Pfizer 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

81

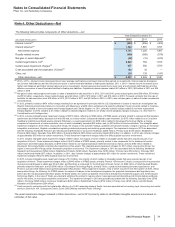

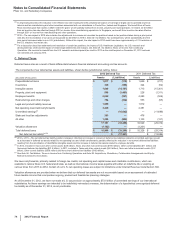

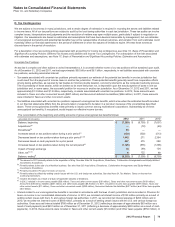

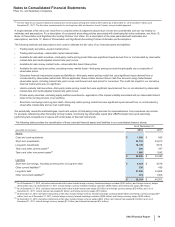

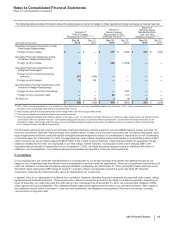

D. Long-Term Debt

The following table provides the components of our senior unsecured long-term debt:

As of December 31,

(MILLIONS OF DOLLARS) Maturity Date 2012 2011

6.20%(a) March 2019 $3,327 $3,248

5.35%(a) March 2015 3,065 3,069

7.20%(a) March 2039 2,903 2,948

4.75% euro(b) June 2016 2,638 2,583

5.75% euro(b) June 2021 2,634 2,581

3.625% euro(b), (c) June 2013 —2,392

6.50% U.K. pound(b) June 2038 2,407 2,306

5.95% April 2037 2,086 2,088

5.50% February 2014 1,832 1,893

5.50%(d) March 2013 —1,564

4.55% euro May 2017 1,384 1,325

4.75% euro December 2014 1,284 1,266

5.50% February 2016 1,048 1,061

Notes and other debt with a weighted-average interest rate of 6.51%(e) 2021–2036 3,403 3,435

Notes and other debt with a weighted-average interest rate of 5.28%(f) 2014–2018 2,254 2,302

Foreign currency notes and other foreign currency debt with a weighted-

average interest rate of 2.48%(g) 2014-2016 771 865

Long-term debt $31,036 $34,926

Current portion of long-term debt (not included above) $2,449 $6

(a) Instrument is callable by us at any time at the greater of 100% of the principal amount or the sum of the present values of the remaining scheduled payments of

principal and interest discounted at the U.S. Treasury rate plus 0.50% plus, in each case, accrued and unpaid interest.

(b) Instrument is callable by us at any time at the greater of 100% of the principal amount or the sum of the present values of the remaining scheduled payments of

principal and interest discounted at a comparable government bond rate plus 0.20% plus, in each case, accrued and unpaid interest.

(c) At December 31, 2012, the note has been reclassified to Current portion of long-term debt.

(d) At December 31, 2012, the note had been called and is no longer outstanding.

(e) Contains debt issuances with a weighted-average maturity of approximately 17 years.

(f) Contains debt issuances with a weighted-average maturity of approximately 4 years.

(g) Contains debt issuances with a weighted-average maturity of approximately 3 years.

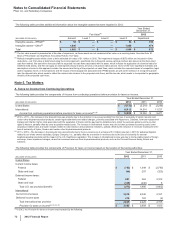

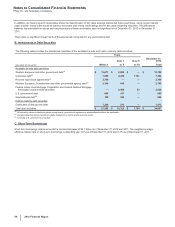

The following table provides the maturity schedule of our Long-term debt outstanding as of December 31, 2012:

(MILLIONS OF DOLLARS) 2014 2015 2016 2017 After 2017 Total

Maturities $3,922 $3,065 $4,449 $1,907 $17,693 $31,036

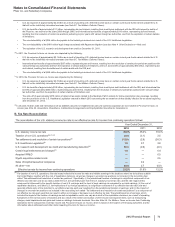

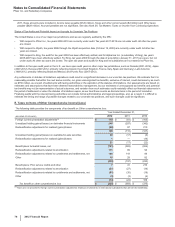

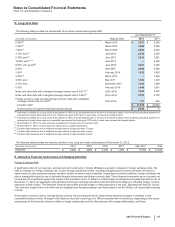

E. Derivative Financial Instruments and Hedging Activities

Foreign Exchange Risk

A significant portion of our revenues, earnings and net investments in foreign affiliates is exposed to changes in foreign exchange rates. We

seek to manage our foreign exchange risk, in part, through operational means, including managing same-currency revenues in relation to

same-currency costs and same-currency assets in relation to same-currency liabilities. Depending on market conditions, foreign exchange risk

also is managed through the use of derivative financial instruments and foreign currency debt. These financial instruments serve to protect net

income and net investments against the impact of the translation into U.S. dollars of certain foreign exchange-denominated transactions. As of

December 31, 2012, the aggregate notional amount of foreign exchange derivative financial instruments hedging or offsetting foreign currency

exposures is $45.6 billion. The derivative financial instruments primarily hedge or offset exposures in the euro, Japanese yen and U.K. pound.

The maximum length of time over which we are hedging future foreign exchange cash flow relates to our $2.4 billion U.K. pound debt maturing

in 2038.

All derivative contracts used to manage foreign currency risk are measured at fair value and are reported as assets or liabilities on the

consolidated balance sheet. Changes in fair value are reported in earnings or in Other comprehensive income/(loss), depending on the nature

and purpose of the financial instrument (offset or hedge relationship) and the effectiveness of the hedge relationships, as follows: