Pfizer 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

40

2012 Financial Report

2011 v. 2010

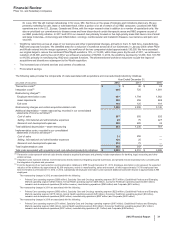

Our net cash provided by investing activities was $1.8 billion in 2011, compared to $492 million net cash used in 2010. The increase in net

cash provided by investing activities was primarily attributable to:

• net proceeds from redemptions, purchases and sales of investments of $4.1 billion in 2011, which were primarily used to finance our

acquisition of King, compared to net proceeds from redemptions, purchases and sales of investments of $1.2 billion in 2010; and

• net proceeds of $2.4 billion received from the sale of Capsugel in 2011 (see Notes to Consolidated Financial Statements—Note 2B.

Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Divestitures),

partially offset by:

• cash paid of $3.3 billion, net of cash acquired, for our acquisitions of King, Icagen and Excaliard in 2011, compared to $273 million

paid for our acquisitions of FoldRx, Vetnex and Synbiotics in 2010.

Financing Activities

2012 v. 2011

Our net cash used in financing activities was $16.0 billion in 2012, compared to $20.6 billion in 2011. The decrease in net cash used in

financing activities was primarily attributable to:

• net repayments of borrowings of $1.7 billion in 2012, compared to net repayments of borrowings of $5.5 billion in 2011;

• purchases of our common stock of $8.2 billion in 2012, compared to $9.0 billion in 2011; and

• increased proceeds from the exercise of stock options,

slightly offset by:

• higher cash dividends paid.

2011 v. 2010

Our net cash used in financing activities was $20.6 billion in 2011, compared to $11.2 billion in 2010. The increase in net cash used in

financing activities was primarily attributable to:

• net repayments of borrowings of $5.5 billion in 2011, compared to net repayments of borrowings of $4.2 billion in 2010; and

• purchases of our common stock of $9.0 billion in 2011, compared to $1.0 billion in 2010.

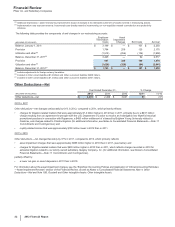

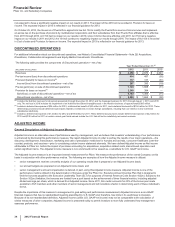

ANALYSIS OF FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

We rely largely on operating cash flows, short-term investments, short-term commercial paper borrowings and long-term debt to provide for

our liquidity requirements. We believe that we have the ability to obtain both short-term and long-term debt to meet our financing needs for the

foreseeable future. Due to our significant operating cash flows as well as our financial assets, access to capital markets and available lines of

credit and revolving credit agreements, we further believe that we have the ability to meet our liquidity needs for the foreseeable future, which

include:

• the working capital requirements of our operations, including our research and development activities;

• investments in our business;

• dividend payments and potential increases in the dividend rate;

• share repurchases;

• the cash requirements associated with our cost-reduction/productivity initiatives;

• paying down outstanding debt;

• contributions to our pension and postretirement plans; and

• business-development activities.

With regard to share repurchases, the Company's new $10 billion share-purchase plan became effective on November 30, 2012. (For

additional information about the new share-purchase plan, see the “Share-Purchase Plans” section of this Financial Review.)

Our long-term debt is rated investment grade by both Standard & Poor’s (S&P) and Moody’s Investors Service (Moody's). See the “Credit

Ratings” section below. As market conditions change, we continue to monitor our liquidity position. We have taken and will continue to take a

conservative approach to our financial investments. Both short-term and long-term investments consist primarily of high-quality, highly liquid,

well-diversified, available-for-sale debt securities.