Pfizer 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

38

2012 Financial Report

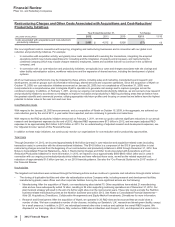

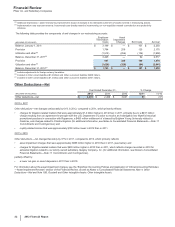

(h) Substantially all included in Other deductions—net (see the “Other Deductions—Net” section of this Financial Review and Notes to Consolidated Financial

Statements—Note 4. Other Deductions—Net).

(i) Included in Cost of sales (see also the “Costs and Expenses––Cost of Sales” section of this Financial Review).

(j) Costs incurred in connection with the initial public offering of a 19.8% ownership stake in Zoetis. Includes expenditures for banking, legal, accounting and similar

services, as well as costs associated with the separation of Zoetis employees, net assets and operations from Pfizer, such as consulting and systems costs. For

2012, included in Costs of sales ($6 million), Selling, informational and administrative expenses ($194 million) and Other deductions—net ($125 million). For

2011, substantially all included in Other deductions—net.

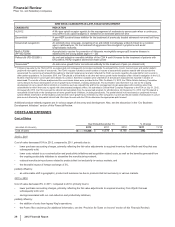

ANALYSIS OF THE CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Changes in the components of Accumulated other comprehensive loss reflect the following:

2012

For Foreign currency translation adjustments, reflects the weakening of several foreign currencies against the U.S. dollar, primarily the euro,

the Japanese yen, the Australian dollar and the Brazilian real.

For Unrealized holding gains/(losses) on derivative financial instruments, reflects the impact of fair value adjustments. See also Notes to

Consolidated Financial Statements—Note 7A. Financial Instruments: Selected Financial Assets and Liabilities.

For Benefit plans: Actuarial losses, reflects the impact of changes in actuarial assumptions and the difference between actual return on plan

assets and expected return on plan assets. See also Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement

Benefit Plans and Defined Contribution Plans.

2011

For Foreign currency translation adjustments, reflects the strengthening of several foreign currencies against the U.S. dollar, primarily the

euro, the Japanese yen, the British pound, and the Australian dollar.

For Unrealized holding gains/(losses) on derivative financial instruments, reflects the impact of fair value adjustments. See also Notes to

Consolidated Financial Statements—Note 7A. Financial Instruments: Selected Financial Assets and Liabilities.

For Benefit plans: Actuarial losses, reflects the impact of changes in actuarial assumptions and the difference between actual return on plan

assets and expected return on plan assets. See also Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement

Benefit Plans and Defined Contribution Plans.

2010

For Foreign currency translation adjustments, reflects the weakening of several foreign currencies against the U.S. dollar, primarily the euro

and the British pound.

For Unrealized holding gains/(losses) on derivative financial instruments, reflects the impact of fair value adjustments. See also Notes to

Consolidated Financial Statements—Note 7A. Financial Instruments: Selected Financial Assets and Liabilities.

For Benefit plans: Actuarial losses, reflects the impact of changes in actuarial assumptions and the difference between actual return on plan

assets and expected return on plan assets. See also Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement

Benefit Plans and Defined Contribution Plans.

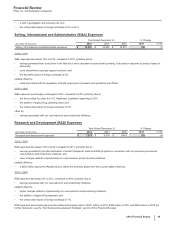

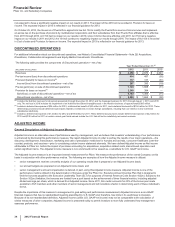

ANALYSIS OF THE CONSOLIDATED BALANCE SHEETS

For information about certain of our financial assets and liabilities, including Cash and cash equivalents, Short-term investments, Long-term

investments, Short-term borrowings, including current portion of long-term debt, and Long-term debt, see “Analysis of Financial Condition,

Liquidity and Capital Resources” below.

For Assets of discontinued operations and other assets held for sale, the decrease reflects the sale of our Nutrition business (see Notes to

Consolidated Financial Statements—Note 2B. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments:

Divestitures).

Many changes in our asset and liability accounts as of December 31, 2012, compared to December 31, 2011, reflect, among other things,

increases associated with our acquisitions of Alacer Corp., Ferrosan Holding A/S and NextWave Pharmaceuticals, Inc. (see Notes to

Consolidated Financial Statements—Note 2A. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments:

Acquisitions) and decreases due to the impact of foreign exchange.

For Accounts Receivable, net, see “Selected Measures of Liquidity and Capital Resources: Accounts Receivable” below.

For Property, plant and equipment, less accumulated depreciation, the change also reflects depreciation in excess of capital additions.

For Identifiable intangible assets, less accumulated amortization, the change also reflects amortization and asset impairments (see Notes to

Consolidated Financial Statements—Note 4. Other Deductions—Net).

For Accounts payable, the change also reflects an increase in Value Added Tax (VAT) payables.

For Other current liabilities and Other noncurrent liabilities, the changes also reflect a decrease in restructuring-related liabilities and the

impact of lower revenues on expense levels. Other noncurrent liabilities also reflects the impact of fair value adjustments on derivative

financial instruments.