investments consist primarily of high-quality, highly liquid,

well-diversified, available-for-sale debt securities. For further discussion of our financial condition, see the “Analysis of Financial Condition,

Liquidity and Capital Resources” section of this Financial Review.

Our Strategy

We believe that our medicines provide significant value for both healthcare providers and patients, not only from the improved treatment of

diseases but also from a reduction in other healthcare costs, such as emergency room or hospitalization costs, as well as improvements in

health, wellness and productivity. We continue to actively engage in dialogues about the value of our products and how we can best work with

patients, physicians and payers to prevent and treat disease and improve outcomes. We will work within the current legal and pricing

structures, as well as continue to review our pricing arrangements and contracting methods with payers, to maximize access to patients and

minimize any adverse impact on our revenues.

On November 30, 2012, we completed the sale of our Nutrition business to Nestlé. On February 6, 2013, we completed the sale of

approximately 19.8% of our ownership stake in Zoetis through an initial public offering. We may in the future make a tax-free distribution to our

shareholders of all or a portion of our remaining equity interest in Zoetis, which may include one or more distributions effected as a dividend to

all Pfizer shareholders, one or more distributions in exchange for Pfizer shares or other securities, or any combination thereof. We will

consider all alternatives to maximize the after-tax return for our shareholders, including a tax-free distribution to our shareholders. If pursued,

any disposition would be subject to various conditions, including receipt of any necessary regulatory or other approvals and the existence of

satisfactory market conditions.

If we decide to fully separate Zoetis, then, following such separation, Pfizer will be a global biopharmaceutical company with an innovative

core (our Primary Care, Specialty Care and Oncology units) and a value core (our Established Products unit) in developed markets, with

different cost structures and operating drivers. Our Emerging Markets unit has a geographic focus that includes both the innovative and value

cores in those markets. The innovative core includes a portfolio of innovative, largely patent-protected, in-line products and an R&D

organization focused on continuing to build a robust pipeline of highly differentiated product candidates in areas of unmet medical needs. The

value core includes a portfolio of products that have lost exclusivity or are approaching the loss of exclusivity that help meet the global need

for less expensive, quality medicines. In addition, we have a complementary Consumer Healthcare business with several well-known brands.

In response to the challenging operating environment, we have taken and continue to take many steps to strengthen our Company and better

position ourselves for the future. We believe in a comprehensive approach to our challenges—organizing our business to maximize research,

development and commercial opportunities, improving the performance of our innovative core, making the right capital allocation decisions,

and protecting our intellectual property.