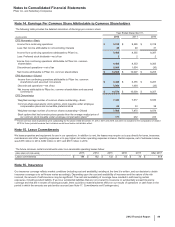

Pfizer 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

95

D. Employee Benefit Trust

The Pfizer Inc. Employee Benefit Trust (EBT) was established in 1999 to fund our employee benefit plans through the use of its holdings of

Pfizer Inc. stock. Our consolidated balance sheets reflect the fair value of the shares owned by the EBT as a reduction of Equity. Beginning in

May 2009, the Company began using the shares held in the EBT to help fund the Company’s matching contribution in the Pfizer Savings Plan.

Note 13. Share-Based Payments

Our compensation programs can include share-based payments, in the form of stock options, Restricted Stock Units (RSUs), Portfolio

Performance Shares (PPSs), Performance Share Awards (PSAs) and Total Shareholder Return Units (TSRUs).

The Company’s shareholders approved the amendment and restatement of the 2004 Stock Plan at the Annual Meeting of Shareholders held on

April 23, 2009. The primary purpose of the amendment was to increase the number of shares of common stock available for grants by 425

million shares. In addition, the amendment provided other changes, including that the number of stock options, Stock Appreciation Rights

(SARs) (known as TSRUs) or other performance-based awards that may be granted to any one individual during any 36-month period is limited

to 8 million shares, and that RSUs, PPSs, PSAs and restricted stock grants count as 2 shares, while stock options and TSRUs count as 1

share, toward the maximums for the incremental 425 million shares. As of December 31, 2012, 236 million shares were available for award.

The 2004 Stock Plan, as amended, is the only Pfizer plan under which equity-based compensation may currently be awarded to executives and

other employees.

Although not required to do so, we have used authorized and unissued shares and, to a lesser extent, shares held in our Employee Benefit

Trust and treasury stock to satisfy our obligations under these programs.

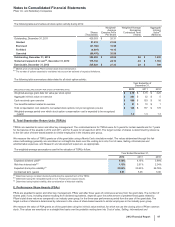

A. Impact on Net Income

The following table provides the components of share-based compensation expense and the associated tax benefit:

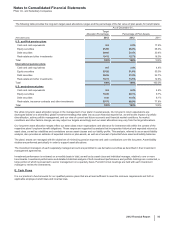

Year Ended December 31,

(MILLIONS OF DOLLARS) 2012 2011 2010

Restricted stock units $235 $228 $211

Stock options 157 166 150

Total shareholder return units 35 17 28

Performance share awards 35 314

Portfolio performance shares 14 ——

Directors’ compensation and other 552

Share-based payment expense 481 419 405

Tax benefit for share-based compensation expense (149)(139)(129)

Share-based payment expense, net of tax $332 $280 $276

Amounts capitalized as part of inventory cost and the impact of modifications under our cost-reduction and productivity initiatives to share-

based awards were not significant for any period presented. Generally, the modifications resulted in an acceleration of vesting, either in

accordance with plan terms or at management’s discretion.

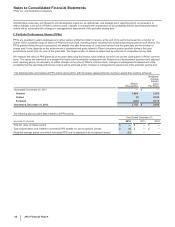

B. Restricted Stock Units (RSUs)

RSUs are awarded to select employees and, when vested, entitle the holder to receive a specified number of shares of Pfizer common stock,

including shares resulting from dividend equivalents paid on such RSUs. For RSUs granted during the periods presented, in virtually all

instances, the units vest after three years of continuous service from the grant date.

We measure the value of RSU grants as of the grant date using the closing price of Pfizer common stock. The values determined through this

fair value methodology generally are amortized on a straight-line basis over the vesting term into Cost of sales, Selling, informational and

administrative expenses, and Research and development expenses, as appropriate.