Pfizer 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

26

2012 Financial Report

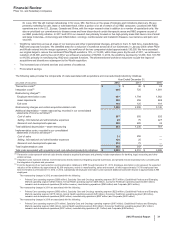

research primarily focuses on five high-priority areas that have a mix of small and large molecules—immunology and inflammation; oncology;

cardiovascular and metabolic diseases; neuroscience and pain; and vaccines. In addition to reducing the number of disease areas of focus,

we have realigned and reduced our research and development footprint and outsourced certain functions that do not drive competitive

advantage for Pfizer.

Our development pipeline, which is updated quarterly, can be found at www.pfizer.com/pipeline. It includes an overview of our research and a

list of compounds in development with targeted indication, phase of development and, for late-stage programs, mechanism of action. The

information currently in our development pipeline is accurate as of February 28, 2013.

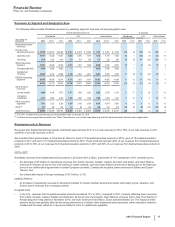

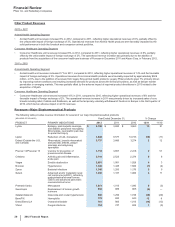

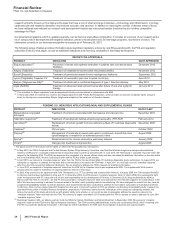

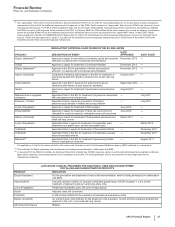

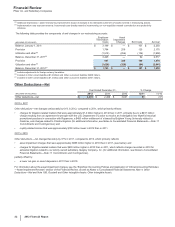

The following series of tables provides information about significant regulatory actions by, and filings pending with, the FDA and regulatory

authorities in the EU and Japan, as well as additional indications and new drug candidates in late-stage development.

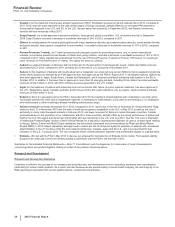

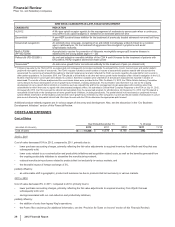

RECENT FDA APPROVALS

PRODUCT INDICATION DATE APPROVED

Eliquis (Apixaban)(a) Prevention of stroke and systemic embolism in patients with nonvalvular atrial

fibrillation

December 2012

Xeljanz (Tofacitinib) Treatment of moderate-to-severe active rheumatoid arthritis November 2012

Bosulif (Bosutinib) Treatment of previously treated chronic myelogenous leukemia September 2012

Lyrica (Pregabalin) Capsules CV Treatment of neuropathic pain due to spinal cord injury June 2012

Elelyso (Taliglucerase Alfa)(b) Treatment of adults with a confirmed diagnosis of type 1 Gaucher disease May 2012

Inlyta (Axitinib) Treatment of advanced renal cell carcinoma after failure of one prior systemic

therapy

January 2012

(a) This indication for Eliquis (apixaban) was developed and is being commercialized in collaboration with BMS.

(b) In November 2009, we entered into a license and supply agreement with Protalix BioTherapeutics, which provides us exclusive worldwide rights, except in

Israel, to develop and commercialize Elelyso (taliglucerase alpha) for the treatment of Gaucher disease.

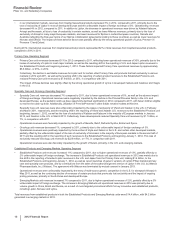

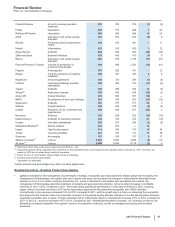

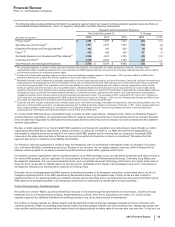

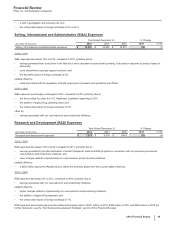

PENDING U.S. NEW DRUG APPLICATIONS (NDA) AND SUPPLEMENTAL FILINGS

PRODUCT INDICATION DATE FILED*

Bazedoxifene-conjugated

estrogens

Treatment of symptoms associated with menopause and osteoporosis December 2012

Tafamidis meglumine(a) Treatment of transthyretin familial amyloid polyneuropathy (TTR-FAP) February 2012

Genotropin(b) Replacement of human growth hormone deficiency (Mark VII multidose disposable

device)

December 2009

Celebrex(c) Chronic pain October 2009

Remoxy(d) Management of moderate-to-severe pain when a continuous, around-the-clock

opioid analgesic is needed for an extended period of time

August 2008

Spiriva(e) Respimat device for chronic obstructive pulmonary disease January 2008

Viviant(f) Osteoporosis treatment and prevention August 2006

* The dates set forth in this column are the dates on which the FDA accepted our submissions.

(a) In May 2012, the FDA's Peripheral and Central Nervous System Drugs Advisory Committee voted that the tafamidis meglumine data provide substantial

evidence of efficacy for a surrogate endpoint that is reasonably likely to predict a clinical benefit. In June 2012, the FDA issued a “complete response” letter with

respect to the tafamidis NDA. The FDA has requested the completion of a second efficacy study and also has asked for additional information on the data within

the current tafamidis NDA. We are continuing to work with the FDA to define a path forward.

(b) In April 2010, we received a “complete response” letter from the FDA for the Genotropin Mark VII multidose disposable device submission. In August 2010, we

submitted our response to address the requests and recommendations included in the FDA letter. In April 2011, we received a second “complete response”

letter from the FDA, requesting additional information. We are working to address the FDA's requests for additional information.

(c) In June 2010, we received a “complete response” letter from the FDA for the Celebrex chronic pain supplemental NDA. The supplemental NDA remains

pending while we await the completion of ongoing studies to determine next steps.

(d) In 2005, King entered into an agreement with Pain Therapeutics, Inc. (PT) to develop and commercialize Remoxy. In August 2008, the FDA accepted the NDA

for Remoxy that had been submitted by King and PT. In December 2008, the FDA issued a “complete response” letter. In March 2009, King exercised its right

under the agreement with PT to assume sole control and responsibility for the development of Remoxy. In December 2010, King resubmitted the NDA for

Remoxy with the FDA. In June 2011, we and PT announced that a “complete response” letter was received from the FDA with regard to the resubmission of the

NDA. We have been working to address the issues raised in the letter, which primarily relate to manufacturing. We have analyzed the results from two, recently

completed bioavailability studies, as well as data from other experiments that were conducted to optimize the formulation composition and analytical methods

for Remoxy. While we have gained important insights from this work, in the fourth quarter of 2012 we initiated a confirmatory bioavailability study to assess the

pharmacokinetic profile of modified Remoxy formulation compositions. Preliminary results from the initial phase of this study are undergoing analysis. We

believe the results of this study will provide us with greater clarity as to whether or not we will be able to adequately address the questions raised in the

“complete response” letter received from the FDA. We continue to target a late-March 2013 meeting with the FDA to discuss our plan to address the June 2011

“complete response" letter.

(e) Boehringer Ingelheim (BI), our alliance partner, holds the NDAs for Spiriva Handihaler and Spiriva Respimat. In September 2008, BI received a “complete

response” letter from the FDA for the Spiriva Respimat submission. The FDA is seeking additional data, and we are coordinating with BI, which is working with

the FDA to provide the additional information. A full response will be submitted to the FDA upon the completion of planned and ongoing studies.