Pfizer 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

32

2012 Financial Report

(d) Additional depreciation––asset restructuring represents the impact of changes in the estimated useful lives of assets involved in restructuring actions.

(e) Implementation costs represent external, incremental costs directly related to implementing our non-acquisition-related cost-reduction and productivity

initiatives.

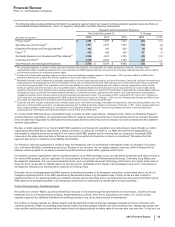

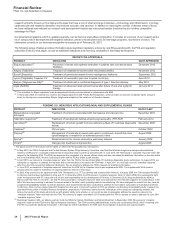

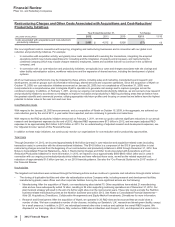

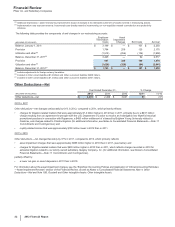

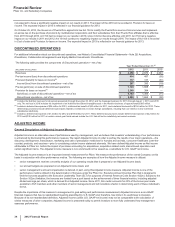

The following table provides the components of and changes in our restructuring accruals:

(MILLIONS OF DOLLARS)

Employee

Termination

Costs

Asset

Impairment

Charges Exit Costs Accrual

Balance, January 1, 2011 $ 2,149 $—$

101 $2,250

Provision 1,794 256 125 2,175

Utilization and other(a) (1,518) (256)(134)(1,908)

Balance, December 31, 2011(b) 2,425 —92

2,517

Provision 997 328 149 1,474

Utilization and other(a) (1,629) (328)(84)(2,041)

Balance, December 31, 2012(c) $1,793 $—$

157 $1,950

(a) Includes adjustments for foreign currency translation.

(b) Included in Other current liabilities ($1.6 billion) and Other noncurrent liabilities ($930 million).

(c) Included in Other current liabilities ($1.2 billion) and Other noncurrent liabilities ($731 million).

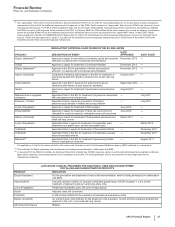

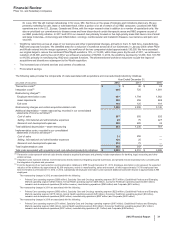

Other Deductions—Net

Year Ended December 31, % Change

(MILLIONS OF DOLLARS) 2012 2011 2010 12/11 11/10

Other deductions—net $4,031 $2,499 $3,941 61 (37)

2012 v. 2011

Other deductions—net changed unfavorably by 61% in 2012, compared to 2011, which primarily reflects:

• charges for litigation-related matters that were approximately $1.4 billion higher in 2012 than in 2011, primarily due to a $491 million

charge resulting from an agreement-in-principle with the U.S. Department of Justice to resolve an investigation into Wyeth's historical

promotional practices in connection with Rapamune, a $450 million settlement of a lawsuit by Brigham Young University related to

Celebrex, and charges related to Chantix litigation (for additional information, see Notes to Consolidated Financial Statements—Note 17.

Commitments and Contingencies); and

• royalty-related income that was approximately $100 million lower in 2012 than in 2011.

2011 v. 2010

Other deductions––net changed favorably by 37% in 2011, compared to 2010, which primarily reflects:

• asset impairment charges that were approximately $888 million higher in 2010 than in 2011, (see below); and

• charges for litigation-related matters that were $939 million higher in 2010 than in 2011, which reflects charges recorded in 2010 for

asbestos litigation related to our wholly owned subsidiary, Quigley Company, Inc. (for additional information, see Notes to Consolidated

Financial Statements—Note 17. Commitments and Contingencies),

partially offset by:

• a lower net gain on asset disposals in 2011 than in 2010.

For information about the asset impairment charges, see the “Significant Accounting Policies and Application of Critical Accounting Estimates

—Asset Impairment Reviews” section of this Financial Review, as well as Notes to Consolidated Financial Statements Note 4. Other

Deductions—Net and Note 10B. Goodwill and Other Intangible Assets: Other Intangible Assets.