Pfizer 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

37

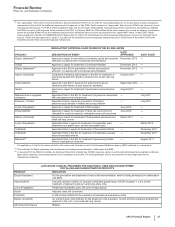

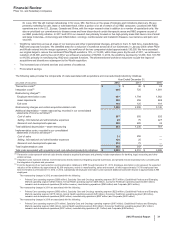

Adjusted income, as shown above, excludes the following items:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2012 2011 2010

Purchase accounting adjustments

Amortization, depreciation and other(a) $4,952 $5,523 $5,314

Cost of sales, primarily related to fair value adjustments of acquired inventory 51,230 2,822

Total purchase accounting adjustments, pre-tax 4,957 6,753 8,136

Income taxes(b) (1,359) (1,753)(2,125)

Total purchase accounting adjustments—net of tax 3,598 5,000 6,011

Acquisition-related costs

Transaction costs(c) 130 22

Integration costs(c) 405 725 1,001

Restructuring charges(c) 279 601 2,122

Additional depreciation—asset restructuring(d) 282 623 781

Total acquisition-related costs, pre-tax 967 1,979 3,926

Income taxes(b) (211)(522)(1,082)

Total acquisition-related costs—net of tax 756 1,457 2,844

Discontinued operations

(Income)/loss from operations—net of tax (297)(350)19

(Gain)/loss on sale of discontinued operations (4,783) (1,304)11

Total discontinued operations—net of tax (5,080) (1,654)30

Certain significant items

Restructuring charges(e) 1,195 1,574 —

Implementation costs and additional depreciation—asset restructuring(f) 693 959 —

Certain legal matters(g) 2,191 822 1,703

Certain asset impairment charges(h) 884 856 1,752

Inventory write-off(i) 28 8 212

Costs associated with the separation of Zoetis(j) 325 35 —

Other 893 (102)

Total certain significant items, pre-tax 5,324 4,347 3,565

Income taxes(b) (2,692) (1,320)(3,145)

Total certain significant items—net of tax 2,632 3,027 420

Total purchase accounting adjustments, acquisition-related costs, discontinued

operations and certain significant items—net of tax $1,906 $7,830 $9,305

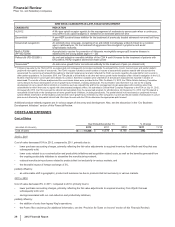

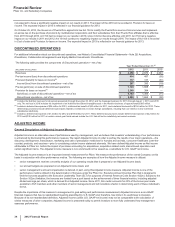

(a) Included primarily in Amortization of intangible assets (see Notes to Consolidated Financial Statements—Note 10. Goodwill and Other Intangible Assets).

(b) Included in Provision for taxes on income. Income taxes includes the tax effect of the associated pre-tax amounts, calculated by determining the jurisdictional

location of the pre-tax amounts and applying that jurisdiction’s applicable tax rate. In addition, income taxes for Certain significant items in 2012 includes a $1.1

billion tax benefit, representing tax and interest, as a result of a settlement with the IRS related to audits for tax years 2006-2008. Amounts in 2010 include a

$2.0 billion tax benefit, representing tax and interest, as a result of a settlement with the IRS of certain audits covering tax years 2002-2005. See Notes to

Consolidated Financial Statements—Note 5A. Tax Matters: Taxes on Income from Continuing Operations.

(c) Included in Restructuring charges and certain acquisition-related costs (see Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and

Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives).

(d) Represents the impact of changes in the estimated useful lives of assets involved in restructuring actions related to acquisitions. For 2012, included in Cost of

sales ($267 million), Selling informational and administrative expenses ($9 million) and Research and development expenses ($6 million). For 2011, included in

Cost of sales ($555 million), Selling, informational and administrative expenses ($45 million) and Research and development expenses ($23 million). For 2010,

included in Cost of sales ($520 million), Selling, informational and administrative expenses ($227 million) and Research and development expenses

($34 million).

(e) Represents restructuring charges incurred for our cost-reduction and productivity initiatives. Included in Restructuring charges and certain acquisition-related

costs (see Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/

Productivity Initiatives).

(f) Amounts primarily relate to our cost-reduction and productivity initiatives (see Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and

Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives). For 2012, included in Cost of sales ($31 million), Selling, informational

and administrative expenses ($140 million) and Research and development expenses ($522 million). For 2011, included in Cost of sales ($250 million), Selling,

informational and administrative expenses ($55 million) and Research and development expenses ($654 million).

(g) Included in Other deductions—net (see the “Other Deductions—Net” section of this Financial Review and Notes to Consolidated Financial Statements—Note 4.

Other Deductions—Net).